Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

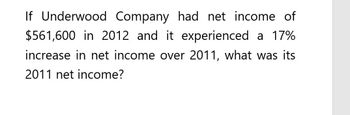

Transcribed Image Text:If Underwood Company had net income of

$561,600 in 2012 and it experienced a 17%

increase in net income over 2011, what was its

2011 net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What was the firm's profit margin in 2019 ?arrow_forwardUsing the Value Line Investment Survey report in Exhibit 11.5, find the following information for Apple. What was the amount of revenues (i.e., sales) generated by the company in 2017? What were the latest annual dividends per share and dividend yield? What is the earnings per share (EPS) projection for 2019? How many shares of common stock were outstanding? What were the book value per share and EPS in 2017? How much long-term debt did the company have in the third quarter of 2018?arrow_forward# 10 . The Sterling Tire Company's Income Statment for 2010 is as follows :arrow_forward

- A consumer products company reported a 25 percent increase in sales from 2009 to 2010. Sales in 2009 were $200,000. In 2010, the company reported Cost of Goods Sold in the amount of $150,000.What was the gross profit percentage in 2010?arrow_forwardNeed Help Please solve this onearrow_forwardČardinal Industries had the following operating results for 2018: Sales = $34,621; Cost of goods sold Dividends paid = $2,023. At the beginning of the year, net fixed assets were $19,970, current assets were $7,075, and current liabilities were $4,01O. At the end of the year, net fixed assets were $24,529, current assets were $8,702, and current liabilities were $4,700. The tax rate for 2018 was 25 percent. $24,359; Depreciation expense = $6,027; Interest expense $2,725; %3D a. What is net income for 2018? (Do not round intermediate calculations.) b. What is the operating cash flow for 2018? (Do not round intermediate calculations.) c. What is the cash flow from assets for 2018? (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) d- If no new debt was issued during the year, what is the cash flow to creditors? (Do not 1. round intermediate calculations.) d- If no new debt was issued during the year, what is the cash flow to stockholders? (Do…arrow_forward

- What was the net lossin dollars ?arrow_forwardLeapFrog Enterprises Inc. had the following quarterly net in- comes during its 2013 fiscal year. (Source: Leapfroginvestors. com) Quarter of Fiscal 2013 Net Income (in millions) First -$3.0 Second -$3.2 Third $26.4 Fourth $63.9 What was the total net income for fiscal year 2013?arrow_forwardA company reported P 18,000 of net income for 2013, P 24,000 for 2014 and P 26,000 for 2015. The percentage change in net income from 2014 to 2015 was:arrow_forward

- In fiscal year 2018, Wal-Mart Stores (WMT) had revenue of $514.41 billion, gross profit of $129.10 billion, and net income of $6.67 billion. Costco Wholesale Corporation (COST) had revenue of $141.6 billion, gross profit of $18.42 billion, and net income of $3.13 billion. a. Compare the gross margins for Walmart and Costco. b. Compare the net profit margins for Walmart and Costco. c. Which firm was more profitable in 2018? a. Compare the gross margins for Walmart and Costco. The gross margin for Walmart is enter your response here %. (Round to two decimal places.) The gross margin for Costco is enter your response here %. (Round to two decimal places.) Part 3 b. Compare the net profit margins for Walmart and Costco. The net profit margin for Walmart is enter your response here %. (Round to two decimal places.) Part 4 The net profit margin for Costco is enter your response here %. (Round to two decimal places.) c. Which firm was more profitable in 2018? (Select from the…arrow_forwardIn fiscal year 2021, Walmart Inc. (WMT) reported annual revenue of $572.75 billion, gross profit of $143.75 billion, and net income of $13.67 billion. Costco Wholesale Corporation (COST) had revenue of $195.9 billion, gross profit of $25.25 billion, and net income of $5.01 billion. a. Compare the gross margins for Walmart and Costco. b. Compare the net profit margins for Walmart and Costco. c. Which firm was more profitable in 2021?arrow_forwardCrane reported the following information for its fiscal year end: On net sales of $ 53.000 billion, the company earned net income after taxes of $ 7.155 billion. It had a cost of goods sold of $ 21.465 billion and EBIT of $ 9.275 billion. What are the company’s gross profit margin, operating profit margin, and net profit margin? (Round answers to 1 decimal place, e.g.12.5%.) Gross profit margin % Operating profit margin % Net profit margin %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub