FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

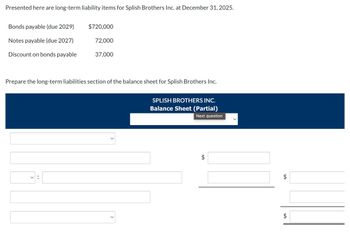

Transcribed Image Text:Presented here are long-term liability items for Splish Brothers Inc. at December 31, 2025.

Bonds payable (due 2029)

$720,000

Notes payable (due 2027)

72,000

Discount on bonds payable

37,000

Prepare the long-term liabilities section of the balance sheet for Splish Brothers Inc.

<

SPLISH BROTHERS INC.

Balance Sheet (Partial)

Next question

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- View Policies Current Attempt in Progress At December 31, 2020, Coronado Corporation has the following account balances: Bonds payable, due January 1, 2029 $2,600,000 Discount on bonds payable 71,000 Interest payable 62,000 Show how the above accounts should be presented on the December 31, 2020, balance sheet, including the proper classifications. (Enter account name only and do not provide descriptive information.) Coronado Corporation Balance Sheet (Partial) December 31, 2020 $arrow_forwardRefer to the following list of liability balances t December 31, 2024. $23,000 Accounts Payable Employee Health Insurance Payable Employee Income Tax Payable Estimated Warranty Payable (Due 2025) Long - Term Notes Payable (Due 2028) FICA-OASDI Taxes Payable Sales Tax Payable 450 1,100 1,000 38.000 660 870 Mortgage Payable (Due 2029) Bonds Payable (Due 2030) Current Portion of Long - Term Notes Payable 8,000 53,000 11,500 What is the total amount of current liabilities? O A. $27,080 O B. $38,580 OC. $25,980 OD. $24,980arrow_forwardAccounting question - thank you for your helparrow_forward

- View Policies Current Attempt in Progress The Bridgeport Company issued $390,000 of 11% bonds on January 1, 2020. The bonds are due January 1, 2025, with interest payable each July 1 and January 1. The bonds are issued at face value. Prepare Bridgeport's journal entries for (a) the January issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) (b) (c)arrow_forwardNeed complete and correct answer for all parts with all workings and steps in text form please show calculation narrations and explanation clearly for all steps answer in text formarrow_forwardcan you show me how to solve this problem for accounting? Presented here are long-term liability items for Metlock, Inc. at December 31, 2022. Bonds payable (due 2026) $660,000 Notes payable (due 2024) 90,000 Discount on bonds payable 28,000arrow_forward

- On July 1, 2018, Miniature Company has bonds with balances as shown below. Bonds Payable 65,000 Discount Payable on Bonds 3,250 If the company retires the bonds for $66,150, what will be gain or loss on the retirement?arrow_forwardDeluxe Suites Hotels includes the following selected accounts in its general ledger at December 31, 2024: (Click the icon to view the accounts.) Prepare the liabilities section of Deluxe Suites' balance sheet at December 31, 2024. Less: Total Liabilities Deluxe Suites Hotels Balance Sheet (Partial) December 31, 2024 Data table ← Note Payable (long-term) Bonds Payable (due 2028) Interest Payable (due next year) Estimated Warranty Payable $ 150,000 250,000 1,200 2,000 Print Accounts Payable Discount on Bonds Payable Salaries Payable Sales Tax Payable Done $ 40,000 7,500 3,300 700arrow_forwardn.wileyplus.com/edugen/fti/mainuni S Kimmel, Financial Accounting, 8e Help I System Announcements Brief Exercise 10-12 Your answer is partially correct. Try again. Presented here are long-term liability items for Windsor, Inc. at December 31, 2017. Bonds payable (due 2021) Notes payable (due 2019) Discount on bonds payable 000'098$ 000'eɛ Prepare the long-term liabilities section of the balance sheet for Windsor, Inc. WINDSOR, INC. Balance Sheet (Partial) December 31, 2017 Current Liabilities Notes Payable 00064 A SSB 781000 000098 Bonds Payable Discount on Bonds Payable 000 Long-term Liabilities 000906 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT INTERACTIVE TLarrow_forward

- Part 1 Prepare journal entries to the following. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) a. Issuance of the bonds on June 1, 2023 b. Payment of interest on December 1, 2023 c. Adjusting entry to accrue bond interest and discount amortization on January 31, 2024 d. Payment of interest on June 1, 2024 Assume JetCom Inventors Inc. has a January 31 year-end. View transaction list Journal entry worksheet 1 2 3 4 Record issued bond at discount. Note: Enter debits before credits. Date June 01, 2023 General Journal Debit Credit >arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Legacy issues $325,000 of 5%, four-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31. They are issued at $292,181 when the market rate is 8%. 2. Determine the total bond interest expense to be recognized over the bonds' life. Total bond interest expense over life of bonds: Amount repaid: payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expensearrow_forwardHow to find accrued interest on bonds payable for just March 2018 info on bonds payable- 6%, interest payment dates May 1 and Nov 1, due May 2036; balance per ledger is 10,000,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education