FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

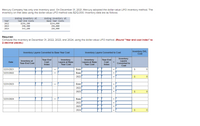

Transcribed Image Text:Mercury Company has only one Inventory pool. On December 31, 2021, Mercury adopted the dollar-value LIFO Inventory method. The

Inventory on that date using the dollar-value LIFO method was $212,000. Inventory data are as follows:

Ending Inventory at

Year-End Costs

Ending Inventory at

Base Year Costs

Year

$256, 200

340,400

343, 200

$244, 000

296,000

286,000

2022

2023

2024

Requlred:

Compute the Inventory at December 31, 2022, 2023, and 2024, using the dollar-value LIFO method. (Round "Year end cost Index" to

2 decimal places.)

Inventory Layers Converted to Base Year Cost

Inventory Layers Converted to Cost

Inventory DVL

Cost

Inventory

Layers

Converted to

Cost

Year-End

Inventory at

Year-End Cost

Year-End

Cost

Index

Inventory

Layers at Base

Year Cost

Inventory

Layers at Base

Year Cost

Date

Cost

Index

12/31/2021

Base

12/31/2022

Base

=

2022

%3D

12/31/2023

Base

2022

2023

=

12/31/2024

Base

2022

2023

2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mercury Company has only one inventory pool. On December 31, 2024, Mercury adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO method was $216,000. Inventory data are as follows: Year Ending Inventory at Year-End Costs Ending Inventory at Base Year Costs 2025 $ 264,600 $ 252,000 2026 354,200 308,000 2027 357,600 298,000 Required: Compute the inventory at December 31, 2025, 2026, and 2027, using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places.arrow_forwardAlpesharrow_forwardOn January 1, 2021, the National Furniture Company adopted the dollar-value LIFO method of computing inventory. An internal cost index is used to convert ending inventory to base year. Inventory on January 1 was $200,000. Year-end inventories at year-end costs and cost indexes for its one inventory pool were as follows: Year EndedDecember 31 Inventory atYear-endCosts Cost Index(Relative toBase Year) 2021 $ 259,200 1.08 2022 296,800 1.12 2023 299,000 1.15 Required:Compute inventory amounts at the end of each year using the dollar-value LIFO method. 12/31/2021 12/31/2022 12/31/2023arrow_forward

- A company uses the dollar-value LIFO method of computing inventory. An external price index is used to convert ending inventory to base year. The company began operations on January 1, 2024, with an inventory of $120,000 Year-end inventories at year-end costs and cost indexes for its one inventory pool were as follows: Year Ended December 31 2024 2025 2026 2027 Date Required: Calculate inventory amounts at the end of each year Note: Round intermediate calculations and final answers to the nearest whole dollars. 01/01/2024 12/31/2024 12/31/2025 12/31/2026 Ending Inventory at Cost Index (Relative to Year-End Costs Base Year) $ 198,000 261,800 243,600 240,800 12/31/2027 Inventory Layers Converted to Base Year Cost Inventory at Year End Cost Inventory Layers at Base Year Cost Inventory Layers Converted to Cost Inventory Layers Converted to Cost Base Base 2024 Base 2024 2025 Base 1.10 1.19 1.16 1.12 2024 2025 2026 Base 2024 2025 2026 2027 Inventory Layers at Base Year Cost Inventory DVL…arrow_forwardInventory, 12/31/25 Purchases Purchase returns Purchase discounts Gross sales (before employee discounts) Sales returns Markups Markup cancellations Markdowns Markdown cancellations Freight in Employee discounts granted Loss from breakage (normal) Cost $158,500 752,100 42,300 11,400 37400 Retail $265.000 1,357,000 75,400 1,243,000 53,600 67,200 15,200 82,200 21,500 10.500 8.800arrow_forwardDo not give image formatarrow_forward

- Give me correct answer with explanation.harrow_forwardCaterpillar Inc (CAT) has the following excerpts from their financial statements December 31, 2021 December 31, 2020 Inventory (in $ Millions) 14,038 11,402 Net Income(in $ Millions) 6,489 2,998 Inventories are principally determined using the last-in, first-out (LIFO) method. The value of inventories on the LIFO basis. If the FIFO (first-in, first-out) method had been in use, inventories would have been $3,258 million and $2,921 million higher than reported at December 31, 2021 and 2020, respectively. Assume corporate tax rate of 21%. If CAT had used FIFO method instead of LIFO method What inventory (in $ Millions) would CAT report for 2021? What net income (profit) would CAT report in 2021? What is the cumulative amount of income tax savings that CAT generated through end of 2021 by using LIFO instead of FIFO? What…arrow_forwardOn January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 48,000 103,040 3,200 Retail $ 64,000 120,000 2025 16,000 3,200 117,850 3,800 Cost 2025 $ 115,150 3,700 Retail Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. $ 133,000 10,400 3,400 119,440 5,920 1.00 1.06 1.12arrow_forward

- On January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20 % discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 56,000 104,000 4,000 Retail $ 80,000 128,000 2025 20,000 4,000 129,465 2,700 Cost 2025 $ 109,695 4,500 Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. Retail $ 134,200 12,000 4,200 121,260 4,400 1.00 1.06 1.12arrow_forwardOn January 1, 2024, a Company adopted the dollar-value LIFO method for its one inventory pool. The pool’s value on this date was $750,000. The 2024 and 2025 ending inventory valued at year-end costs were $793,000 and $882,000, respectively. The appropriate cost indexes are 1.04 for 2024 and 1.05 for 2025. Required: Complete the below table to calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places. Round other final answer values to the nearest whole dollars.arrow_forwardOn January 1, 2024, a Company adopted the dollar-value LIFO method for its one inventory pool. The pool’s value on this date was $660,000. The 2024 and 2025 ending inventory valued at year-end costs were $690,000 and $760,000, respectively. The appropriate cost indexes are 1.04 for 2024 and 1.08 for 2025. Required: Complete the below table to calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education