Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Provide Accurate Answer

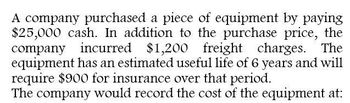

Transcribed Image Text:A company purchased a piece of equipment by paying

$25,000 cash. In addition to the purchase price, the

company incurred $1,200 freight charges. The

equipment has an estimated useful life of 6 years and will

require $900 for insurance over that period.

The company would record the cost of the equipment at:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Steele Corp. purchases equipment for $25,000. Regarding the purchase, Steele recorded the following transactions: Paid shipping of $1,000 Paid installation fees of $2,000 Pays annual maintenance cost of $200 Received a 5% discount on $25,000 sales price Determine the acquisition cost of the equipment.arrow_forwardPrepare journal entries for the following transactions: a. A machine with a cost of 10,000 and accumulated depreciation of 8,000 was sold for 2,500. b. A machine with a cost of 10,000 and accumulated depreciation of 8,000 was traded for a new machine with a market value of 12,000. Cash of 9,500 was also paid.arrow_forwardSheridan Company incurs the following costs in purchasing equipment: invoice price, $40,500; shipping, $1,025; installation and testing, $1,600; one-year insurance policy, $2,750.What is the cost of the equipment?arrow_forward

- Midnight, Inc. incurred the following costs related to equipment purchased on January 1, 2022: • Purchased equipment for $80,000, terms 2/ 10, net 30. Paid for the equipment on January 5, 2022. • Had the equipment installed and paid the installer $5,000. • Paid the freight bill for the truck that delivered the equipment for $800. • Advertised a new product that will be produced by the new equipment, $1,900. • Sales taxes paid on the equipment amounted to $6,000. • During installation, a part was broken off and had to be replaced for $2,700. • Midnight believes the machine will be useful for 5 years, at which time it will be sold for $5,000. Assuming Midnight, Inc. uses the straight-line method of depreciation, what will depreciation expense on its 2023 income statement be? Select one: a. $35,330 b. $17,580 c. $19,170 d. $34,720 e. $17,040arrow_forwardOn January 2, 2021, Athol Company bought a machine for use in operations. The machine has an estimated useful life of eight years and an estimated residual value of $1,600. The company provided the following information: a. Invoice price of the machine, $71,600. b. Freight paid by the vendor per sales agreement, $900. c. Installation costs, $2,200 cash. d. Cost of cleaning up the supplies, boxes, and other garbage that remained after the installation of the machine, $140 cash. e. Payment of the machine's price was made as follows: January 2: • Issued 1,150 common shares of Athol Company at $4 per share. • Signed a $39,000 note payable due April 16, 2018, plus 8 percent interest. • Balance of the invoice price to be paid in cash. The invoice allows for a 2 percent cash discount if the cash payment is made by January 11. January 15: Paid the balance of the invoice price in cash. April 16: Paid the note payable and interest in cash. f. On June 30, 2023, the company completed the…arrow_forwardALPHA Company purchased equipment on 1/1/N with an invoice price of $80,000. Purchase taxes $16,000. Other costs incurred were freight costs, $1,100; installation wiring and foundation, $2,200; material and labor costs in testing equipment, $700; fire insurance policy for the factory is, $1,400. The equipment is estimated to have a $5,000 salvage value at the end of its 5-year useful service life. Required: (a)Compute the acquisition cost of the equipment. (b)If the double-declining-balance method of depreciation was used for the machine, prepare the depreciation schedule for the full period. (c) Based on which criteria companies choose the depreciation methods for their depreciable assets?arrow_forward

- ALPHA Company purchased equipment on 1/1/N with an invoice price of $80,000. Purchase taxes $16,000. Other costs incurred were freight costs, $1,100; installation wiring and foundation, $2,200; material and labor costs in testing equipment, $700; fire insurance policy for the factory is, $1,400. The equipment is estimated to have a $5,000 salvage value at the end of its 5-year useful service life. Required: (b) If the double-declining-balance method of depreciation was used for the machine, prepare the depreciation schedule for the full period. Answer: Depreciation schedule: Year Beginning book value Declining balance rate Annual depreciation expenses Accumulated depreciation Book value 2017 2018 2019 2020 2021arrow_forwardOwearrow_forwardOaktree Company purchased new equipment and made the following expenditures: Purchase price $45,000 2,200 Sales tax Freight charges for shipment of equipment Insurance on the equipment for the first year Installation of equipment 700 900 1,000 The equipment, including sales tax, was purchased on open account, with payment due in 30 days. The other expenditures listed above were paid in cash. Required: Prepare the necessary journal entries to record the above expenditures.arrow_forward

- teele Corp. purchases equipment for $25,000. Regarding the purchase, Steele recorded the following transactions: • Paid shipping of $1,000• Paid installation fees of $2,000• Pays annual maintenance cost of $200• Received a 5% discount on $25,000 sales price Determine the acquisition cost of the equipment.arrow_forwardSteele Corp. purchases equipment for $20,000. Regarding the purchase, Steele recorded the following transactions: • Paid shipping of $800. • Paid installation fees of $1,600. Pays annual maintenance cost of $240. • Received a 5% discount on $20,000 sales price. Determine the acquisition cost of the equipment.arrow_forwardWhat is the total cost of the equipment? General accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,