FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Prepare the income statement of Mary's manufacturers the year ended 31 December 2020 using the:

1. Marginal costing method

2. Absorption costing method

Transcribed Image Text:Mary commenced business in January 2019, manufacturing a single product. At the end of 2019 she calculated

her profit using the absorption costing method and was pleased with the profits that were realised. However, she

recently read that preparation of the income statement according to the marginal costing method would be more

beneficial to her. She also learnt that if there are opening or closing inventories, then the profits calculated using

the two methods would be different.

She forecasted her sales and costs for July to December 2021 and wanted to undertake cost-volume-profit

(CVP) analysis since it made use of the marginal costing approach with which she was impressed.

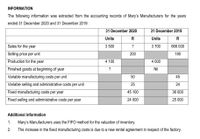

Transcribed Image Text:INFORMATION

The following information was extracted from the accounting records of Mary's Manufacturers for the years

ended 31 December 2020 and 31 December 2019:

31 December 2020

31 December 2019

Units

R

Units

R

Sales for the year

3 500

3 700

666 000

Selling price per unit

200

180

Production for the year

4 100

4 000

Finished goods at beginning of year

?

Nil

Variable manufacturing costs per unit

50

45

Variable selling and administrative costs per unit

25

24

Fixed manufacturing costs per year

45 100

36 000

Fixed selling and administrative costs per year

24 000

25 000

Additional information

1.

Mary's Manufacturers uses the FIFO method for the valuation of inventory.

2.

The increase in the fixed manufacturing costs is due to a new rental agreement in respect of the factory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- eBook Show Me How Calculator E Print Item Cost of Goods Sold, Cost of Goods Manufactured Timbuk 3 Company has the following information for March: Cost of direct materials used in production $65,000 Direct labor 75,000 Factory overhead 27,000 Work in process inventory, March 1 54,000 Work in process inventory, March 31 41,990 Finished goods inventory, March 1 24,000 Finished goods inventory, March 31 16,000 a. For March, determine the cost of goods manufactured. く Using the data given, prepare a statement of Cost of Goods Manufactured. Timbuk 3 Company Statement of Cost of Goods Manufactured KSHEET.A... 24 $4 Total manufacturing costs incurred during March Total manufacturing costs NKSHEET.A... LANKSHEET Cost of goods manufactured CEL.ALGO Check My Work 5 more Check My Work uses remaining. D items : 30% All work saved. MacBook Pro 20 F1 F2 F3 F4 F5 F6 F7 F8 %23 LCarrow_forward5arrow_forwardprepare a costs of good schedulearrow_forward

- The following transactions pertain to Year 1, the first-year operations of Rooney Company. All inventory was started and completed during Year 1. Assume that all transactions are cash transactions. 1. Acquired $4,900 cash by issuing common stock. 2. Paid $660 for materials used to produce inventory. 3. Paid $1,900 to production workers. 4. Paid $1,078 rental fee for production equipment. 5. Paid $90 to administrative employees. 6. Paid $106 rental fee for administrative office equipment. 7. Produced 340 units of inventory of which 190 units were sold at a price of $13 each. Required Prepare an income statement and a balance sheet in accordance with GAAP.arrow_forwardNeed help for this questionarrow_forwarda. Prepare a schedule of cost of goods manufactured. b. Prepare an income statement.arrow_forward

- Please do not give solution in image format thankuarrow_forwardDo not give answer in imagearrow_forwardView Policies Current Attempt in Progress The following data were taken from the records of Shamrock Company for the fiscal year ended June 30, 2022. Raw Materials Inventory 7/1/21 Raw Materials Inventory 6/30/22 Finished Goods Inventory 7/1/21 Finished Goods Inventory 6/30/22 Work in Process Inventory 7/1/21 Work in Process Inventory 6/30/22 Direct Labor Indirect Labor $50,400 39,900 99,600 20,600 27,300 20,100 148,350 25,660 Accounts Receivable Factory Insurance Factory Machinery Depreciation Factory Utilities Office Utilities Expense Sales Revenue Sales Discounts Factory Manager's Salary Factory Property Taxes Factory Repairs Raw Materials Purchases Cash $28,000 5,500 18,100 30,100 8,650 562,100 5,300 64,900 9.610 2,200 98,700 38,200arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education