FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:This table is designed to present data related to the multiple operating departments based on regions. The regions highlighted are Asia, Africa/Australia, and Europe, with a column for the Total. Each region and the total have corresponding percentage entries depicted as empty boxes where data can be entered.

- **Operating Departments**: This is the main category under which the data is organized into different regions.

- **Asia, Africa/Australia, Europe**: These are the regional categories under "Operating Departments".

- **Total**: This column is meant to display the aggregated percentage from the three regions combined.

Each regional column has two rows of blank spaces followed by a percentage symbol where specific data can be entered, suggesting that multiple data points or sets can be inputted. Similarly, the "Total" column has two rows with blank spaces to summarize the data for these regions. This structure indicates the flexibility to input data potentially for comparison or analysis purposes.

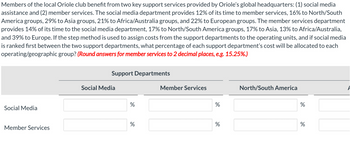

Transcribed Image Text:Members of the local Oriole club benefit from two key support services provided by Oriole’s global headquarters: (1) social media assistance and (2) member services. The social media department provides 12% of its time to member services, 16% to North/South America groups, 29% to Asia groups, 21% to Africa/Australia groups, and 22% to European groups. The member services department provides 14% of its time to the social media department, 17% to North/South America groups, 17% to Asia, 13% to Africa/Australia, and 39% to Europe. If the step method is used to assign costs from the support departments to the operating units, and if social media is ranked first between the two support departments, what percentage of each support department’s cost will be allocated to each operating/geographic group? *(Round answers for member services to 2 decimal places, e.g. 15.25%.)*

---

**Support Departments Allocation Table:**

- **Social Media Department:**

- Social Media: _____%

- Member Services: _____%

- North/South America: _____%

- Asia: _____%

- Africa/Australia: _____%

- Europe: _____%

- **Member Services Department:**

- Social Media: _____%

- Member Services: _____%

- North/South America: _____%

- Asia: _____%

- Africa/Australia: _____%

- Europe: _____%

This table indicates how costs from the social media and member services support departments are distributed across various geographic regions using the step method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Indra Nooyi, the former CEO of PepsiCo describes how she led an effort to the company being a "better corporate citizen." She advises other companies who wish to adopt a "Performance with Purpose" approach to consider all of the following except: Ensure the company's board of directors support the intiative. O Hire a Chief Sustainability Officer to oversee all aspects of the initiative. O Adapt the strategy to accommodate the needs of local markets. O Form partnerships and coalitions with NGOS and other companies.arrow_forwardGadubhaiarrow_forwardthe book I use for study: Horngren's Cost Accounting: A Managerial Emphasis, 16th edition, Global Edition. Questions in image Request Compute: direct method and step methodarrow_forward

- tealesxille Sanctuary is a family-owned and operated wildlife park located in Melbourne. Healesville Sanctuary has more than 150 animal species, some of which are loaned from overseas animal parks. Healesville Sanctuary has two divisions for selling merchandise: a retail operation that sells food, beverages, shirts, souvenirs and other novelties to visitors within the park, and a wholesale operation that sells toys to department stores. The following management figures are relevant for the year ended 30 June 2020: Total assetS 69 120 000 Total current assets 34 560 000 Inventories 28 800 000 Net assets 51 840 000 Profit after income tax 9 792 000 The company tax rate is 30 per cent. During the conduct of the audit, the following items of interest were noted by the audit team: Due to an electrical contractor accidentally drilling through a power cable, all invoices for items sold through tealesxille sanctuary's wholesale operations on 22 and 23 June had to be manually prepared. Many of…arrow_forwardanswer in text form please (without image)arrow_forwardMusic Teachers, Incorporated, is an educational association for music teachers that has 20,300 members. The association operates from a central headquarters but has local membership chapters throughout the United States. Monthly meetings are held by the local chapters to discuss recent developments on topics of interest to music teachers. The association's magazine, Teachers' Forum, is issued monthly with features about recent developments in the field. The association publishes books and reports and also sponsors professional courses that qualify for continuing professional education credit. The association's statement of revenues and expenses for the current year is presented below. Revenues Expenses: Salaries Music Teachers, Incorporated Statement of Revenues and Expenses For the Year Ended November 30 $ 3,354,300 Personnel costs Occupancy costs Reimbursement of member costs to local chapters Other membership services Printing and paper Postage and shipping Instructors' fees General…arrow_forward

- purchase products seamlessly in stores, online, or through mobile devices. Most of its opera- Target Corporation operates in a single business segment that is designed to enable guests to tions are in the United States. Walmart is engaged in the operation of retail, wholesale, and other units located throughout the United States, Africa, Argentina, Brazil, Canada, Central America, Chile, China, India, Japan, Mexico, and the United Kingdom. The Company's operations are conducted in three reportable segments: Walmart U.S., Walmart International, and Sam's Club. CASES C11-1 Target Corporation and Walmart Stores, Inc.: Identifying depreciation dif- ferences and performing financial statement analysis (LO 11-8)arrow_forwardPhoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments administrative services (AS) and information systems (IS) and two operating departments-government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2020, Phoenix's cost records indicate the following: (Click the icon to view the cost records.) Read the requirements. Requirement 1a. Allocate the two support departments' costs to the two operating departments using the direct method. (Do not round intermediary calculations and round your final answers to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs. Enter a "0" for any zero balances.) Operating Departments Support Departments AS GOVT CORP Direct Method Budgeted overhead costs before interdepartment cost allocations Allocation of AS costs Allocation of IS costs Total budgeted overhead of operating departments …………. IS Totalarrow_forwardActing and Reporting on Sustainability Sustainability and the environment are topics of increasing importance in business and society today. Locate an article that profiles an organization from one of the sectors we have studied in this course (governments, not-for-profit organizations, and colleges or universities) and how that organization is addressing and reporting their activities related to sustainability. What can you learn about the organization’s commitment to sustainability from their financial statements and reporting? (Note: This may require more research than just one article.) Compare your findings to those of your classmates. What conclusions can you draw from the information shared?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education