FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

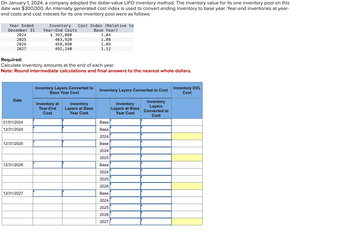

Transcribed Image Text:On January 1, 2024, a company adopted the dollar-value LIFO inventory method. The inventory value for its one inventory pool on this

date was $300,000. An internally generated cost index is used to convert ending inventory to base year. Year-end inventories at year-

end costs and cost indexes for its one inventory pool were as follows:

Year Ended

December 31

2024

2025

2026

2027

Date

Required:

Calculate inventory amounts at the end of each year.

Note: Round intermediate calculations and final answers to the nearest whole dollars.

01/01/2024

12/31/2024

12/31/2025

12/31/2026

Inventory Cost Index (Relative to

Base Year)

Year-End Costs

$392,080

403, 920

458, 890

492,240

12/31/2027

Inventory Layers Converted to

Base Year Cost

Inventory at

Year-End

Cost

1.04

1.08

1.09

1.12

Inventory

Layers at Base

Year Cost

Inventory Layers Converted to Cost

Inventory

Layers

Converted to

Cost

Base

Base

2024

Base

2024

2025

Base

2024

2025

2026

Base

2024

2025

2026

2027

Inventory

Layers at Base

Year Cost

Inventory DVL

Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company has four types of products in its inventory. The company applies the rules under lower of cost and net realizable value to its inventory at the end of each year as shown below: Product A B CA с D Quantity 15 10 20 15 Cost $7 15 8 11 Net Realizable Value $8 14 6 10 The year-end adjustment based upon the information above would include a:arrow_forwardcalculate number of days sales in inventoryarrow_forwardPrepare the journal entry to record the LIFO adjustment. See the information below: The balances in Inventory – Finished Goods for the first and second year that WTG was in business were $275,000 and $350,000, respectively. The relevant indices for the 4 years are as follows: Year 1: 100 Year 2: 101 Year 3: 102 Year 4 (Current Year): 103 The computation of LIFO is included in the “Inventory” spreadsheet attached.arrow_forward

- A physical inventory or count of inventory should be taken around the _____ to make sure that the quantity of inventory reported in the financial statements is accurate. end of the year beginning of the year middle of the year None of these are correct.arrow_forwardAssume the perpetual inventory system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless stated otherwise. Estimating sales returns On December 31, Jack Photography Supplies estimated that approximately 2% of merchandise sold will be returned. Sales Revenue for the year was $80,000 with a cost of $48,000. Journalize the adjusting entries needed to account for the estimated returns.arrow_forwardWould the quarter total for desired ending inventory be 16,800 or the total of all 3 months? The same question for begining inventory, would it be 42,000 or 21,000?arrow_forward

- Question: Langley Inc. inventory records for a particular development program show the following at October 31, 2020: At October 31, ten of these programs are on hand. Langley uses the perpetual inventory system. 1. Journalize for Langley: a. Total October purchases in one summary entry. All purchases were on credit. b. Total October sales and cost of goods sold in two summary entries. The selling price was $500 per unit, and all sales were on credit. Langley uses the FIFO inventory method. (Please show the calculations/where the number is from) Ex: I didn't understand the part of the answer for the entry Cost of Goods Sold & Inventory 1,710. 2. Under FIFO, how much gross profit would Langley earn on these transactions? What is the FIFO cost of Langley’s ending inventory?arrow_forwardYou are provided with the following data: inventory - to -sale conversion period = 100days Sale - to - cash conversionperiod = 46 days Purchase - to -payment conversion period30 days What is the operatingcycle?arrow_forwardSunland Company uses a periodic inventory system. Details for the inventory account for the month of January, 2020 are as follows: Balance, 1/1/20 Purchase, 1/28/20 Per Units unit price Total $6.00 $1260 Purchase, 1/15/20 150 210 O 180 O 300 O 30 O 330 150 5.40 5.60 810 840 An end of the month (1/31/20) inventory showed that 180 units were on hand. How many units did the company sell during January, 2020?arrow_forward

- Jenbright Incorporated adopted the dollar-value LIFO method last year. Last year's ending inventory was $53,700. The ending inventory for the current year at year-end (FIIFO) costs is $98,000 and on a dollar-value LIFO basis is $76,520. Based on this information, prepare the journal entry required to adjust Jenbright's ending inventory from a FIFO to a dollar-value LIFO basis. Prepare the journal entry required to adjust Jenbright's ending inventory from a FIFO to a dollar-value LIFO basis. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the adjusting entry for the current year. Account Year-endarrow_forwardplease all answerarrow_forwardPlease helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education