Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help

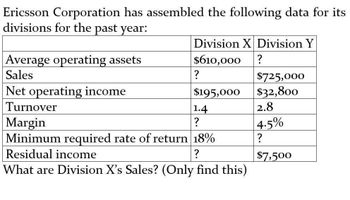

Transcribed Image Text:Ericsson Corporation has assembled the following data for its

divisions for the past year:

Average operating assets

Sales

Net operating income

Turnover

Margin

Division X Division Y

$610,000

?

?

$725,000

$195,000

$32,800

1.4

2.8

?

4.5%

?

?

$7,500

| Minimum required rate of return 18%

Residual income

What are Division X's Sales? (Only find this)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What are division x's sales?arrow_forwardWant Correct Answerarrow_forwardKyle Corporation provides the following information for the Product Division and Service Division for the year. Product Division Service Division 420,000 $ 650,000 195,000 245,000 640,000 610,000 14.0% 14.0% Net sales Operating income Average total assets Target rate of return $ Requirement 1. Calculate the return on investment for each division. (Enter answers as a percent rounded to the nearest hundredth percent, X.XX%) The return on investment for the Product Division is The return on investment for the Service Division is Requirement 2. Which division has the highest ROI? % % Requirement 3. Calculate the residual income for each division. (Round answers to the nearest whole dollar.) The residual income for the Product Division is The residual income for the Service Division is Requirement 4. Which division has the highest residual income?arrow_forward

- Consider the following data from two divisions of a company, P and Q: Divisional P Q Sales $ 2,000,000 $ 1,100,000 Operating Income $ 800,000 $ 660,000 Investment $ 3,200,000 $ 1,760,000 If the minimum rate of return is 9%, what is Division P's residual income (RI)?arrow_forwardNeed Answer Pls provide fast..arrow_forwardH1.arrow_forward

- Provide the missing data in the following tabulation: Division Alpha Bravo Charlie Revenue 11500000 Operating profit 920000 210000 Average operating assets 800000 Margin 4,00% 7,00% Turnover 5 Return on investment (ROI) 20% 14%arrow_forwardAssume the Residential Division of Kipper Faucets had the following results last year: What is the division’s RI? a. $(140,000) b. $104,000 c. $140,000 d. $(104,000)arrow_forwardConsider the following data from two divisions of a company, P and Q: Divisional P Q Sales $ 1,100,000 $ 1,600,000 Operating Income $ 440,000 $ 960,000 Investment $ 1,870,000 $ 3,040,000 If the minimum rate of return is 12%, what is Division P's residual income (RI)? Multiple Choice $1,817,200. $215,600. $1,047,200. $664,400. $875,600.arrow_forward

- Can you help me with accounting questionsarrow_forwardThe following information relates to the Quilt Division of TDS Corporation for last year:Sales $200,000Net operating income $60,000Average operating assets $500,000Minimum required rate of return 10%The divisions residual income is closest to? 50,000 10,000 140,000 40,000arrow_forwardCoolbrook Company has the following information available for the past year: River Division Stream Division Sales revenue $ 1,209,000 $ 1,810,000 Cost of goods sold and operating expenses 900,000 1,286,000 Net operating income $ 309,000 $ 524,000 Average invested assets $ 1,200,000 $ 1,460,000 The company’s hurdle rate is 6.26 percent. Required: 1. Calculate return on investment (ROI) and residual income for each division for last year. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.)) river steam ROI % % Residual income (loss) 2. Recalculate ROI and residual income for the division for each independent situation that follows: Operating income increases by 11 percent. (Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%.). Loss…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning