FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

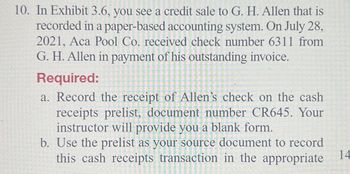

Transcribed Image Text:10. In Exhibit 3.6, you see a credit sale to G. H. Allen that is

recorded in a paper-based accounting system. On July 28,

2021, Aca Pool Co. received check number 6311 from

G. H. Allen in payment of his outstanding invoice.

Required:

a. Record the receipt of Allen's check on the cash

receipts prelist, document number CR645. Your

instructor will provide you a blank form.

b. Use the prelist as your source document to record

this cash receipts transaction in the appropriate

14

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Directions: Record checks, a check card payment, an ATM transaction and a deposit in the checkbook register below. Include the date, description, and amount of each entry. Calculate the balance. 1. May 26: write beginning balance of $527.96. 2. May 27: write check #107 to Mrs. Wilson. You pay your landlord your share of the rent payment: $225.00. May 28: make a check card payment to Foodland. You pay $22.52 for groceries. 3. 4. June 1: write check #108 to Bank of Illinois. You make a car payment of $165.23. 5. June 2: write check #109 to Interstate Phone Service for $62.77. 6. June 2: use your ATM card to withdraw $20.00. 7. June 15: you deposit your paycheck for $425.00. Write this amount in the DEPOSIT column.arrow_forwardCan i get help with the attached imagearrow_forwardOn august 31, baginski aunt company receives its bank statement on below. The company deposit it’s receipts in the bank and makes all payments by check. The debit memo for $95 is for an NSF check written by L. Pets. Check number 925 for $47, payable to Jordan company(a creditor) was recorded in the checkbook and journal as $74. The ledger balance of cash as of august 31st are no. 928, $150 and no. 929, $292. The accountant notes that the deposit of august 31 for $599 did not appear on the bank statement. How would I prepare a bank reconciliation as of august 31, assuming that the debit memos have not been recorded, as well as journal the entries, as well as complete the bank form to determine the adjusted balance of cash?arrow_forward

- On March 20, Oriole's petty cash fund of $119 is replenished when the fund contains $12 in cash and receipts for postage $49, freight- out $21, and travel expense $32. Prepare the journal entry to record the replenishment of the petty cash fund. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Mar. 20 Debit Creditarrow_forwardUpon receipt of the documents from accounts payable department, the cash disbursements clerk files the documents until their payment due date. On the due date, the clerk prepares a cheque for the invoiced amount, which is sent to the treasurer who signs it and mails back to the supplier. The cash disbursement clerk then updates the cheque register, accounts payable ledger, and accounts payable control account from the clerk’s terminal. Finally, the clerk files the invoice and copy of purchase order, receiving report, cheque in the department. Required: Describe the internal control weakness in Two Symbols’ cash disbursements system and discuss the risk associated with the weakness.arrow_forward1. Analyze these transactions, noting the accounts affected and the appropriate action: Transaction A deposit slip dated September 17, 2026, for $208.56 Copies of checks from: Windemere Kennels: Check number 18871 for $225 for August 2026 invoices GreenWay Kennels: Check number 15205 for August 2026 invoices • A copy of a deposit slip dated September 28, 2026, for $634.50 A City Credit Union credit card receipt from Office Plus for printer paper and toner, dated September 28, 2026, for $158.14 Accounts Affected Action to Takearrow_forward

- Sal's Surf Shop deposits all receipts in the bank and makes all payments by check. On July 31 the cash account had a balance of $6,105.42. The bank statement on July 31 reported a balance of $4,146.46. Upon comparing the bank statement to the books, the following items were found.arrow_forward1)The credit department runs a credit check on all customers who apply for credit one in account proves uncollectible, the credit department authorizes the right off of the accounts receivable number 2) cash receipts come into the credit department which separates the cash received from the customers remittance slips. The credit department list all cash receipts by customer name and amount of cash received 3) The cash goes to the treasurer for deposit in the bank the remittance slip go to the accounting department for posting to customers. 4) The controller compares the daily deposit slip to the total amount posted to the customers account. Both amounts must agree.arrow_forwardAccompanying a bank statement for Borden Company is a credit memo for $15,225 representing the principal ($15,000) and interest ($225) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries. Journalize the entry that should be made by the company to bring the accounting records up to date. If an amount box does not require an entry, leave it blank. UDarrow_forward

- Record the transactions in the cash receipts journal. Use two lines for December 7 and December 14 transactions. Enter the cash sales first, followed by bank credit card sales. Total the columns. Use the general journal to record sales returns and allowances. Enter the posting references when you complete part 2.arrow_forwardAt Reyes Company, checks are not prenumbered because both the purchasing and the treasurer are authorized to issue checks. Each signer has access to unissued checks kept in a unlocked file cabinet. The purchasing agent pays all bills pertaining to goods purchased for resale. Prior to payment, the purchasing agent determines that the goods hae been received and verifies the mathematical accuracy of the vendor’s invoice. After payment, the invoice is filed by vendor and the purchasing agent records the payment in the cash disbursement journal. The treasurer pays all other bills following approval by authorized employees. After payment, the treasurer stamps all bills “Paid”, files them by paymet date, and records the checks in the cash disbursement journal. Reyes Company maintains one checking account that is reconciled by the Treasurer. Requirements: List the weaknesses in internal conrtrol over cash disbursements. Identity improvements for correcting these weaknesses.arrow_forwardCan you help with the image attachedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education