Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

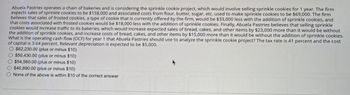

Transcribed Image Text:Abuela Pastries operates a chain of bakeries and is considering the sprinkle cookie project, which would involve selling sprinkle cookies for 1 year. The firm

expects sales of sprinkle cookies to be $158,000 and associated costs from flour, butter, sugar, etc. used to make sprinkle cookies to be $69,000. The firm

believes that sales of frosted cookies, a type of cookie that is currently offered by the firm, would be $33,000 less with the addition of sprinkle cookies, and

that costs associated with frosted cookies would be $18,000 less with the addition of sprinkle cookies. Finally, Abuela Pastries believes that selling sprinkle

cookies would increase traffic to its bakeries, which would increase expected sales of bread, cakes, and other items by $23,000 more than it would be without

the addition of sprinkle cookies, and increase costs of bread, cakes, and other items by $15,000 more than it would be without the addition of sprinkle cookies.

What is the operating cash flow (OCF) for year 1 that Abuela Pastries should use to analyze the sprinkle cookie project? The tax rate is 41 percent and the cost

of capital is 3.64 percent. Relevant depreciation is expected to be $5,000.

O $62,230.00 (plus or minus $10)

$50,430.00 (plus or minus $10)

$54,560.00 (plus or minus $10)

$46,890.00 (plus or minus $10)

None of the above is within $10 of the correct answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Delta Sonic, a chain of full service automotive detailers, is considering introducing a new 15-minute car wash and wax service at one of its Chicago locations. The company expects that sales from the new 15-minute service will be $145,000 per year. Delta Sonic currently offers a 1-hour wash/wax/detail service with annual sales of $267,500. While many of the 15-minute sales will be to new customers who, in the past, could not wait a full hour to have their car detailed, Delta Sonic estimates that 10% of their 1-hour sales will be lost as a result of existing customers switching to the new, faster service. The level of incremental sales associated with introducing the new 15-minute wash/wax service that should be used when analyzing this project is closest to O A. $171,750 B. $14,500 C. $145,000 O D. $26,750 O E. $118,250arrow_forwardPlease help me. Fast solution please. Thankyou.arrow_forwardNeptune Company has developed a small inflatable toy that it is anxious to introduce to its customers. The company's Marketing Department estimates that demand for the new toy will range between 15,000 units and 35,000 units per month. The new toy will sell for $3 per unit. Enough capacity exists in the company's plant to produce 18,000 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.00, and incremental fixed expenses associated with the toy would total $22,000 per month. Neptune has also identified an outside supplier who could produce the toy for a price of $1.75 per unit plus a fixed fee of $15,000 per month for any production volume up to 20,000 units. For a production volume between 20,001 and 40,000 units the fixed fee would increase to a total of $30,000 per month. Required: 1. Calculate the break-even point in unit sales assuming that Neptune does not hire the outside supplier. 2. How much profit will Neptune earn assuming: a. It…arrow_forward

- Micro Tek Inc. is considering an investment in new equipment that will be used to manufacture a smartphone. The phone is expected to generate additional annual sales of 4,000 units at $450 per unit. The equipment has a cost of $3,950,000, residual value of $50,000, and an 8-year life. The equipment can only be used to manufacture the phone. The cost to manufacture the phone follows: Cost per unit: Direct labor $20 Direct materials 205 Factory overhead (including depreciation) 39 Total cost per unit $264 Determine the average rate of return on the equipment. Round your answer to one decimal place.fill in the blank 1 %arrow_forwardMadetaylor Inc. manufactures financial calculators. The company is deciding whether to introduce a new calculator. This calculator will sell for $130. The company feels that sales will be 18,000, 22,000, 24,000, 22,000, and 18,000 units annually for the next five years. Variable costs will be 21% of sales, and fixed costs are $500,000 annually. The firm hired a marketing team to analyze the product's viability, and the marketing analysis cost $1,250,000. The company plans to manufacture and store the calculators in a vacant warehouse. Based on a recent appraisal, the warehouse and the property are worth $2.5 million after tax. If the company does not sell the property today, it will sell it five years from today at the currently appraised value. This project will require an injection of net working capital at the onset of the project, $250,000. The firm recovers the net working capital at the end of the project. The firm must purchase equipment for $5,000,000 to produce the…arrow_forwardPappy's Potato has come up with a new product, the Potato Pet (they are freeze-dried to last longer). Pappy's paid $120,000 for a marketing survey to determine the viability of the product. It is felt that Potato Pet will generate sales of $915,000 per year. The fixed costs associated with this will be $235,000 per year, and variable costs will amount to 20 percent of sales. The equipment necessary for production of the Potato Pet will cost $890,000 and will be depreciated in a straight-line manner for the four years of the product life (as with all fads, it is felt the sales will end quickly). This is the only initial cost for the production. The tax rate is 23 percent and the required return is 13 percent. Calculate the payback period, NPV, and IRR.arrow_forward

- One year ago, your company purchased a machine used in manufacturing for $90,000. You have learned that a new machine is available that offers many advantages and you can purchase it for $155,000 today. It will be depreciated on a straight-line basis over 10 years and has no salvage value. You expect that the new machine will produce a gross margin (revenues minus operating expenses other than depreciation) of $50,000 per year for the next 10 years. The current machine is expected to produce a gross margin of $22,000 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $8,182 per year. The market value today of the current machine is $55,000. Your company's tax rate is 38%, and the opportunity cost of capital for this type of equipment is 12%. Should your company replace its year-old machine?arrow_forwardMesa Cheese Company has developed a new cheese slicer called Slim Slicer. The company plans to sell this slicer through its catalog, which it issues monthly. Given market research, Mesa believes that it can charge $30 for the Slim Slicer. Prototypes of the Slim Slicer, however, are costing $31. By using cheaper materials and gaining efficiencies in mass production, Mesa believes it can reduce Slim Slicer's cost substantially. Mesa wishes to earn a return of 40% of the selling price. (a) Compute the target cost for the Slim Slicer. Target cost $arrow_forwardHelp please and thank you!arrow_forward

- Gold Star Industries is contemplating a purchase of computers. The firm has narrowed its choices to the SAL 5000 and the HAL 1000. The company would need nine SALs, and each SAL costs $3,250 and requires $300 of maintenance each year. At the end of the computer’s eight-year life, each one could be sold for $195. Alternatively, the company could buy seven HALs. Each HAL costs $3,600 and requires $355 of maintenance every year. Each HAL lasts for six years and has a resale value of $140 at the end of its economic life. The company will continue to purchase the model that it chooses today into perpetuity, and the tax rate is 25 percent. Assume that the maintenance costs occur at year-end. Depreciation is straight-line to zero. What is the EAC of each model if the appropriate discount rate is 12 percent? (Your answers should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardPremium Corporation believes that there is a market for a portable electronic toothbrush that can be easily carried by business travelers. Premium's market research department has surveyed the features and prices of electronic brushes currently on the market. Based on this research, Premium believes that $75 would be about the right price. At this price, marketing believes that about 78,000 new portable brushes can be sold over the product's life cycle. It will cost about $1,170,000 to design and develop the portable brush. Premium has a target profit of 25% of sales. Requirement 1. Determine the total and unit target cost to manufacture, sell, distribute, and service the portable brushes. Requirement 1. Determine the total and unit target cost to manufacture, sell, distribute, and service the portable brushes. Begin by computing the total target cost to manufacture, sell, distribute, and service the portable brushes, then compute the unit target cost to manufacture, sell, distribute,…arrow_forwardMadetaylor Inc. manufactures financial calculators. The company is deciding whether to introduce a new calculator. This calculator will sell for $130. The company feels that sales will be 18,000, 22,000, 24,000, 22,000, and 18,000 units annually for the next five years. Variable costs will be 21% of sales, and fixed costs are $500,000 annually. The firm hired a marketing team to analyze the product's viability, and the marketing analysis cost $1,250,000. The company plans to manufacture and store the calculators in a vacant warehouse. Based on a recent appraisal, the warehouse and the property are worth $2.5 million after tax. If the company does not sell the property today, it will sell it five years from today at the currently appraised value. This project will require an injection of net working capital at the onset of the project, $250,000. The firm recovers the net working capital at the end of the project. The firm must purchase equipment for $5,000,000 to produce the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education