FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

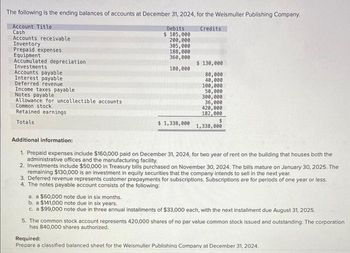

Transcribed Image Text:The following is the ending balances of accounts at December 31, 2024, for the Weismuller Publishing Company.

Account Title

Credits

Cash

Debits

$ 105,000.

200,000

305,000

188,000

360,000

180,000

Accounts receivable

Inventory

Prepaid expenses

Equipment

Accumulated depreciation

Investments

Accounts payable

Interest payable

Deferred revenue

Income taxes payable

Notes payable

Allowance for uncollectible accounts

Common stock

Retained earnings

Totals

$ 1,338,000

$ 130,000

80,000

40,000

100,000

50,000

300,000

36,000

420,000

182,000

$

1,338,000

Additional information:

1. Prepaid expenses include $160,000 paid on December 31, 2024, for two year of rent on the building that houses both the

administrative offices and the manufacturing facility.

2. Investments include $50,000 in Treasury bills purchased on November 30, 2024. The bills mature on January 30, 2025. The

remaining $130,000 is an investment in equity securities that the company intends to sell in the next year.

3. Deferred revenue represents customer prepayments for subscriptions. Subscriptions are for periods of one year or less.

4. The notes payable account consists of the following:

a. a $60,000 note due in six months.

b. a $141,000 note due in six years.

c. a $99,000 note due in three annual installments of $33,000 each, with the next installment due August 31, 2025.

5. The common stock account represents 420,000 shares of no par value common stock issued and outstanding. The corporation

has 840,000 shares authorized.

Required:

Prepare a classified balanced sheet for the Weismuller Publishing Company at December 31, 2024.

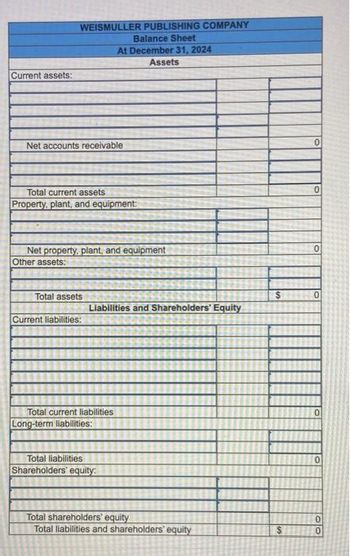

Transcribed Image Text:Current assets:

WEISMULLER PUBLISHING COMPANY

Balance Sheet

At December 31, 2024

Assets

Net accounts receivable

Total current assets

Property, plant, and equipment:

Net property, plant, and equipment

Other assets:

Total assets

Current liabilities:

Liabilities and Shareholders' Equity

Total current liabilities

Long-term liabilities:

Total liabilities

Shareholders' equity:

Total shareholders' equity

Total liabilities and shareholders' equity

S

22

en

$

0

0

0

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hancock Company reported the following account balancesat December 31, 2027:Sales revenue $97,000Dividends. $11,000Supplies 13,000Accounts payable 41,000Patent $59,000Building Common stock.. $27,000Insurance expense .... $31,000Notes payable .. $39,000Income tax expense $42,000Cash . . $19,000Repair expense ?Copyright $20,000Equipment $14,000Utilities payable. $22,000Inventory $64,000Retained earnings. .. $87,000 (at Jan. 1, 2027)Interest revenue $55,000Cost of goods sold ..... .. $37,000Accumulated depreciation .... $23,000 $34,000Accounts receivable ? Trademark. ... $51,000Calculate the total intangible assets reported in HancockCompany's December 31, 2027 balance sheet. The following additional information is available:1) The note payable listed above was a 4- year bank loan taken out on September 1, 2024.2) The total P - P - E at Dec. 31, 2027 was equal to 75% of the total current liabilities at Dec. 31, 2027. ՄԴ Sarrow_forwardOn January 1, 2024, the general ledger of ACME Fireworks includes the following account balances: Accounts Debit Credit Cash $25,700 Accounts Receivable 47,400 Allowance for Uncollectible Accounts $4,800 Inventory 20,600 Land 52,000 Equipment 18,000 Accumulated Depreciation 2,100 Accounts Payable 29,100 Notes Payable (6%, due April 1, 2025) 56,000 Common Stock 41,000 Retained Earnings 30,700 Totals $163,700 $163,700 During January 2024, the following transactions occur: January 2 Sold gift cards totaling $9,200. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $153,000. ACME uses the perpetual inventory system. January 15 Firework sales for the first half of the month total $141,000. All of these sales are on account. The cost of the units sold is $76,800. January 23 Receive $126,000 from customers on accounts receivable. January 25…arrow_forwardOn January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:Accounts Debit CreditCash $ 21,900Accounts Receivable 36,500Allowance for Uncollectible Accounts $ 3,100Inventory 30,000Land 61,600Accounts Payable 32,400Notes Payable (8%, due in 3 years) 30,000Common Stock 56,000Retained Earnings 28,500Totals $150,000 $150,000The $30,000 beginning balance of inventory consists of 300 units, each costing…arrow_forward

- Consider the following financial data for Smith Corp.: Balance Sheet as of December 31, 2019 Cash $ 195,000 Accounts payable $ 94,000 Receivables 185,500 Short-term bank note 119,500 Inventories 214,500 Accruals 71,000 Total current assets $ 595,000 Total current liabilities $ 284,500 Long-term debt 462,500 Net plant & equip. 621,500 Common equity 469,500 Total assets $ 1,216,500 Total liab. & equity $ 1,216,500 Profit & Loss Statement for 2019 Industry Average Ratios Net sales $ 1,265,000 Current ratio 1.9× Cost of sales 986,500 Quick ratio 1.2× Gross profit $ 278,500 Days sales outstanding 64 days Operating expenses 166,500 Inventory turnover 3.3× EBIT $ 112,000 Total asset turnover 0.7× Interest expense 32,000 Net profit margin 9.1% Pre-tax income $ 80,000…arrow_forwardThe current assets and current liabilities sections of the balance sheet of Sunland Co. appear as follows. Sunland Co.Balance Sheet (Partial)As of December 31, 2017 Cash $ 17,900 Accounts payable $ 29,500 Accounts receivable $ 39,600 Notes payable 15,400 Less: Allowance for doubtful accounts 3,200 36,400 Unearned revenue 3,800 Inventory 61,100 Total current liabilities $ 48,700 Prepaid expenses 7,400 Total current assets $ 122,800 The following errors in the corporation’s accounting have been discovered: 1. Keane collected $ 5,200 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company’s controller recorded the amount as revenue. 2. The inventory amount reported included $ 2,300 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $ 1,600 had been received on…arrow_forwardThe following data concern Tech Corporation for the 2022 financial year. Credit sales during the year $2 400 000 Accounts receivable 30 June 2022 410 000 Allowance for bad debts 30 June 2022 55 000 Bad debt expense for the year 70 000 What amount will Tech Corporation show on its year-end balance sheet for the net realisable value of its accounts receivable? a. 410 000 b. $285 000 c. $340 000 d. $ 355 000arrow_forward

- On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forwardAccounts Payable$ 46,000 Accounts Receivable23, 800Cash (balance on January 1, 2021)90, 400Cash ( balance on December 31, 2021)78,000Common Stock152, 500 Dividends0Equipment137, 700Income Tax Expense10, 200Interest Expense 29, 600Inventory 17, 300Notes Payable25,000Office Expense 14, 400Prepaid Rent7, 100 Retained Earnings (beginning)6, 800Salaries and Wages Expense35, 800Service Revenue139,800 Utilities Expense25, 200Salaries and Wages Payable9, 000 Other cash flow information: Cash from issuing common stock$ 22,000Cash paid to reacquire common stock24, 500Cash paid for income taxes11, 100Cash paid to purchase long-term assets53, 400Cash paid to suppliers and employees84, 400Cash received from customers139,000 Prepare a statement of retained earnings for 2021.arrow_forwardSagararrow_forward

- The balance sheet and income statement for J. P. RObard Manufatcuring Company are as follows: Item Cash J.P. Robard Manufacturing Company Balance Sheet as at 31 December 2021 ($ in thousands) 500 Account receivable Inventory Total current assets Net fixed assets Total assets Accounts payable Accrued expenses Short-term notes payable Total curernt liabilities Long-term debt Total common equity Total liabilities and equity 2,000 1,000 3,500 4,500 8,000 1,100 600 300 2,000 2,000 4.000 8,000arrow_forward1. The following account balances were extracted from the accounting records of Macy Corporation at the end of the year:Accounts Receivable $1,100,000Allowance for Uncollectible Accounts (Credit) $37,000Uncollectible-Account Expense $63,000What is the net realizable value of the accounts receivable? Select one:A. $1,163,000B. $1,137,000C. $1,100,000D. $1,063,000 Please show all steps.arrow_forwardjjjarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education