FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

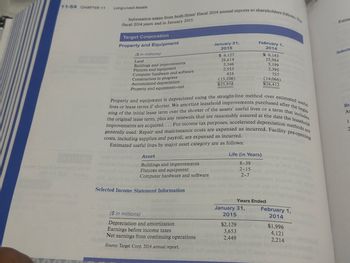

Transcribed Image Text:11-54 CHAPTER 11

Long-Lived Assets

Information taken from both firms' fiscal 2014 annual reports to shareholders follows. The

fiscal 2014 years end in January 2015.

Target Corporation

Property and Equipment

January 31,

2015

February 1,

2014

(in millions)

Land

$6.127

26.614

$6.143

25,984

Fixtures and equipment

Buildings and improvements

5,346

5.199

Construction in progress

Computer hardware and software

2,553

2.395

424

757

Accumulated depreciation

(15,106)

$25,958

(14,066)

Property and equipment-net

$26.412

Estim

Selecte

lives or lease terms if shorter. We amortize leasehold improvements purchased after the begin

Property and equipment is depreciated using the straight-line method over estimated usef

ning of the initial lease term over the shorter of the assets' useful lives or a term that includes

improvements are acquired.... For income tax purposes, accelerated depreciation methods are

the original lease term, plus any renewals that are reasonably assured at the date the leasehold

generally used. Repair and maintenance costs are expensed as incurred. Facility pre-opening

costs, including supplies and payroll, are expensed as incurred.

Estimated useful lives by major asset category are as follows:

Asset

Buildings and improvements

Life (in Years)

8-39

2-15

Computer hardware and software

2-7

Fixtures and equipment

Re

As

1

2

Selected Income Statement Information

Years Ended

January 31,

February 1,

($ in millions)

2015

2014

Depreciation and amortization

$2,129

$1,996

Earnings before income taxes

3,653

4,121

Net earnings from continuing operations

2,449

2,214

Source: Target Corp. 2014 annual report.

Transcribed Image Text:purchase products seamlessly in stores, online, or through mobile devices. Most of its opera-

Target Corporation operates in a single business segment that is designed to enable guests to

tions are in the United States.

Walmart is engaged in the operation of retail, wholesale, and other units located throughout

the United States, Africa, Argentina, Brazil, Canada, Central America, Chile, China, India,

Japan, Mexico, and the United Kingdom. The Company's operations are conducted in three

reportable segments: Walmart U.S., Walmart International, and Sam's Club.

CASES

C11-1

Target Corporation and

Walmart Stores, Inc.:

Identifying depreciation dif-

ferences and performing

financial statement analysis

(LO 11-8)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please don't provide answer in image format thank youarrow_forwardX Transactions for CCA Class 8 assets. Date Item Activity Amount March 11, 2002 Machine 1 Purchase $50,000 April 24, 2002 Machine 2 Purchase $150,000 November 3, 2005 Machine 3 Purchase $230,000 November 22, 2005 Machine 1 Sale $10,000 May 20, 2009 Machine 4 Purchase $50,000 August 3, 2014 Machine 5 Purchase $345,000 September 12, 2015 Machine 3 Sale $50,000 Churchill Metal Products opened for business in 2002. Its transactions for CCA Class 8 assets over the years are shown in the accompanying table. What CCA amount did Churchill Metal Products claim for the 20 percent UCC account in 2016? Click on the icon to view the transactions for CCA Class 8 assets. Churchill Metal Products claimed a CCA of $ in 2016. (Do not round until the final answer. Then round to the nearest dollar as needed.)arrow_forwardNonearrow_forward

- Current assets Plant assets PROBLEM: Balance sheet information for Hope Corp at Jan 1, 2016, is summarized as follows: $ 920,000 $ 1,200,000 1,800,000 800,000 720,000 1200 solev Hood $2,720,000 $ 2,720,000 Hope's assets and liabilities are fairly valued except for plant assets that are undervalued by $200,000. On January 2, 2016, Robin Corporation issues 80,000 shares of its $10 par value common stock for all of Hope's net assets and Hope is dissolved. Market quotations for the two stocks on this date are: Robin common: Hope common: Liabilities Capital stock $10 par Retained earnings $28 $19 Robin pays the following fees and costs in connection with the combination: Finder's fee $10,000 Costs of registering and issuing stock 5,000 160 a Legal and accounting fees 29VB- 6,000 20 Required: Prepare the journal entries on the books of Robin Corporation to record the acquisition Hope Corp. on January 1, 2016.arrow_forward1. Find the TIme Intrest Earned 2. Find the Asset Turnoverarrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Retained earnings, January 1 $3,704,000 $3,264,000 Net income $ 600,000 $ 550,000 Dividends: On preferred stock (10,000) (10,000) On common stock (100,000) (100,000) Increase in retained earnings $ 490,000 $ 440,000 Retained earnings, December 31 $4,194,000 $3,704,000 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Υ1 Sales $ 10,850,000 $10,000,000 Cost of goods sold (6,000,000) (5,450,000) $ 4,850,000 $ (2,170,000) Gross profit $ 4,550,000 Selling expenses $ (2,000,000) Administrative expenses (1,627,500) (1,500,000) Total operating expenses $(3,797,500) $ (3,500,000) Operating income $ 1,052,500 $ 1,050,000 Other revenue and expense:…arrow_forward

- QUESTION 13 A company had net non-current assets of R13 000 at the end of 2019 and R11 000 at the end of 2018. In addition, the company had a depreciation expense of R350 during 2019 and R500 during 2018. Based on this information, the company’s net non-current asset investment for 2019 was ... 1. R 0. R2 000. R2 350. 4 R2 500.arrow_forwardSTATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31 All answers round to two decimal places except (c) & (e), eg 54.544 input as 54.54, 54.545 input as 54.55 2019 2018 2017 2$ $ $ 2019 2018 times Plant and equipment (net) 500,000 466,000 440,000 a)Current ratio 5.11 times times times Intangible Assets 580,000 480,000 412,000 b) Acid Test Ratio times times Short Term Investments 56,000 140,000 97,200 b)lnventory Turnover Prepaid Insurance (less than 12 months) 4,000 4,000 3,800 c)Average days to sell inventory 100 Days Days (Round to days, no decimal place required) Inventory 126,000 119,000 79,000 d)Accounts Receivable turnover times times (Assume all the sale are credit sales) Accounts receivables (net) 54,000 48,000 60,000 e) Average Collection Period Days Days (Round to days, no decimal place required) % Cash 220,000 144,000 122,000 f)Profit Margin 1,540,000 1,401,000 1,214,000 g)Return on Assets times times h)Asset Turnover % Accounts Payable 80,000 100,000 100,000 i) Return on…arrow_forwardCurrent Attempt in Progress Carla Vista Co., organized in 2024, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2025 and 2026. 7/1/25 10/1/25 12/31/25 1/2/26 3/1/26 4/1/26 6/1/26 9/1/26 Intangible Assets 8-year franchise; expiration date 6/30/33 Advance payment on laboratory space (2-year lease) Net loss for 2025 including state incorporation fee, $3,000, and related legal fees of organizing, $7,000 (all fees incurred in 2025) Patent purchased (10-year life) Cost of developing a secret formula (indefinite life) Goodwill purchased (indefinite life) Legal fee for successful defense of patent purchased above Research and development costs $48,000 25,800 17,800 80,600 82,000 279,600 12,765 165,000 Prepare the necessary entries to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Make the entries as of December 31, 2026, recording any necessary…arrow_forward

- S-14 Computing the asset turnover ratio Biagas Company had net sales revenue of $55,600,000 for the year ended May 31, 2018. Its beginning and ending total assets were $52,800,000 and $98,500,000, respec- tively. Determine Biagas's asset turnover ratio for year ended May 31, 2018.arrow_forwardHasbro, Inc. Consolidated Statements of Operations - USD ($) $ in Thousands 12 Months Ended Dec. 31, 2018 Consolidated Statements of Operations [Abstract] Net revenues, external $ 4,579,646 Costs and expenses Cost of sales 1,850,678 Royalties 351,660 Product development 246,165 Advertising 439,922 Amortization of intangibles 28,703 Program production cost amortization 43,906 Selling, distribution and administration 1,287,560 Total expenses 4,248,594 Operating profit 331,052 Non-operating (income) expense Interest Expense 90,826 Interest income (22,357) Other (income) expense, net (7,819) Total non-operating expense, net 60,650 Earnings before income taxes 270,402 Income taxes 49,968 Net earnings 220,434 Net Loss Attributable to Noncontrolling Interests 0 Net Earnings Attributable to Hasbro, Inc. $ 220,434 Net earnings attributable to Hasbro, Inc. per common share: Basic (in dollars per share) $ 1.75 Diluted (in dollars per…arrow_forwardDec. 31, 2017 Dec. 31, 2016 $ 253,500 $ 210,500 1,362,800 Current assets Plant assets 800,200 Total assets $1,573,300 $1,053,700 Compute the amount and percentage changes in 2017 using horizontal analysis, assuming 2016 is the base year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education