FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

answer in text form please (without image)

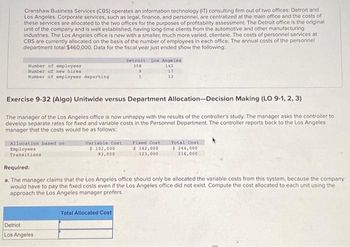

Transcribed Image Text:Cranshaw Business Services (CBS) operates an information technology (IT) consulting firm out of two offices: Detroit and

Los Angeles. Corporate services, such as legal, finance, and personnel, are centralized at the main office and the costs of

these services are allocated to the two offices for the purposes of profitability assessment. The Detroit office is the original

unit of the company and is well established, having long-time clients from the automotive and other manufacturing

industries. The Los Angeles office is new with a smaller, much more varied, clientele. The costs of personnel services at

CBS are currently allocated on the basis of the number of employees in each office. The annual costs of the personnel

department total $460,000. Data for the fiscal year just ended show the following:

Number of employees

Number of new hires

Number of employees departing

Allocation based on

Employees

Transitions

Exercise 9-32 (Algo) Unitwide versus Department Allocation-Decision Making (LO 9-1, 2, 3)

The manager of the Los Angeles office is now unhappy with the results of the controller's study. The manager asks the controller to

develop separate rates for fixed and variable costs in the Personnel Department. The controller reports back to the Los Angeles

manager that the costs would be as follows:

Variable Cost

$ 102,000

93,000

Detriot

Los Angeles

Detroit Los Angeles

358

142

9

1

Total Allocated Cost

17

13

Fixed Cont

$ 142,000

123,000

Required:

a. The manager claims that the Los Angeles office should only be allocated the variable costs from this system, because the company

would have to pay the fixed costs even if the Los Angeles office did not exist. Compute the cost allocated to each unit using the

approach the Los Angeles manager prefers.

Total Cost

$ 244,000

216,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Select the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forwardExplain an example of source documents.arrow_forwardCurrent Attempt in Progress Lee Enterprises reports the following information: Net income Depreciation expense Increase in accounts payable Increase in accounts receivable $5180000 $3979520. $5180000. $6380480. $5706480. 704480 159000 337000 Lee should report cash provided by operating activities ofarrow_forward

- I need answer typing clear urjent no chatgpt used i will give upvotesarrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forwardhow do you calculat mpg in excel?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education