FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

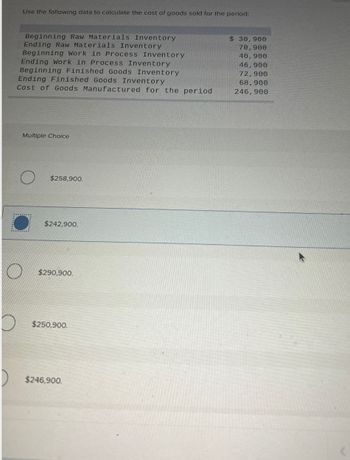

Transcribed Image Text:Use the following data to calculate the cost of goods sold for the period:

Beginning Raw Materials Inventory

Ending Raw Materials Inventory

Beginning Work in Process Inventory

Ending Work in Process Inventory

Beginning Finished Goods Inventory

Ending Finished Goods Inventory

Cost of Goods Manufactured for the period

Multiple Choice

O

$258,900.

O

$242,900

$290,900.

$250,900.

$246,900.

$ 30,900

70,900

40,900

46,900

72,900

68,900

246,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Use the included information about Raw Materials Inventory (RM), Work in Process Inventory (WIP), Finished Goods Inventory (FG), and the Income Summary (IS). Determine the total conversion costs added. 1 2 3 4 5 6 7 1 00 RM B Bal T1 T2 T3 T4 E Bal 8 9 FG 10 B Bal 11 T1 12 T2 13 T3 14 T4 15 E Bal 2 Debits 4300 29 050 Debits 4800 45 592 3 Credits 28 000 Credits 33 500 4 5 WIP B Bal DM DL FOH CGM E Bal IS Rev CGS V Op Exp F Op Exp NIBT 6 Debits 8920 28 000 17 430 11 130 Debits 33 500 5130 7960 7 Credits 45 592 Credits 66 200arrow_forwardDirect materials: Beginning inventory Purchases Ending inventory Direct manufacturing labor Manufacturing overhead Beginning work-in-process inventory Ending work-in-process inventory Beginning finished goods inventory Ending finished goods inventory P 40,000 123,200 20,800 32,000 24,000 8,000 1,600 48,000 32,000 Required: A. What is the cost of direct materials used during 2022? B. What is cost of goods manufactured for 2022? C. What is cost of goods sold for 2022? D. What amount of prime costs was added to production during 2022? E. What amount of conversion costs was added to production during 2022?arrow_forwardRequired: Supply the missing information on the following schedule of cost of goods manufactured VIVAUVIT Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2014 Raw materials Beginning inventory Plus: Purchases Raw materials available for 119,900 $ 148,400 use Minus: Ending raw materials inventory Cost of direct raw materials $ 122,300 used Direct labor Manufacturing overhead Total manufacturing costs Plus: Beginning work in process inventory Total work in process Minus: Ending work in process inventory 22,500 308,000 47,400 Cost of goods manufactured 306,900arrow_forward

- Please don't provide answer in image format thank youarrow_forwardBonita Industries reported the following year-end information: beginning work in process inventory, $72000; cost of goods manufactured, S670000; beginning finished goods inventory, $42000: ending work in process inventory, S62000; and ending finished goods inventory, $32000. How much is Bonita's cost of goods sold for the year? A. S660000 B. $680000 C. $690000 D. $670000arrow_forwardCullumber Company reported the following amounts for May: Raw materials purchased Beginning raw materials inventory Ending raw materials inventory Direct labor incurred Indirect materials requisitioned and used Actual manufacturing overhead costs Beginning work-in-process inventory Ending work-in-process inventory $257000 $257000. $256800. ◆ $259900. O $261100. 12300 8200 54000 4300 40000 15400 12300 How much is the cost of direct materials used in production?arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardPlease do not give solution in image format thankuarrow_forwardComplete the chart using the LIFO and FIFO costing methods, assuming a period of increasing costs: Highest Amount Lowest Amount Cost of Merchandise Sold Gross Profit Net Income Ending Merchandise Inventoryarrow_forward

- dont give answer in image formatarrow_forwardPlease do not give solution in image format thankuarrow_forward0 jor pro se Used Balances: Direct Materials Work-in-Process Inventory Finished Goods Inventory Data table Direct Materials Used: Direct Materials Used Print Other information: Depreciation, plant building and equipment Direct materials purchases Insurance on plant Sales salaries Repairs and maintenance-plant Indirect labor Direct labor Administrative expenses Manufacturing Overhead: Cost of Goods Manufactured Beginning Ending $ Done Total Manufacturing Overhead Total Manufacturing Costs incurred during the Year Total Manufacturing Costs to Account For Requirements 1. Use the information to prepare a schedule of cost of goods manufactured. 2. What is the unit product cost if Clark manufactured 4,380 lamps for the year? 57,000 $ 22,000 103,000 67,000 50,000 52,000 $ 4 Clark, Corp. Schedule of Cost of Goods Manufactured Year Ended December 31, 2024 11,000 155,000 23,000 43,000 13,000 40,000 125,000 53,000 - Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education