Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General account question

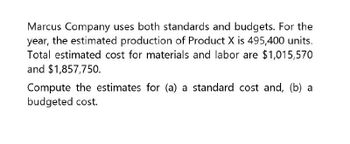

Transcribed Image Text:Marcus Company uses both standards and budgets. For the

year, the estimated production of Product X is 495,400 units.

Total estimated cost for materials and labor are $1,015,570

and $1,857,750.

Compute the estimates for (a) a standard cost and, (b) a

budgeted cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The problem gives me total costs for materials and labor. Can you tell me the cost per materials and labor per unit?arrow_forwardKoontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard Cost per Unit Actual Cost per Unit Direct materials: Standard: 1.80 feet at $2.80 per foot $ 5.04 Actual: 1.75 feet at $3.00 per foot $ 5.25 Direct labor: Standard: 0.90 hours at $17.00 per hour 15.30 Actual: 0.95 hours at $16.40 per hour 15.58 Variable overhead: Standard: 0.90 hours at $7.40 per hour 6.66 Actual: 0.95 hours at $7.00 per hour 6.65 Total cost per unit $ 27.00 $ 27.48 Excess of actual cost over standard cost per unit $ 0.48 The production superintendent was pleased when he saw this report and commented: “This $0.48 excess cost is well within the 5 percent limit management has set for acceptable variances. It's obvious…arrow_forwardKoontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard Cost per Unit Actual Cost per Unit Direct materials: Standard: 1.90 feet at $4.60 per foot $ 8.74 Actual: 1.85 feet at $5.00 per foot $ 9.25 Direct labor: Standard: 0.95 hours at $19.00 per hour 18.05 Actual: 1.00 hours at $18.50 per hour 18.50 Variable overhead: Standard: 0.95 hours at $7.00 per hour 6.65 Actual: 1.00 hours at $6.60 per hour 6.60 Total cost per unit $ 33.44 $ 34.35 Excess of actual cost over standard cost per unit $ 0.91 The production superintendent was pleased when he saw this report and commented: “This $0.91 excess cost is well within the 4 percent limit management has set for acceptable variances. It's obvious…arrow_forward

- The company makes a product with the following costs: Direct materials→₱17.00; Direct labor→₱22.00; Variable manufacturing overhead→₱4.00; Fixed manufacturing overhead→₱504,000.00; Variable selling, general and administrative expenses→₱4.90; Fixed selling, general and administrative expenses→₱319,200. The company uses the absorption costing approach to cost-plus pricing. The pricing calculations are based on budgeted production and sales of 30,000 units per year. The company has invested ₱360,000 in this product and expects a return on investment of 15%. Tax rate is 25%. The markup on absorption cost would be closest to: a. 41.72% b. 15.00% c. 30% d. 43% e. 37.45% f. 45.30%arrow_forwardThe cost per unit associated with the production of Xen Merchandising are the following: Direct Materials - P1,000; Direct Wages - P200; Variable Overhead - P1,500; and Fixed Overhead - P2,000. Given the data, what is the product cost?arrow_forwardThe standard and actual cost data of M/s. ABC Company are as follows: Standard Raw Material (DM) is 5000 units @ Rs. 10 while Actual 4900 units @ Rs. 8 Standard Direct Labor (DL) is 10000 hours @ Rs. 4 while Actual 12000 Hours @ Rs. 5 Standard Factory Overhead (FOH) is 50% of Direct Labor while Actual FOH Rs. 15000 Required: A) Calculate; Material Price Variance and Material Quantity Variance Labor rate variance and Labor time variance Overhead Variance B) Give journal entries to record the above information and close the variance accounts. hello sir maam pls give me Ans B B) Give journal entries to record the above information and close the variance accounts.arrow_forward

- Koontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard Cost per Unit Actual Cost per Unit Direct materials: Standard: 1.90 feet at $3.00 per foot $ 5.70 Actual: 1.85 feet at $3.40 per foot $ 6.29 Direct labor: Standard: 1.00 hours at $18.00 per hour 18.00 Actual: 1.05 hours at $17.40 per hour 18.27 Variable overhead: Standard: 1.00 hours at $8.00 per hour 8.00 Actual: 1.05 hours at $7.60 per hour 7.98 Total cost per unit $ 31.70 $ 32.54 Excess of actual cost over standard cost per unit $ 0.84 The production superintendent was pleased when he saw this report and commented: “This $0.84 excess cost is well within the 4 percent limit management has set for acceptable variances. It's obvious that there's not much to worry about with this product." Actual production for the month was 15,000 units.…arrow_forwardKoontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard Cost per Unit Actual Cost per Unit Direct materials: Standard: 1.90 feet at $4.40 per foot $ 8.36 Actual: 1.85 feet at $4.80 per foot $ 8.88 Direct labor: Standard: 0.95 hours at $18.00 per hour 17.10 Actual: 1.00 hours at $17.50 per hour 17.50 Variable overhead: Standard: 0.95 hours at $6.00 per hour 5.70 Actual: 1.00 hours at $5.60 per hour 5.60 Total cost per unit $ 31.16 $ 31.98 Excess of actual cost over standard cost per unit $ 0.82 The production superintendent was pleased when he saw this report and commented: “This $0.82 excess cost is well within the 4 percent limit management has set for acceptable variances. It's obvious that…arrow_forwardKoontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard Cost per Unit Actual Cost per Unit Direct materials: Standard: 1.90 feet at $4.40 per foot $ 8.36 Actual: 1.85 feet at $4.80 per foot $ 8.88 Direct labor: Standard: 0.95 hours at $18.00 per hour 17.10 Actual: 1.00 hours at $17.50 per hour 17.50 Variable overhead: Standard: 0.95 hours at $6.00 per hour 5.70 Actual: 1.00 hours at $5.60 per hour 5.60 Total cost per unit $ 31.16 $ 31.98 Excess of actual cost over standard cost per unit $ 0.82 The production superintendent was pleased when he saw this report and commented: “This $0.82 excess cost is well within the 4 percent limit management has set for acceptable variances. It's obvious that…arrow_forward

- Stargate Corporation has established the following standards for the costs of one unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows: Std Cost Std Qty Std Price/Rate Direct Material $ 14.40 6.00 kg $ 2.40 per kg Direct Labor $ 3.00 0.40 hour $ 7.50 per hour Variable Overhead $ 4.00 0.40 hour $ 10.0 per hour Fixed Overhead $ 4.80 0.40 hour $ 12.0 per hour Total $ 26.20 *based on practical capacity of 2,500 direct-labor hour per month During December 2020, Henry purchased 30,000 kg of direct material at a total cost of $75,000. The total wages for December were $20,000, 75% of which were for direct labor. Henry manufactured 4,500 units of product during December 2020, using 28,000kg of the direct material purchased in December and 2,100 direct-labor hours. Actual variable and fixed overhead cost were $23,100…arrow_forwardStargate Corporation has established the following standards for the costs of one unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows: Std Cost Std Qty Std Price/Rate Direct Material $ 14.40 6.00 kg $ 2.40 per kg Direct Labor $ 3.00 0.40 hour $ 7.50 per hour Variable Overhead $ 4.00 0.40 hour $ 10.0 per hour Fixed Overhead $ 4.80 0.40 hour $ 12.0 per hour Total $ 26.20 *based on practical capacity of 2,500 direct-labor hour per month During December 2020, Henry purchased 30,000 kg of direct material at a total cost of $75,000. The total wages for December were $20,000, 75% of which were for direct labor. Henry manufactured 4,500 units of product during December 2020, using 28,000kg of the direct material purchased in December and 2,100 direct-labor hours. Actual variable and fixed overhead cost were $23,100…arrow_forwardStargate Corporation has established the following standards for the costs of one unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows: Std Cost Std Qty Std Price/Rate Direct Material $ 14.40 6.00 kg $ 2.40 per kg Direct Labor $ 3.00 0.40 hour $ 7.50 per hour Variable Overhead $ 4.00 0.40 hour $ 10.0 per hour Fixed Overhead $ 4.80 0.40 hour $ 12.0 per hour Total $ 26.20 *based on practical capacity of 2,500 direct-labor hour per month During December 2020, Henry purchased 30,000 kg of direct material at a total cost of $75,000. The total wages for December were $20,000, 75% of which were for direct labor. Henry manufactured 4,500 units of product during December 2020, using 28,000kg of the direct material purchased in December and 2,100 direct-labor hours. Actual variable and fixed overhead cost were $23,100…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College