FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

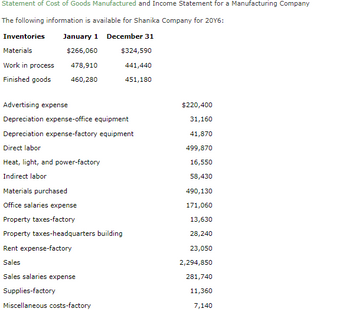

Transcribed Image Text:Statement of Cost of Goods Manufactured and Income Statement for a Manufacturing Company

The following information is available for Shanika Company for 20Y6:

Inventories

January 1 December 31

Materials

$266,060

Work in process

478,910

Finished goods 460,280

$324,590

441,440

451,180

Advertising expense

Depreciation expense-office equipment

Depreciation expense-factory equipment

Direct labor

Heat, light, and power-factory

Indirect labor

Materials purchased

Office salaries expense

Property taxes-factory

Property taxes-headquarters building

Rent expense-factory

Sales

Sales salaries expense

Supplies-factory

Miscellaneous costs-factory

$220,400

31,160

41,870

499,870

16,550

58,430

490,130

171,060

13,630

28,240

23,050

2,294,850

281,740

11,360

7,140

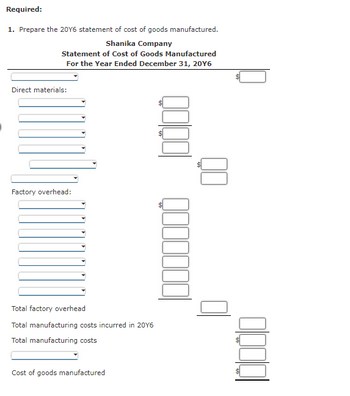

Transcribed Image Text:Required:

1. Prepare the 20Y6 statement of cost of goods manufactured.

Shanika Company

Statement of Cost of Goods Manufactured

For the Year Ended December 31, 20Y6

Direct materials:

Factory overhead:

Total factory overhead

Total manufacturing costs incurred in 2016

Total manufacturing costs

Cost of goods manufactured

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 0 jor pro se Used Balances: Direct Materials Work-in-Process Inventory Finished Goods Inventory Data table Direct Materials Used: Direct Materials Used Print Other information: Depreciation, plant building and equipment Direct materials purchases Insurance on plant Sales salaries Repairs and maintenance-plant Indirect labor Direct labor Administrative expenses Manufacturing Overhead: Cost of Goods Manufactured Beginning Ending $ Done Total Manufacturing Overhead Total Manufacturing Costs incurred during the Year Total Manufacturing Costs to Account For Requirements 1. Use the information to prepare a schedule of cost of goods manufactured. 2. What is the unit product cost if Clark manufactured 4,380 lamps for the year? 57,000 $ 22,000 103,000 67,000 50,000 52,000 $ 4 Clark, Corp. Schedule of Cost of Goods Manufactured Year Ended December 31, 2024 11,000 155,000 23,000 43,000 13,000 40,000 125,000 53,000 - Xarrow_forwardRaw materials inventory Work in process inventory Finished goods inventory. Purchases of direct materials Direct labor.. Indirect labor. Beginning of Year End of Year $ 23,000 $25,000 $ 35,000 $31,000 $ 20,000 $ 22,000 $ 74,000 $ 86,000 $ 42,000 Insurance on plant Depreciation-plant building and equipment Repairs and maintenance-plant Marketing expenses General and administrative expenses End of Year $ 11,500 $ 13,400 $ 3,700 $ 77,000 $ 28,500arrow_forwardCOGS?arrow_forward

- Required information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,250,000 37,000 53,900 62,700 175,600 225,000 47,000 23,000 57,000 94,000 129,300 42,700 41,500 67,300 Prepare its schedule of cost of goods manufactured for the year ended December 31.arrow_forwardRequired information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,500 16,100 7,400 34,750 19,800 21,800 26,200 7,200 12,600 27,000 14,750 4,940 41,500 58,000 296,220 26,000 13,600 Pepper Company $ 17,350 22,050 9,450 25,150 39,400 14,600 20, 200 8,000 15,750 43,000 14,320 3,750 60,500 46,000 388,450 18,700 21,950 1. Prepare income statements for both Garcon Company and Pepper Company. 2. Prepare the current assets section of…arrow_forwardRequired information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Garcon Pepper Company Company $ $ 13,200 18,550 Work in process inventory, beginning 17,700 22,500 Raw materials inventory, beginning 7,700 14,100 Rental cost on factory equipment 31,000 24,100 Direct labor 24,200 43,800 Finished goods inventory, 19,700 13,800 ending Work in process inventory, ending 24,400 21,000 Raw materials inventory, ending 6,700 7,600 Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net 12,300 17,000 34,000 53,500 13,000 14,000 6,500 3,550 36,000 68,000 50,400 56,800 297,600 379,360 27,000 24,200 15,000 20,950 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the…arrow_forward

- Manufacturing Income Statement, Statement of Cost of Goods Manufactured Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December. OnCompany OffCompany Materials inventory, December 1 $88,830 $121,700 Materials inventory, December 31 (a) 137,520 Materials purchased 225,630 (a) Cost of direct materials used in production 238,060 (b) Direct labor 334,890 273,830 Factory overhead 103,930 136,300 Total manufacturing costs incurred in December (b) 787,400 Total manufacturing costs 847,430 1,080,700 Work in process inventory, December 1 170,550 293,300 Work in process inventory, December 31 143,900 (c) Cost of goods manufactured (c) 780,100 Finished goods inventory, December 1 150,120 136,300 Finished goods inventory, December 31 157,230 (d) Sales 1,309,350 1,217,000 Cost of goods sold (d) 787,400 Gross…arrow_forward*need help with C please *arrow_forwardManufacturing Income Statement, Statement of Cost of Goods Manufactured Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December: OnCompany OffCompany Materials inventory, December 1 $87,370 $114,450 Materials inventory, December 31 (a) 129,330 Materials purchased 221,920 (a) Cost of direct materials used in production 234,150 (b) Direct labor 329,380 257,510 Factory overhead 102,220 128,180 Total manufacturing costs incurred in December (b) 740,490 Total manufacturing costs 833,500 833,500 Work in process inventory, December 1 167,750 275,820 Work in process inventory, December 31 141,540 (c) Cost of goods manufactured (c) 733,620 Finished goods inventory, December 1 147,660 128,180 Finished goods inventory, December 31 154,640 (d) Sales 1,287,830 1,144,500 Cost of goods sold (d) 740,490 Gross…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education