FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

1. Record the estimated

2. Wrote off P. Park's account as uncollectible.

3. Reinstated Park's previously written off account.

4. Record the cash received on account.

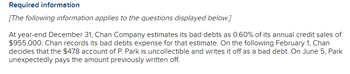

Transcribed Image Text:**Required Information**

*The following information applies to the questions displayed below.*

At year-end December 31, Chan Company estimates its bad debts as 0.60% of its annual credit sales of $955,000. Chan records its bad debts expense for that estimate. On the following February 1, Chan decides that the $478 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off.

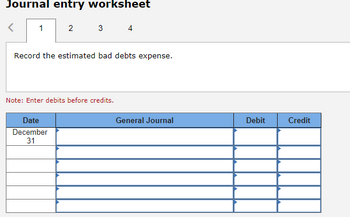

Transcribed Image Text:**Journal Entry Worksheet**

**Step 1: Record the estimated bad debts expense.**

*Note: Enter debits before credits.*

---

| Date | General Journal | Debit | Credit |

|------------|--------------------|-------|--------|

| December 31| | | |

| | | | |

| | | | |

| | | | |

| | | | |

---

This worksheet is designed to help record journal entries, specifically for estimated bad debts expense. The template includes fields for the date, general journal description, and debit and credit amounts. Remember to enter debits before credits as per accounting conventions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Janet works in the credit department handling accounts receivable transactions. At the end of each period, the allowance for uncollectible accounts has a larger and larger debit balance. What may be going wrong here? What possible corrections should be made?arrow_forwardIn a bank reconciliation, to adjust for an incorrect deposit of $1,000 from another company in your account requires: O reducing the bank balance by the amount of the deposit O increasing the bank balance by the amount of the deposit O reducing the book balance by the amount of the deposit O increasing the book balance by the amount of the depositarrow_forwardAn objective of the expense recognition principle ("matching") is to have bad debt expense recorded in: Multiple Choice O the same period that the related accounts receivable is determined to be uncollectible. the same period the related credit sales are recorded. a later period after the related credit sales are recorded. the period that a customer eventually becomes bankrupt.arrow_forward

- In the reconciliation of the June bank statement, a deposit made on June 30 did not appear on the June bank statement. How is this deposit in transit shown on the bank reconciliation? Multiple Choice O O Added to the unadjusted bank balance. Subtracted from the unadjusted bank balance. Added to the unadjusted book balance. Subtracted from the unadjusted book balance.arrow_forwardMay you please help me determine which of the following statements are false?arrow_forward7) Adjusting entries are made: A) For the differences between the bank statement cash balance and adjusted cash balance on the bank reconciliation. B) For the difference between the book (financial statement) cash balance and the adjusted cash balance on the bank reconciliation. C) Both A and B are true. D) Neither A, nor B, is true.arrow_forward

- Which of the following statements is false? a) An entry to write off an uncollectible account does not change the net realizable value of accounts receivable. b)The issuer ofa note records a receivable on their books on the date the note is issued. c)Using the allowance method of accounting for accounts receivables follows the matching concept. d)Recording an accrued asset for interest increases stockholders' equity.arrow_forwardSolve this problem with correct solutionarrow_forwardI need helparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education