FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

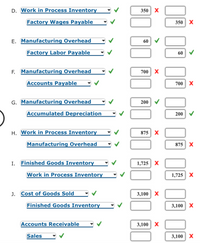

Transcribed Image Text:D. Work in Process Inventory

350

Factory Wages Payable

350 X

E. Manufacturing Overhead

60

Factory Labor Payable

60

F. Manufacturing Overhead

700

X

Accounts Payable

700 X

G. Manufacturing Overhead

200

Accumulated Depreciation

200

H. Work in Process Inventory

875

X

Manufacturing Overhead

875

X

I.

Finished Goods Inventory

1,725 X

Work in Process Inventory

1,725 X

J.

Cost of Goods Sold

3,100

X

Finished Goods Inventory

3,100

Accounts Receivable

3,100 | Х

Sales

3,100| Х

>

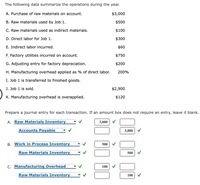

Transcribed Image Text:The following data summarize the operations during the year.

A. Purchase of raw materials on account.

$3,000

B. Raw materials used by Job 1.

$500

C. Raw materials used as indirect materials.

$100

D. Direct labor for Job 1.

$300

E. Indirect labor incurred.

$60

F. Factory utilities incurred on account.

$750

G. Adjusting entry for factory depreciation.

$200

H. Manufacturing overhead applied as % of direct labor.

200%

I. Job 1 is transferred to finished goods.

J. Job 1 is sold.

$2,900

K. Manufacturing overhead is overapplied.

$120

Prepare a journal entry for each transaction. If an amount box does not require an entry, leave it blank.

A. Raw Materials Inventory

3,000

Accounts Payable

3,000

B. Work in Process Inventory

500

Raw Materials Inventory

500

C. Manufacturing Overhead

100

Raw Materials Inventory

100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blossom Company purchases various types of beach toys for sale to consumers. Listed below are the transactions for the month of June. Blossom uses a perpetual inventory system. June 1 Purchased 25 water tubes for $260 each terms n/30 FOB destination. 8 Returned 4 tubes purchased on June 1 due to defects. Received a full refund for the defective tubes. 10 Freight charges of $100 for the June 1 transaction are paid by the responsible party. 11 Made a complaint about competitive pricing. Received a $400 credit for the water tubes purchased on June 1. 15 Purchased 110 water tubes for $235 each on account, terms 2/10 n/30. 18 Made payment for the amount owing for the June 1 transaction. 20 Made payment for the amount owing for the June 15 transaction.arrow_forwardWildhorse Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2025. Wildhorse had the following transactions related to notes payable Sept. 1 Sept. 30 Oct. 1 Oct. 31 Nov. 1 Nov. 30 Dec. 1 Dec. 31 Issued a $13,200 note to Pippen to purchase inventory. The 3-month note payable bears interest of 9% and is due December 1. (Wildhorse uses a perpetual inventory system) Recorded accrued interest for the Pippen note. Issued a $22,800, 9%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Recorded accrued interest for the Pippen note and the Prime Bank note. Issued a $24,000 note and paid $7,600 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 6% and matures in 12 months. Recorded accrued interest for the Pippen note, the Prime Bank note, and…arrow_forwardJournalize the transactions on the "Journal Entry data" tab. Because Chart of Account numbers are not provided, post-reference information is not required. Journal entries should be prepared in proper form. Refer to the "Unadjusted TB Data tab" for proper account titles. The journal must have date, description, credit and debit. Also must be a total of 64 journal entries. And must find the total.arrow_forward

- Show a journal entry writing off an account using both the allowance method and the direct write-off method. NOTE: YOU CAN INCLUDE ANY AMOUNTS AS LONG AS THEY MAKE SENSE, BUT DO NOT FORGET TO INCLUDE ACTUAL NUMBERS FOR THIS JOURNAL SHOWING BOTH METHODS AS STATED ABOVE. THIS CAN BE MADE UP BUT DO NOT FORGET THE NUMBERS.arrow_forwardView Policies Current Attempt in Progress Carla Vista Company manufactures pizza sauce through two production departments: cooking and canning. In each process, materials and conversion costs are incurred evenly throughout the process. For the month of April, the work in process inventory accounts show the following debits: Beginning work in process inventory Direct materials Direct labour Manufacturing overhead Costs transferred in Cooking $-0- 26,900 7,350 32,800 Canning $3,750 7,620 7,490 26,000 52,200 I dit ontries Credit account titles are automatically indented when the anarrow_forwardFill in the Blank Question A posting reference in a (journal/ledger) includes the page number of the account debited or credited in the (journal/ledger) and serves as a link to cross-reference the transaction from one record to another.arrow_forward

- Vaughn Limited, which uses a perpetual inventory system, purchased inventory costing $22,000 on February 1 by issuing a 3-month note payable bearing interest at 6%, with interest and principal due on May 1. The company's year end is on March 31 and the company records adjusting entries only at that time. Your answer is correct. Prepare the journal entry to record the purchase of inventory on February 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles Feb. 1 (b) Inventory Notes Payable eTextbook and Media List of Accounts Your answer is correct. Mar. 31 Date Account Titles Interest Expense Debit Interest Payable Prepare the journal entry to record the accrual of interest expense on March 31. (Credit account titles are automatically indented when the amount is entered. Do not indent…arrow_forwardNash's Trading Post, LLC uses the allowance method for estimating uncollectible accounts. Prepare journal entries to record the following transactions: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record jour entries in the order presented in the problem.) Do not give answer in imagearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education