FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

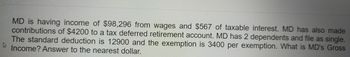

Transcribed Image Text:MD is having income of $98,296 from wages and $567 of taxable interest. MD has also made

contributions of $4200 to a tax deferred retirement account. MD has 2 dependents and file as single.

The standard deduction is 12900 and the exemption is 3400 per exemption. What is MD's Gross

Income? Answer to the nearest dollar.

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- J5.arrow_forwardArnie is single and receives Social Security benefits. His AGI is $27,000 (includes half of the social security) and his Social Security benefits are $7,200 per year. $ 2800 of his Social Security benefits are taxable. Dlonk 1arrow_forwardBernie is a former executive who is retired. This year Bernie received $192,500 in pension payments and $19,600 of social security payments. What amount must Bernie include in his gross income? Multiple Choice 1. $192,500. 2. $202,300. 3. $209,160. 4. $212,100. 5. Zero.arrow_forward

- Kevin is a 48-year-old nurse who earns an annual salary of $95,000. His employer provides group-term life insurance coverage equal to twice the annual salary for all employees. The annual amount of income for each $1,000 of taxable insurance coverage for an individual 48 years old is $1.80. How much gross income must Kevin report for this benefit? (Round answer to O decimal places, e.g. 125.) Income $arrow_forwardAlfred Morneau earned gross pay of $820. Each period he makes a 401(k) contribution of 5% of gross pay, and his current year taxable earnings for Social Security tax, to date, are $37,200.Total Social Security tax = $ 2:Rachel Schillo earned gross pay of $1,900. She does not make any retirement plan contributions, and her current year taxable earnings for Social Security tax, to date, are $105,000.Total Social Security tax = $ 3:Rudolph Fabrizio earned gross pay of $3,200. Each period he contributes 3% of gross pay to a flexible spending account, and his current year taxable earnings for Social Security tax, to date, are $136,200.Total Social Security tax = $ 4:Michael Frank earned gross pay of $2,650. Each period he designates 6% of gross pay for a dependent care flexible spending account, and his current year taxable earnings for Social Security tax, to date, are $224,300.Total Social Security tax = $arrow_forwardDuela Dent is single and had $178,400 in taxable income. Use the rates from Table 2.3. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Calculate her income taxes. Income taxes $ 57,088.00arrow_forward

- Please explain every step. Thank youarrow_forwardSuppose you made $63,245 of income from wages and $784 of taxable interest. You also made contributions of $6000 to a tax deferred retirement account. You have 3 dependents and file as single. The standard deduction is 3500 and the exemption amount is 5500 per exemption. What is your Taxable Income? Answer to the nearest dollar. 70 hp * M اشتarrow_forwardFind the gross income, the adjusted gross income, and the taxable income. Base the taxable income on the greater of a standard deduction or an temized deduction A taxpayer earned wages of $94,600, received $560 in interest from a savings account, and contributed $10,800 to a tax-deferred retirement plan She is entitled to a standard deduction of $18,800. The interest on her home mortgage was $6800, she contributed $9640 to charity, and she paid $2825 in state taxes Her gross income is $ (Simplify your answer)arrow_forward

- Alex and Addison are married and have the following income items: Alex's salary$ 57,000Addison's Schedule C net profit31,700Interest income2,400 Addison's self-employment tax was $4,479. Addison's Schedule C net business profit is qualified business income (non-service). The couple have $10,270 itemized deductions and no children or other dependents. Required: Compute their income tax on a joint return. Assume the taxable year is 2022. Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount.arrow_forwardA man earned wages of $38,100, received $1800 in interest from a savings account, and contributed $3400 to a tax-deferred retirement plan. He was entitled to a personal exemption of $4050 and had deductions totaling $6350. Find his gross income, adjusted gross income, and taxable income. His gross income was $ (Simplify your answer.) Carrow_forwardBoyd Salzer, an unmarried individual, has $246,400 AGI consisting of the following items: Salary Interest income $ 214,000 3,800 Dividend income 11,100 Rental income from real property 17,500 1. Compute Mr. Salzer's Medicare contribution tax. 2. Compute the Medicare contribution tax if Boyd Salzer files a joint income tax return with his wife Harriet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education