Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

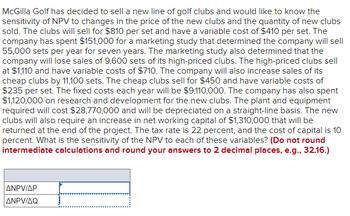

Transcribed Image Text:McGilla Golf has decided to sell a new line of golf clubs and would like to know the

sensitivity of NPV to changes in the price of the new clubs and the quantity of new clubs

sold. The clubs will sell for $810 per set and have a variable cost of $410 per set. The

company has spent $151,000 for a marketing study that determined the company will sell

55,000 sets per year for seven years. The marketing study also determined that the

company will lose sales of 9,600 sets of its high-priced clubs. The high-priced clubs sell

at $1,110 and have variable costs of $710. The company will also increase sales of its

cheap clubs by 11,100 sets. The cheap clubs sell for $450 and have variable costs of

$235 per set. The fixed costs each year will be $9,110,000. The company has also spent

$1,120,000 on research and development for the new clubs. The plant and equipment

required will cost $28,770,000 and will be depreciated on a straight-line basis. The new

clubs will also require an increase in net working capital of $1,310,000 that will be

returned at the end of the project. The tax rate is 22 percent, and the cost of capital is 10

percent. What is the sensitivity of the NPV to each of these variables? (Do not round

intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)

ANPV/AP

ANPV/AQ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 12 images

Knowledge Booster

Similar questions

- Shue Music Company is considering the sale of a new sound board used in recording studios. The new board would sell for $24,700, and the company expects to sell 1,640 per year. The company currently sells 1,990 units of its existing model per year. If the new model is introduced, sales of the existing model will fall to 1,660 units per year. The old board retails for $23,100. Variable costs are 53 percent of sales, depreciation on the equipment to produce the new board will be $1,035,000 per year, and fixed costs are $3,250,000 per year. If the tax rate is 24 percent, what is the annual OCF for the project? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. OCFarrow_forwardNytre Limited sells executive office chairs for a price of $195 each. The contribution margin ratio of the chairs is 60% and the company’s fixed costs for this year are expected to be $80,000. The company has a profit target this year of $85,000 and is considering an improved design which is expected to increase sales. Question 13: How many chairs must the company sell to reach its profit target?arrow_forwardShue Music Company is considering the sale of a new sound board used in recording studios. The new board would sell for $24,100, and the company expects to sell 1,580 per year. The company currently sells 1,930 units of its existing model per year. If the new model is introduced, sales of the existing model will fall to 1,600 units per year. The old board retails for $22,500. Variable costs are 53 percent of sales, depreciation on the equipment to produce the new board will be $1,395,000 per year, and fixed costs are $3,100,000 per year. If the tax rate is 23 percent, what is the annual OCF for the project? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. OCFarrow_forward

- Supersonic Tire Company makes a special kind of racing tire. Variable costs are $210 per unit, and fixed costs are $42,000 per month. Supersonic sells 400 units per month at a sales price of $320. If the quality of the tire is upgraded, the company believes it can increase the price to $350. If so, the variable cost will increase to $220 per unit, and the fixed costs will rise by 20%. If Supersonic decides to upgrade, how will operating income be affected? A. Operating income will increase by $20. B. Operating income will decrease by $400. C. Operating income will decrease by $12,000. D. Operating income will increase by $12,000.arrow_forwardUnder pressure from its board of directors, management at Roadside is planning to enter the conventional battery-powered flashlight market. Roadside expects to sell this boring product to wholesalers for $18.12 per unit. Relevant fixed costs will total $334,573, and variable costs to make this product will be $14.57 per unit. Background research estimates the size of the market for conventional flashlights at 1.8 million units per year. If sales of this unit reach breakeven, what market share will Roadside have? Report your answer as a percent. Report 27.5%, for example, as "27.5". Rounding: tenth of a percent.arrow_forwardPhlight Restaurant is considering a delivery service. The firm expects that sales from the new service will be $150,000 per year. Phlight currently offers a sit-down service with annual sales of $100,000. While many of the delivery sales will be to new customers, Phlight estimates that 60% of their current sit-down customers will switch and use the delivery service. The level of incremental sales associated with introducing the delivery service is closest to: Select one: a. $90,000 b. $150,000 c. $60,000 d. $120,000arrow_forward

- Praveen Co. manufactures and markets a number of rope products. Management is considering the future of Product XT, a special rope for hang gliding that has not been as profitable as planned. Because Product XT is manufactured and marketed independently of the other products, its total costs can be precisely measured. Next year's plans call for a $200 selling price per unit. Its fixed costs for the year are expected to be $270,000. Variable costs for the year are expected to be $140 per unit. Required 1. Estimate Product XT's break-even point in terms of (a) sales units and (b) sales dollars. Check (10) Break-even sales, 4,500 units 2. Prepare a contribution margin income statement for Product XT at the break-even point.arrow_forwardPraveen Co. manufactures and markets a number of rope products. Management is considering the future of Product XT, a special rope for hang gliding that has not been as profitable as planned. Because Product XT is manufactured and marketed independently of the other products, its total costs can be precisely measured. Next year's plans call for a $200 selling price per unit. Its fixed costs for the year are expected to be $270,000. Variable costs for the year are expected to be $140 per unit. Required 1. Estimate Product XT's break-even point in terms of (a) sales units and (b) sales dollars. Check (1a) Break-even sales, 4,500 units 2. Prepare a contribution margin income statement for Product XT at the break-even point.arrow_forwardBaghibenarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education