FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

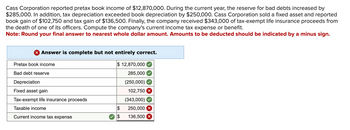

Transcribed Image Text:Cass Corporation reported pretax book income of $12,870,000. During the current year, the reserve for bad debts increased by

$285,000. In addition, tax depreciation exceeded book depreciation by $250,000. Cass Corporation sold a fixed asset and reported

book gain of $102,750 and tax gain of $136,500. Finally, the company received $343,000 of tax-exempt life insurance proceeds from

the death of one of its officers. Compute the company's current income tax expense or benefit.

Note: Round your final answer to nearest whole dollar amount. Amounts to be deducted should be indicated by a minus sign.

X Answer is complete but not entirely correct.

Pretax book income

Bad debt reserve

Depreciation

Fixed asset gain

Tax-exempt life insurance proceeds

Taxable income

Current income tax expense

$ 12,870,000

285,000

(250,000)

$

$

102,750 X

(343,000)

250,000 X

136,500 ×

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes (EBT)? Show your answer using the income statement structure.arrow_forwardWynn Farms reported a net operating loss of $270,000 for financial reporting and tax purposes in 2021. The enacted tax rate is 25%. Taxable income, tax rates, and income taxes paid in Wynn's first four years of operation were as follows: 2017 $ 2018 2019 Taxable Income 2020 82,000 92,000 190,000 40,000 Tax Rates 30 % 30 40 Income Taxes Paid 45 $ 24,600 27,600 76,000 18,000 Required: 1. NOL carrybacks are not allowed for most companies, except for property and casualty insurance companies as well as some farm-related businesses. Assume Wynn is one of those businesses. Complete the table given below and prepare the journal entry to recognize the income tax benefit of the net operating loss. 2. Show the lower portion of the 2021 income statement that reports the income tax benefit of the net operating loss. Please correct answer only wit explanation. Thank you so much!arrow_forwardBefore considering a net operating loss carryforward of $75 million, Fama Corporation reported $110 million of pretax accounting and taxable income in the current year. The income tax rate for all previous years was 35%. On January 1 of the current year, a new tax law was enacted, reducing the rate to 25% effective immediately. Fama's income tax payable for the current year would be: Note: Round your answer to the nearest whole million. $65 million. $19 million. $12 million. $9 million.arrow_forward

- Sol Limited. reported earnings of $550,000 in 20X8. The company has $95,000 of depreciation expense this year, and claimed CCA of $150,000. The tax rate was 28%. At the end of 20X7, there was a $130,000 loss carryforward that was not recorded because use was considered less than probable. The company also reported a deferred tax liability of $75,000 caused by capital assets with a net book value of $1,350,000 and UCC of $1,050,000. The tax rate had been 20% in 20X7. Required: What is the amount of income tax expense in 20X8? Tax expense Prepare the income tax entry or entries. A View transaction list No 1 2 Date 20X8 20X8 View journal entry worksheet Income tax expense Deferred income tax asset Income tax payable Income tax payable Income tax expense General Journal Debit Credit 138,600arrow_forwardIn its first year of operations, Seagate Tech reported pretax accounting income of $780 million for the current year. Depreciation reported in the tax return in excess of depreciation in the income statement was $900 million. The excess tax will reverse itself evenly over the next three years. The current year's tax rate of 25% will be reduced under the current law to 30% next year and 35% for all subsequent years. At the end of the current year, the deferred tax liability related to the excess depreciation will be: Multiple Choice $315 million. $300 million. $270 million. $360 million.arrow_forwardSt. George, Incorporated reported $711,800 net income before tax on this year’sfinancial statement prepared in accordance with GAAP. The corporation’s recordsreveal the following information:Four years ago, St. George realized a $283,400 gain on the sale of investmentproperty and elected the installment sale method to report the sale for taxpurposes. Its gross profit percentage is 50.12, and it collected $62,000 principaland $14,680 interest on the installment note this year.Five years ago, St. George purchased investment property for $465,000 cash froman LLC. Because St. George and the LLC were related parties, the LLC’s $12,700realized loss on the sale was disallowed for tax purposes. This year, St. George soldthe property to an unrelated purchaser for $500,000.A flood destroyed several antique carpets that decorated the floors of corporateheadquarters. Unfortunately, St. George’s property insurance does not coverdamage caused by rising water, so the loss was uninsured. The carpets’…arrow_forward

- Wynn Farms reported a net operating loss of $180,000 for financial reporting and tax purposes in 2021. The enacted tax rate is 25%. Taxable income, tax rates, and income taxes paid in Wynn's first four years of operation were as follows: 2017 2018 Taxable Tax Income Rates $ 80,000 20% 90,000 20 Income Taxes Paid $16,000 18,000 2019 160,000 25 2020 80,000 35 40,000 28,000 Required: 1. Prepare the journal entry to recognize the income tax benefit of the net operating loss. NOL carrybacks are not allowed for most companies, except for property and casualty insurance companies as well as some farm-related businesses. Assume Wynn is one of those businesses. 2. Show the lower portion of the 2021 income statement that reports the income tax benefit of the net operating loss. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to recognize the income tax benefit of the net operating loss. NOL carrybacks are not allowed for most…arrow_forwardBefore considering a tax loss carryforward of $80 million, Aero Corporation reported $200 million of pretax accounting and taxable income in the current year. The income tax rate for all previous years was 40%. On January 1 of the current year a new tax law was enacted, reducing the rate to 35% effective immediately. Aero's income tax payable for the current year would be: Select one: a. $48 million. b. $28 million. c. $36 million. d. $42 million. e. $80 million.arrow_forwardLi Corporation reported pretax book income of $660,000. Tax depreciation exceeded book depreciation by $412, 000. Li's beginning book (tax) basis in its fixed assets was $1,960,000 ($1,748, 000) and its ending book (tax) basis is $1,860,000 ($1, 272, 000). In addition, the company received $360, 000 of tax-exempt municipal bond interest. The company's prior - year tax return showed taxable income of $49,000. Assuming a tax rate of 21 percent, compute the company's deferred income tax expense or benefit.arrow_forward

- In its first year of operations, HD Corporation reported pretax accounting income of $820 million for the current year. Depreciation reported in the tax return in excess of depreciation in the income statement was $1,020 million. The excess tax will reverse itself evenly over the next three years. The current year's tax rate of 25% will be changed under the current law to 30% next year and 35% for all subsequent years. At the end of the current year, the deferred tax liability related to the excess depreciation for HD Corp, will be: Multiple Choice $340 million $306 million $408 million $357 millionarrow_forwardAbbot Corporation reported pretax book income of $500,000. During the current year, the reserve for bad debts increased by $5,000. In addition, tax depreciation exceeded book depreciation by $40,000. Finally, Abbot received $3,000 of tax-exempt life insurance proceeds from the death of one of its officers. Abbot's current income tax expense or benefit would be:arrow_forwardCandyland Property and Casualty Insurance Corporation reported a net operating loss of $220,000 for financial reporting and tax purposes in 2019. The enacted tax rate is 25%. Taxable income and tax rates in Candyland's first two years of operation were as follows: 2017 $40,000 30% 2018 $100,000 25% Assuming NOL carryback is allowed for companies up to 2 years, the amount of net loss reported on the income statement for the year ended December 31, 2019 would be: O $154,000 O $158,000 O $163,000 O $165,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education