FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Some interest cost of Metlock Inc. is capitalized for the year ended May 31, 2026. Compute the amount of each of the items that must be disclosed in Metlock's financial statements.

Total actual interest cost $ Total interest capitalized $ Total interest expensed $

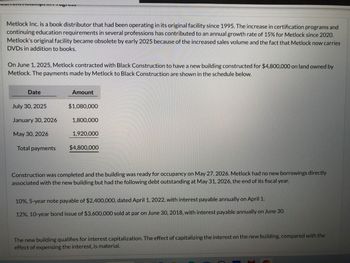

Transcribed Image Text:Metlock Inc. is a book distributor that had been operating in its original facility since 1995. The increase in certification programs and

continuing education requirements in several professions has contributed to an annual growth rate of 15% for Metlock since 2020.

Metlock's original facility became obsolete by early 2025 because of the increased sales volume and the fact that Metlock now carries

DVDs in addition to books.

On June 1, 2025, Metlock contracted with Black Construction to have a new building constructed for $4,800,000 on land owned by

Metlock. The payments made by Metlock to Black Construction are shown in the schedule below.

Date

July 30, 2025

January 30, 2026

May 30, 2026

Total payments

Amount

$1,080,000

1,800,000

1,920,000

$4,800,000

Construction was completed and the building was ready for occupancy on May 27, 2026. Metlock had no new borrowings directly

associated with the new building but had the following debt outstanding at May 31, 2026, the end of its fiscal year.

10%, 5-year note payable of $2,400,000, dated April 1, 2022, with interest payable annually on April 1.

12%, 10-year bond issue of $3,600,000 sold at par on June 30, 2018, with interest payable annually on June 30.

The new building qualifies for interest capitalization. The effect of capitalizing the interest on the new building, compared with the

effect of expensing the interest, is material.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Part c pleasearrow_forwardFinanced by: Paid-up: Share Capital Retained Earnings Reserves Long Term Liabilities Current Other payables Trade creditors Liabilities Accrued expense Barakah Company Balance Sheet as at 31st December 2019 100,000 245,500 30,000 Additional Information: i) ii) 600,000 155,500 75,000 830,500 25,000 375,500 1,231,000 Fixed Assets (net after depreciation) $ Land & Buildings Equipment Vehicles Fixtures & Fittings Current Assets Inventory Accounts Receivable Prepayments Cash at Bank Cash in Hand Work-in-Progress is one-sixth of the total Inventory. Prepayments are related to the rental of buildings. Bad debt is 5% for the year. Non-Muslim ownership is at 20%. 350,500 200,500 150,000 50,000 751,000 Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method. 125,000 215,000 10,000 110,000 20,000 1,231,000arrow_forwardUsing the attached financial statement footnote. Explain why the application of time value is appropriate to account for the transaction.arrow_forward

- Total capital as of December 31, 2019arrow_forwardAble Inc. borrowed $60,000 on October 1, 2019 and agreed to pay back $75,000 on October 1, 2022. How much did Able show in interest payable and interest expense in its annual financial statements at December 31, 2021? O Interest expense $5,000; interest payable $11,250 Interest expense $5,000; interest payable $3,750 O Interest expense $5,000; interest payable $5,000 Both interest expense and interest payable $11,250 O Interest expense is $11,250 and interest payable is $5,00Oarrow_forwardSubject: acountingarrow_forward

- View Policies Current Attempt in Progress At December 31, 2020, Coronado Corporation has the following account balances: Bonds payable, due January 1, 2029 $2,600,000 Discount on bonds payable 71,000 Interest payable 62,000 Show how the above accounts should be presented on the December 31, 2020, balance sheet, including the proper classifications. (Enter account name only and do not provide descriptive information.) Coronado Corporation Balance Sheet (Partial) December 31, 2020 $arrow_forwardSubject: acountingarrow_forwardThe following is the ending balances of accounts at December 31, 2024, for the Weismuller Publishing Company. Account Title Credits Cash Debits $ 105,000. 200,000 305,000 188,000 360,000 180,000 Accounts receivable Inventory Prepaid expenses Equipment Accumulated depreciation Investments Accounts payable Interest payable Deferred revenue Income taxes payable Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals $ 1,338,000 $ 130,000 80,000 40,000 100,000 50,000 300,000 36,000 420,000 182,000 $ 1,338,000 Additional information: 1. Prepaid expenses include $160,000 paid on December 31, 2024, for two year of rent on the building that houses both the administrative offices and the manufacturing facility. 2. Investments include $50,000 in Treasury bills purchased on November 30, 2024. The bills mature on January 30, 2025. The remaining $130,000 is an investment in equity securities that the company intends to sell in the next year. 3. Deferred revenue…arrow_forward

- The following are the ending balances of accounts at December 31, 2021, for the Valley Pump Corporation. Credits Account Title Cash Accounts receivable Inventory Interest payable Investment in equity securities Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Copyright (net) Prepaid expenses (next 12 months) Accounts payable Deferred revenue (next 12 months) Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals $ Debits 44,000 94,000 119,000 82,000 158,000 395,000 113,000 31,000 51,000 $ 29,000 119,000 44,000 84,000 39,000 345,000 6,000 390,000 31,000 $1,087,000 $1,087,000 Additional Information: 1. The $158,000 balance in the land account consists of $119,000 for the cost of land where the plant and office buildings are located. The remaining $39,000 represents the cost of land being held for speculation. 2. The $82,000 balance in the investment in equity securities account represents an investment in the…arrow_forwardRecord the appropriation of $77000 of retained earnings on December 31, 2022, by Jack Inc. to establish an appropriation for bond retirement. Record the entry to establish appropriation.arrow_forwardSonic Corporation recorded current assets of $345,200 and current liabilities of $318,650 for year 2020. Compute for Sonic's working capital for the year. Select one: a. $663,850 b. $26,550 O C. 92% d. 1.08arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education