Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hastings company has purchased a group solve this accounting questions

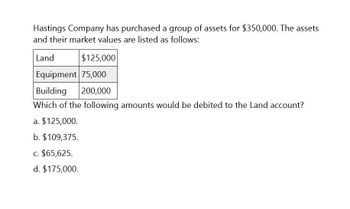

Transcribed Image Text:Hastings Company has purchased a group of assets for $350,000. The assets

and their market values are listed as follows:

Land

$125,000

Equipment 75,000

Building

200,000

Which of the following amounts would be debited to the Land account?

a. $125,000.

b. $109,375.

c. $65,625.

d. $175,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide answerarrow_forwardAmountarrow_forwardAnderson Corporation has purchased a group of assets for $23,200. The assets and their relative fair value are listed below Land Equipment Building $7,300 2,300 3,100 Which of the following amounts would be debited to the Land account? Round any intermediate calculations to two (2) decimal places, and the final answer to the nearest dollar OA $4.233 OB. $4,176 OC. $5.568 OD. $13,224arrow_forward

- What amount should be recorded for the land ?arrow_forwardHosting Companyarrow_forwardSuppose the subject's net operating income is $100,000, the direct capitalization rate of the land is 3.5%, the direct capitalization rate of the improvements is 6.0%, and the value of the improvements is $750,000. What is the overall value of the subject property (round to the nearest thousand)? A. $2,321,000 ⒸB. $2,036,000 OC. $1,571,000 OD.$1,286,000arrow_forward

- Please need answer this general accounting questionarrow_forwardGaarrow_forwardThese expenditures were incurred by Blossom Company in purchasing land: cash price $55,000, assumed accrued property taxes $4,500, attorney's fees $2,100, real estate broker's commission $3,000, and clearing and grading $4,000. What is the cost of the land? The cost of the land 73900arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning