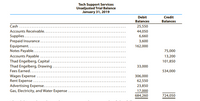

Tech Support Services has the following unadjusted

The debit and credit totals are not equal as a result of the following errors:

a. The cash entered on the trial balance was overstated by $8,000.

b. A cash receipt of $4,100 was posted as a debit to Cash of $1,400.

c. A debit of $12,350 to

d. A return of $235 of defective supplies was erroneously posted as a $325 credit to Supplies.

e. An insurance policy acquired at a cost of $3,000 was posted as a credit to Prepaid

Insurance.

f. The balance of Notes Payable was overstated by $21,000.

g. A credit of $3,450 in Accounts Payable was overlooked when the balance of the account was determined.

h. A debit of $6,000 for a withdrawal by the owner was posted as a debit to Thad

Engelberg, Capital.

i. The balance of $28,350 in Advertising Expense was entered as $23,850 in the trial

balance.

j. Miscellaneous Expense, with a balance of $4,600, was omitted from the trial balance.

Instructions

1. Prepare a corrected unadjusted trial balance as of January 31, 2019.

2. Does the fact that the unadjusted trial balance in (1) is balanced mean that

there are no errors in the accounts? Explain.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Ace Inc. made a recording error. The check written to a supplier for $650 was incorrectly recorded in the ledger as $560. During a bank reconciliation process, $90 should be 1. Added to the bank statement balance 2. Added to the depositor's balance 3. Subtracted to the bank statement balance 4. Subtracted to the depositor's balance 5. Both 1 and 2 6. Both 3 & 4 7. No adjustment is requirement *Enter the item number for your answer 1arrow_forwardRyan has a suspense account with a debit balance of $740. Upon investigation, the following discrepancies were found: (i) Discounts unexpectedly taken by customers of $229 have only been entered in the receivables control account (ii) Cash sales of $820 has not been recorded to the sales account, the cash has been debited to cash at bank (iii)Bank interest received of $54 has been debited to the interest income account and credited to the cash account. What is the balance on the suspense account after the errors have been corrected? DR or CR?arrow_forwardWw.202.arrow_forward

- Do not give answer in imagearrow_forwardDatarrow_forwardOne company has estimated that $3150 of its accounts receiable will be uncollectible. If allownace for doubtful accounts already has a credit balance of $1102, and the percentage of receivables method is used, it sadjustment to recrod for the period will require a debit to what for what amount?arrow_forward

- On October 12 of the current year, a company determined that a customer's account receivable was uncollectible and that the account should be written off. Assuming the allowance method is used to account for bad debts, what effect will this write-off have on the company's net income and total assets? Multiple Choice No effect on net income; no effect on total assets. Decrease in net income; no effect on total assets. Decrease in net income; decrease in total assets. No effect on net income; decrease in total assets.arrow_forwardIngrid Inc. has strict credit policies and only extends credit to customers with outstanding credit history. The company examined its accounts and determined that at January 1, 2018, it had balances in accounts receivable and allowance for doubtful accounts of $478,000 and $7,900 (credit), respectively. During 2018, Ingrid extended credit for $3,075,000 of sales, collected $2,715,000 of accounts receivable, and had customer defaults of $4,280. Ingrid performed an aging analysis on its receivables at year-end and determined that $6,800 of its receivables will be uncollectible. Required: 1. Calculate Ingrid's balance in accounts receivable on December 31, 2018, prior to the adjustment.$ 2. Calculate Ingrid's balance in allowance for doubtful accounts on December 31, 2018, prior to the adjustment.$ Prepare the necessary adjusting entry for 2018. Account and Explanation Debit Credit Bad Debt Expense Allowance for Doubtful Accounts Record…arrow_forwardSince it started its operations in 2019, Valdo Co. carried no allowance for doubtful accounts. Uncollectible receivables were expensed as written off and recoveries were credited to income as collected. On March 1, 2023(after the financial statements were issued), management recognized that Valdo accounting policy with respect to doubtful accounts was not correct, and determined that an allowance for doubtful accounts was necessary. Data for the five years follow: 2019 2020 2021 2022 2023 Credit sales 2,100,000 1,850,000 2,050,000 2,000,000 2,000,000 Accounts written off 20,000 40,000 130,000 22,000 113,000 The year-end balance of accounts receivable are as follows: December 31, 2022 - P1,000,000 December 31, 2023 P1,200,000 Recoveries 15,000 20,000 5,000 20,000 40,000 Bad debts are provided for as a percentage of sales. a) The percentage to be used to compute for the allowance for bad debts on December 31, 2023 would be b) How much would be the doubtful accounts expense for 2023? c)…arrow_forward

- want the answerarrow_forwardThe trial balance of Vivien for 30 June 2020 did not agree, and the difference was posted to a Suspense Account. The following errors were subsequently discovered: (i) A payment of RM1,144 in cash by Fatt Lee, a debtor, had been posted to the account of Lee Fatt. (ii) A credit notes for RM234 from Ali had been posted to the account of Ali as RM23. (iii) Discounts allowed of RM123 had been posted to the credit of discounts received. (iv) Goods totalling RM4,567 had been purchased and had been correctly entered in the purchases daybook but had not been posted to the purchase's ledger control account. (v) No entries were made in the books for goods originally sent to Wong on a sale or return basis. These goods have now been sold and the value to be invoiced is RM4,321. (vi) A new car porch had been built at the house of Vivien. The cost of the car porch was RM6,789 and this had been charged to the 'factory building' account. (vii) The purchases daybook had been under-cast by RM1,000. The…arrow_forwardCan I please get help with this question along with a quick explaination to help me understand?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education