College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Get correct answer general accounting question

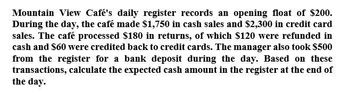

Transcribed Image Text:Mountain View Café's daily register records an opening float of $200.

During the day, the café made $1,750 in cash sales and $2,300 in credit card

sales. The café processed $180 in returns, of which $120 were refunded in

cash and $60 were credited back to credit cards. The manager also took $500

from the register for a bank deposit during the day. Based on these

transactions, calculate the expected cash amount in the register at the end of

the day.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardHappy Tails Inc. has a September 1, 20Y4, accounts payable balance of 620, which consists of 320 due Labradore Inc. and 300 due Meow Mart Inc. Transactions related to purchases and cash payments completed by Happy Tails Inc. during the month of September 20Y4 are as follows: a. Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those used in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Happy Tails Inc. uses the following accounts: b. Prepare a listing of accounts payable creditor balances on September 30, 20Y4. Verify that the total of the accounts payable creditor balances equals the balance of the accounts payable controlling account on September 30, 20Y4. c. Why does Happy Tails Inc. use a subsidiary ledger for accounts payable?arrow_forwardValley Creek Store's daily register records an opening float of $300. During the day, the store made $2,850 in cash sales and $3,400 in credit card sales, while processing $240 in returns. Based on these transactions, calculate the expected cash amount in the register at the end of the day.arrow_forward

- Archer allows customers to use bank credit cards to charge purchases. The bank used by Archer processes all bank credit cards in exchange for a 3% processing fee. All credit card receipts deposited are credited to the company account on the day of deposit. Assume that on August 10, Archer sold and deposited $5,200 worth of bank credit card receipts. The cost of sales is $2,800. Record this transaction in the general journal.arrow_forwardCalculate the cash amountarrow_forwardRoper Electronics received its bank statement for the month of August with an ending balance of $11,775. Roper determined that Check No. 613 for $155 and Check No. 601 for $420 were both outstanding. A $6,900 deposit for August 30 was in transit as of the end of the month. Northern Regional Bank also collected $5,250 on a note receivable, which included interest of $250. The bank statement reveals a bank service charge of $20. A customer check for $68 was returned with the bank statement marked “NSF.” The ending balance of the Roper cash account is $12,938. Question Content Area a. Prepare a bank reconciliation as of August 31. Cash balance according to bank statement Add bank service chargeAdd collection feeAdd deposit in transitDeduct collection feeDeduct deposit in transit Deduct outstanding checks: No. 600No. 601No. 603No. 604No. 605 No. 611No. 612No. 613No. 614No. 615 Adjusted balance Cash balance according to Roper Electronics Add deposit in transitAdd note and…arrow_forward

- At the end of the day, the cash register tape lists $1,147.42 as total income from services. Cash on hand consists of $21.13 in coins, $547.52 in currency, $70.00 in traveler's checks, and $603.62 in customers' checks. The amount of the Change Fund is $100. Required: Record the entry to record the day's cash revenue. If an amount box does not require an entry, leave it blank.arrow_forwardAt the end of the day, the cash register tape lists $881.40 as total income from services. Cash on hand consists of $18.25 in coins, $433.60 in currency, $100.00 in traveler's checks, and $427.00 in customers' checks. The amount of the Change Fund is $100. Required: Record the entry to record the day's cash revenue. If an amount box does not require an entry, leave it blank.arrow_forwardAt the end of the day, the cash register tape lists $885.69 as total income from services. Cash on hand consists of $15.68 in coins, $459.77 in currency, $90.00 in traveler's checks, and $409.74 in customers' checks. The amount of the Change Fund is $100. Required: Record the entry to record the day's cash revenue. If an amount box does not require an entry, leave it blank. GENERAL JOURNAL PAGE DATE DESCRIPTION DOC. NO. POST. REF. DEBIT CREDIT Cash Cash Short and Over Income from Services To record revenue earned during the day involving a cash shortage of $10.50.arrow_forward

- Lowell Bank reported the following checking account fees: $2 to see a real-live teller, $20 to process a bounced check, and $1 to $3 if you need an original check to prove you paid a bill or made a charitable contribution. This past month you had to transact business through a teller six times-a total $12 cost to you. Your bank statement shows a $305.33 balance; your checkbook shows a $1,009.76 balance. You received $1.10 in interest. An $801.15 deposit was not recorded on your statement. The following checks were outstanding: No. 413, $28.30; No. 414, $18.60; and No. 418, $60.72. Prepare your bank reconciliation. (Input all amounts as positive values. Round your answers to 2 decimal places.) BANK RECONCILIATION Checkbook balance Bank balance Add: Add: Subtotal Subtotal Deduct: Deduct: Reconciled balance Reconciled balance Rext > < Prev 1 of 15arrow_forwardEgrane, Incorporated's monthly bank statement showed the ending balance of cash of $20,400. The bank reconciliation for the period showed an adjustment for a deposit in transit of $2,450, outstanding checks of $3,900, an NSF check of $2,600, bank service charges of $125 and the EFT from a customer in payment of the customer's account of $3,400. What was the cash balance on the Egrane's books (before the adjustments for items on the bank reconciliation)?arrow_forwardBourne Incorporated reports a cash balance at the end of the month of $2,620. A comparison of the company's cash records with the monthly bank statement reveals several additional cash transactions: bank service fees ($85), an NSF check from a customer ($350), a customer’s note receivable collected by the bank ($1,000), and interest earned ($35). Please do journal enteriesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,