FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

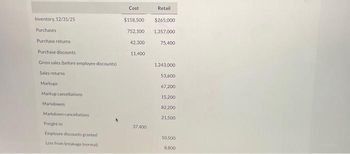

Transcribed Image Text:Inventory, 12/31/25

Purchases

Purchase returns

Purchase discounts

Gross sales (before employee discounts)

Sales returns

Markups

Markup cancellations

Markdowns

Markdown cancellations

Freight in

Employee discounts granted

Loss from breakage (normal)

Cost

$158,500

752,100

42,300

11,400

37400

Retail

$265.000

1,357,000

75,400

1,243,000

53,600

67,200

15,200

82,200

21,500

10.500

8.800

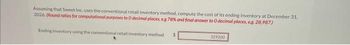

Transcribed Image Text:Assuming that Sweet Inc. uses the conventional retail inventory method, compute the cost of its ending inventory at December 31.

2026. (Round ratios for computational purposes to 0 decimal places, eg 78% and final answer to 0 decimal places, eg. 28,987)

Ending inventory using the conventional retail inventory method

$

329200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- un.9arrow_forwardGiven the following information for Miller, Inc.: Cost Retail Markdown cancellations $950 Markup cancellations 3,500 Employee discounts 1,020 Purchase returns $1,030 1,520 Purchases 35,400 46,787 Inventory, January 1 7,160 13,820 Purchase discounts taken 756 Freight-in 4,000 Markups 14,500 Markdowns 2,600 Sales 56,700 Required: a. Determine the inventory value using the retail inventory method and the FIFO cost flow assumption. b. Determine the inventory value using the retail inventory method and the lower of average cost or market cost flow assumption. Round intermediate calculation to two decimal places and final answer to nearest dollar.arrow_forwardaj.4arrow_forward

- Incomplete manufacturing costs, expenses, and selling data for two different cases are as follows. (a) Indicate the missing amount for each letter. Case 2 Direct materials used $9,700 %24 Direct labor 5,100 8,100 Manufacturing overhead 8,400 4,100 Total manufacturing costs (a) 16,100 Beginning workin process inventory 1,100 (h) Ending work in process inventory (b) 3,100 Sales revenue 25,000 (1) Sales discounts 2,600 1,500 Cost of goods manufactured 17,100 22,100 Beginning finished goods inventory (c) 3,400arrow_forwardPlease don't provide answer in image format thank youarrow_forwardEnrichment Activity 4-1. Missing Elements Net Sales Gross Sales Less: Sales Returns & Allowances P 54,000 Sales Discounts 19,200 Net Sales Less: Cost of Sales 225,000 Inventory, 1/1/21 Add: Net Purchases P. Purchases P 890,200 Less: Purchases Returns & Allow. P 31,000 Purchase Discounts 12,200 Add: Freight In 12,000 Net Purchases 859,000 P 1,084,000 Goods Available for Sales Less: Inventory, 12/31/21 Cost of Sales Gross Profit Less: Operating Expenses Distribution Expenses Administrative Expenses Total Expense 138.480 (258,780) Net Income 125,220 Required: Insert the missing figures in the income statement above. Note that Net Income is 10% of Gross Sales.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education