Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

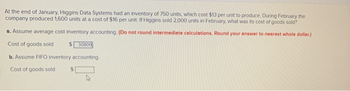

Transcribed Image Text:At the end of January, Higgins Data Systems had an inventory of 750 units, which cost $13 per unit to produce. During February the

company produced 1,600 units at a cost of $16 per unit. If Higgins sold 2,000 units in February, what was its cost of goods sold?

a. Assume average cost inventory accounting. (Do not round intermediate calculations. Round your answer to nearest whole dollar.)

Cost of goods sold

$30800

b. Assume FIFO inventory accounting.

Cost of goods sold $1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- On July 1, the total inventory for Save-Mor Merchandisers was $614,100. Net purchases during the month were $315,900 and sales amounted to $611,400. Gross margin on sales was 63%. Estimate the cost value of the inventory as of July 31 using the gross profit method (in $). $arrow_forwardThe Holden Corp. company has the following purchases and sales during the year ended December 31, 2014. Inventory and Purchases Beginning: 130 units@ $51/unit March 28: 150 units @ $54/unit June 28: 150 units @ $50/unit The units have a selling price of $65.00 per unit. a) Please fill in the table by calculating the dollar value of cost of goods sold and ending inventory, as well as the gross profit earned by Holden Corp. using the FIFO system. Cost of Goods Sold Ending Inventory Gross Profit Date b) Prepare journal entries to record the following (assuming all sales and purchases are for cash): (a) The purchase on June 28, (b) The sale on July 17. Enter the transaction letter as the description when preparing a journal entry. When a transaction requires two separate journal entries, use the same letter for both descriptions. Dates must be entered in the format dd/mmm (ie. 15/Jan). 14 F Sales February 9:30 units July 17: 200 units FIFO E General Journal Account/Explanation Page GJB F…arrow_forwardThe following amounts and costs of platters were available for sale by Sierra Pottery during the year: Beginning inventory 10 units at $41 First purchase 15 units at $55 Second purchase 30 units at $70 Third purchase 25 units at $65 Sierra Pottery has 35 platters on hand at the end of the year. How much is cost of goods sold in dollars at the end of the year according to the weighted-average cost method? Select one: a. $4,960 b. $1,732.50 C. $2,790 d. $1,860arrow_forward

- Quick Stop Dairy had beginning inventory of Heavy Cream of 200 units at a cost of $2 each. During the month, they had the following purchases: 1st purchase: 500 units at $3 each 2nd purchase: 400 units at $4 each Quick Stop Dairy sold 1,000 units to a customer. Using a FIFO cost flow assumption, determine the cost of goods sold for this sale as well as the balance in ending inventoryarrow_forwardOn November 1, Lacy Company began business with the purchase of 250 units of inventory for $21,625. During the month, Lacy had the following inventory transactions: Date November 6 Purchased 100 units @ $75 per unit 11 Sold 200 units 17 Sold 85 units 24 Purchased 100 units @ $125 per unit 28 Purchased 50 units @ $110 per unit 30 Sold 100 units Required:Compute the cost of the inventory at the end of November under the following alternatives: Inventory Cost a. FIFO periodic $fill in the blank 1 b. FIFO perpetual $fill in the blank 2 c. LIFO periodic $fill in the blank 3 d. LIFO perpetual $fill in the blank 4 e. Weighted average $fill in the blank 5 f. Moving average (Round unit costs to 2 decimal places.) $fill in the blank 6arrow_forwardn its first month of operations, Waterway Company made three purchases of merchandise in the following sequence: (1) 320 units at $8, (2) 440 units at $9, and (3) 240 units at $10. Calculate the average unit cost. (Round answer to 2 decimal places, e.g. 15.25.) Average unit cost $ Compute the cost of the ending inventory under the average-cost method, assuming there are 360 units on hand. (Round answer to 0 decimal places, e.g. 1,250.) The cost of the ending inventory $ Click if you would like to Show Work for this question: Open Show Workarrow_forward

- The following data are available for Sellco for the fiscal year ended on January 31, 2020: Sales 830 units Beginning inventory 230 units @ $ 4 Purchases, in chronological order 290 units @ $ 5 450 units @ $ 7 250 units @ $ 7 Required:a. Calculate cost of goods sold and ending inventory under the cost flow assumptions, FIFO, LIFO and Weighted average (using a periodic inventory system): (Round unit cost to 2 decimal places.) b. Assume that net income using the weighted-average cost flow assumption is $15,300. Calculate net income under FIFO and LIFO. (Round unit cost to 2 decimal places.)arrow_forwardThe 123 Accounting Company sells accounting videos. The following information has been extracted from the records of 123 Accounting Co. January 1: Opening Inventory is 60 units @ $10/each January 10: Bought 100 units @ $11 each January 15: Bought 100 units @ $13 each January 20: Sold 220 units @ $20 each January 25: Bought 40 units @ $15 each If 123 Accounting uses the LIFO cost flow assumption and the periodic method for inventory, the ending inventory for January, isarrow_forwardWhat is the Weighted average cost per unit?arrow_forward

- Marsh Company had 150,000 units of product A on hand at January 1, costing P21 each. Purchases of product A during the month of January were as follows: Units Unit cost January 10 200,000 22 18 250,000 23 28 100,000 24 A physical count on January 31 shows 250,000 units of product A on hand. What is the cost of the inventory on January 31 under the FIFO method?arrow_forwardAssume Ava Co. has the following purchases of inventory during the first month of operations Number of Units Cost per unit First Purchase 140 2.4 Second Purchase 105 4.7 Assuming Ava Co sells 120 units at $14 each, what is the cost of goods sold if they use LIFO?arrow_forwardSunland Company reports the following for the month of June. Date Explanation Units Unit Cost Total Cost June 1 Inventory 150 $2 $300 12 Purchase 450 5 2,250 23 Purchase 400 6 2,400 30 Inventory 80 Assume a sale of 500 units occurred on June 15 for a selling price of $7 and a sale of 420 units on June 27 for $8. (a1) Calculate cost of goods available for sale. The cost of goods available for sale $Enter the cost of goods available for sale in dollars eTextbook and Media Attempts: 0 of 3 used (a2) Calculate Moving-Average unit cost for June 1, 12, 15, 23 & 27. (Round answers to 3 decimal places, e.g. 2.525.) June 1 $Enter a dollar amount June 12 $Enter a dollar amount June 15 $Enter a dollar amount June 23 $Enter a dollar amount June 27 $Enter a dollar…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education