FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The follwing trial balance of Joy McDowell Tutoring Service as of May 31, 2018, does not balance.

Prepare the correct trial balance as of May 31, 2018, complete with a heading; journal entries are not required.

Investigation of the accounting records reveals that the bookkeeper:

A. Recorded a $400 cash revenue transaction by debiting accounts receivable . The credit entry was correct.

B. Posted a $2,000 credit to Accounts Payable as $200.

C. Did not record utilities expense or the related utilities payable in the amount of $300.

D. Understanded McDowell, Capital by $100.

Fullfil the empty boxes:

The options in each one of them are

-Trial Balance

-Joy McDowell Tutoring Service

-May 31,2018

-Year Ended May 31, 2018

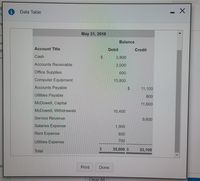

Transcribed Image Text:The following trial balance of Joy McDowell Tutoring Service as of May 31, 2018, does not balance.

E (Click the icon to view the trial balance.) i (Click the icon to view the investigation results.)

Prepare the corrected trial balance as of May 31, 2018, complete with a heading; journal entries are not required.

Transcribed Image Text:Data Table

ri

May 31, 2018

Balance

Account Title

Debit

Credit

Cash

24

2,800

Accounts Receivable

2,000

Office Supplies

600

Computer Equipment

15,800

Accounts Payable

$

11,100

Utilities Payable

800

McDowell, Capital

11,600

McDowell, Withdrawals

10,400

Service Revenue

9,600

Salaries Expense

1,900

Rent Expense

800

Utilities Expense

700

Total

$

35,000 $

33,100

is

Print

Done

Clear All

Expert Solution

arrow_forward

Step 1 Introduction

The trial balance is prepared by entering the closing balances of all the ledger accounts as Debit and credit balance. In case of the debit and credit balance do not match, the records are check out and changes are made accordingly.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me to solve this problemarrow_forwardTeal Company is presently testing a number of new agricultural seed planters that it has recently developed. To stimulate interest, it has decided to grant to five of its largest customers the unconditional right of return to these products if not fully satisfied. The right of return extends for 4 months. Teal estimates returns of 20%. Teal sells these planters on account for $1,500,000 (cost $825,000) on January 2, 2020. Customers are required to pay the full amount due by March 15, 2020. Your answer is correct. Prepare the journal entry for Teal at January 2, 202o. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 2, Accounts Receivable 1,500,000 2020 Sales Revenue 1,500,000 (To recognize revenue.) Cost of Goods Sold 825000 Inventory 825000 (To record cost of goods sold.) eTextbook and…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Want the Answer please without any failarrow_forwardSwaggy Steve's Clothing Company just completed their fiscal year ending August 31, 2019. The company's controller, when reviewing the trial balance, has discovered that the following four errors were made: 1. Swaggy recorded a $400 purchase of supplies on account by debiting Accounts Payable and crediting Supplies. 2. A cash receipt of $1,800 received from a customer as payment on their account was debited to cash and credited to sales revenue. 3. Swaggy recorded the payment of $750 in salaries expense as $570 (the correct accounts were debited and credited). 4. A payment of $1,200 for October's rent was debited to rent expense. Required: A. Using the space provided below, indicate how each element of the basic accounting equation is affected by the error by writing the amount and whether it is overstated (higher than what it is supposed to be) or understated (lower than what it is supposed to be), e.g., if the error caused assets to be overstated by $100 write "$100 Overstated" under…arrow_forwardDexter Company applies the direct write-off method in accounting for uncollectible accounts. March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from its customer Leer Company 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad d Prepare journal entries to record the above selected transactions of Dexter. View transaction list Journal entry worksheet 1 2 Record write off of Leer Company account Note: Enter debits before credits. Date General Journal Debit Credit March 11 Record entry Clear entry View general journal 2arrow_forward

- [The following Information applles to the quIestions alsplayed below Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and It reported two checks outstanding, No. 5888 for $1,028.05 and No. 5893 for $494.25. The following Information Is avallable for Its September 30 reconcilation. From the September 30 Bank Statement PREVIOUS BALANCE TOTAL CHECKS AND DEBITS TOTAL DEPOSITS AND CREDITS CURRENT BALANCE 16,800.45 9,628.85 11,272.85 18,453.25 CHECKS AND DEBITS DEPOSITS AND CREDITS Date No. Anount Date Aпount 09/03 09/04 09/07 09/17 09/28 09/22 09/22 09/28 69/29 5888 1,e28.es 69/05 09/12 1,183.75 5982 719.90 2.226.90 5981 1,824,25 09/21 4,093.ee 2,351.7e 09/25 09/30 09/30 6e0.25 NSF 5985 937.00 12.5e IN 1,485.ee CM 5983 399.10 2,e90.ee 5984 5987 213.85 5989 1,807.65 From Chavez Company's Accounting Records Cash Receipts Deposited Cash Date Debit 1,183.75 2,226.90 4,093.ee 2,351.7e 1,682.75 Sep. 5 12 21 25 30 11,458.18 Cash Disbursenents Check…arrow_forwardQuantum Solutions Company, a computer consulting firm, has decided to write off the $33,550 balance of an account owed by a customer, Alliance Inc. Required: On March 1, journalize the entry to record the write-off, assuming that (a) the direct write-off method is used and (b) the allowance method is used. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Quantum Solutions Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Alliance Inc. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215…arrow_forwardPrepare journal entries for the following transactions, using the accounts in the order listed: PLEASE NOTE: For similar accounting treatment (DR or CR), you are to record accounts in the order in which they are mentioned in the transactions. On June 1, Kellie Company had decided to initiate a petty cash fund in the amount of $1,200. DR CR On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. DR DR DR DR DR DR or CR? CR On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $80. DR DR DR DR DR DR or CR?…arrow_forward

- If a $335.00 debit item in the general journal is posted as a credit: By how much will the trial balance be out of balance? Explain how you might detect such an error.arrow_forwardEntries to Write Off Accounts Receivable Capstone Solutions Company, a computer consulting firm, has decided to write off the $45,800 balance of an account owed by a customer, Philadelphia Inc. a. Journalize the entry to record the write-off, assuming that the direct write-off method is used. If an amount box does not require an entry, leave it blank. Bad Debt Expense Accounts Receivable-Philadelphia Inc. ✔ Feedback 45,800 Check My Work Remember that under the direct write-off method, Bad Debt Expense is not recorded until the customer's account is determined to be worthless. Feedback 45,800 b. Journalize the entry to record the write-off, assuming that the allowance method is used. If an amount box does not require an entry, leave it blank. ✓ Check My Workarrow_forwardplease answer do not image.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education