Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

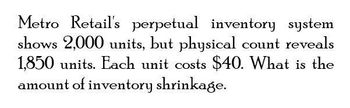

What is the amount of inventory shrinkage.

Transcribed Image Text:Metro Retail's perpetual inventory system

shows 2,000 units, but physical count reveals

1,850 units. Each unit costs $40. What is the

amount of inventory shrinkage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Step by step answerarrow_forwardSequoia Co. is evaluating its inventory, computer paper, at the end of the period. The cost of each package of paper costs Sequoia $5 and there are 5,000 units in ending inventory. They sold 27,000 packages during the period. Due to increased use of the electronic cloud, the net realizable value of each package of paper is $3.50. What is the correct amount of the inventory write-down?arrow_forwardMonarch Company uses a weighted-average perpetual inventory system, and has the following purchases and sales: 20 units were purchased at $10 per unit. January 1 12 units were sold. January 12 18 units were purchased at $11 per unit. January 20 What is the value of ending inventory? (Round average cost per unit to 2 decimal places and final answer to the nearest dollar.)arrow_forward

- Sheffield Corp. sells one product and uses a perpetual inventory system. The beginning inventory consisted of 79 units that cost $22 per unit. During the current month, the company purchased 480 units at $22 each. Sales during the month totaled 360 units for $45 each. What is the cost of goods sold using the LIFO method? $7920. $1738. $10560. $16200.arrow_forwardSandork, Inc., has 200 units of inventory which are currently priced at $4.90 per unit at the market. Originally this inventory cost $5.50 per unit from an order of 400. Sandork, Inc., should take what following steps? a. Dr. Loss on inventory write-down, 120; Cr. Inventory, 120.1 b. Dr. Loss on inventory write-down, 240; Cr. Inventory, 240.1 c. Dr. Inventory, 240; Cr. Loss on inventory write-down, 240.1 d. Dr. Inventory, 120; Cr. Loss on inventory write-down, 120.1 e. Make no entry.arrow_forwardAt the end of January, Higgins Data Systems had an inventory of 750 units, which cost $13 per unit to produce. During February the company produced 1,600 units at a cost of $16 per unit. If Higgins sold 2,000 units in February, what was its cost of goods sold? a. Assume average cost inventory accounting. (Do not round intermediate calculations. Round your answer to nearest whole dollar.) Cost of goods sold $30800 b. Assume FIFO inventory accounting. Cost of goods sold $1arrow_forward

- INVENTORY MANAGEMENT 1) Lakeside Market sells 848 units of an item priced at $49 each year. The carrying cost per unit is $2.26 and the fixed costs per order are $46. What is the economic order quantity? 2) One of the best-selling items the Corner Store offers sells for $3.99 a unit with a variable cost per unit of $2.88. The carrying cost per unit is $1.07 and the fixed order cost is $42. What is the economic order quantity assuming the store sells 650 units annually? 3) Cohen Industrial Products uses 3,600 switch assemblies per week and then reorders another 3,600 units. The annual carrying cost per switch assembly is $9.74, and the fixed order cost is $78. What is the EOQ? 4) The Electronics Store begins each week with 60 gadgets in stock. This stock is depleted and reordered weekly. The carrying cost per gadget is $21 per year and the fixed order cost is $45. What is the optimal number of orders that should be placed each year? 5) A new customer has placed an order for a turbine…arrow_forwardearrow_forwardPlease helparrow_forward

- A firm has beginning inventory of 150 units at a cost of $10 each. Production during the period was 650 units at $13 each. If sales were 600 units, what is the cost of goods sold (assume FIFO)? What is the value of the ending inventory using FIFO? Show your work I also want to learn how to get the answer to this, can you please help provide how you got the answers.arrow_forwardTristan, Inc., uses the LIFO cost-flow assumption to value inventory. It began the current year with 1,950 units of inventory carried at LIFO cost of $69 per unit. During the first quarter, it purchased 5,550 units at an average cost of $99 per unit and sold 6,400 units at $195 per unit. 1. Assume the company does not expect to replace the units of beginning inventory sold; it plans to reduce inventory by year-end to 500 units. What amount of cost of goods sold should be recorded for the quarter ended March 31?$608,100.$633,600.$646,400.$635,300. 2. Assume the company expects to replace the units of beginning inventory sold in April at a cost of $101 per unit and expects inventory at year-end to be between 1,500 and 2,000 units. What amount of cost of goods sold should be recorded for the quarter ended March 31?$608,100.$633,600.$646,400.$635,300.arrow_forwardPlease solve this problemarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning