FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

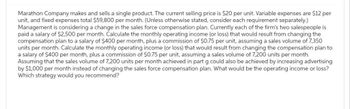

Transcribed Image Text:Marathon Company makes and sells a single product. The current selling price is $20 per unit. Variable expenses are $12 per

unit, and fixed expenses total $59,800 per month. (Unless otherwise stated, consider each requirement separately.)

Management is considering a change in the sales force compensation plan. Currently each of the firm's two salespeople is

paid a salary of $2,500 per month. Calculate the monthly operating income (or loss) that would result from changing the

compensation plan to a salary of $400 per month, plus a commission of $0.75 per unit, assuming a sales volume of 7,350

units per month. Calculate the monthly operating income (or loss) that would result from changing the compensation plan to

a salary of $400 per month, plus a commission of $0.75 per unit, assuming a sales volume of 7,200 units per month.

Assuming that the sales volume of 7,200 units per month achieved in part g could also be achieved by increasing advertising

by $1,000 per month instead of changing the sales force compensation plan. What would be the operating income or loss?

Which strategy would you recommend?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Brooks Advertising pays Lee Young $97,290 per year. Requirements 1. What is the hourly cost to Brooks Advertising of employing Young? Assume a 45-hour week and a 47-week year. 2. What direct labor cost would be assigned to Client 507 if Young works 19 hours to prepare Client 507's magazine ad? Requirement 1. What is the hourly cost to Brooks Advertising of employing Young? Assume a 45-hour week and 47-week year. Select the formula below that Brooks Advertising would use to calculate the hourly cost and complete the formula. (Round the hourly cost to the nearest cent.) + Hourly costarrow_forwardThe Colin Division of Crane Company sells its product for $30.00 per unit. Variable costs per unit include: manufacturing, $13.80; and selling and administrative, $4.00. Fixed costs are: $322000 manufacturing overhead, and $54000 selling and administrative. There was no beginning inventory. Expected sales for next year are 46000 units. Matthew Young, the manager of the Colin Division, is under pressure to improve the performance of the Division. As part of the planning process, he has to decide whether to produce 46000 units or 54000 units next year. What would the manufacturing cost per unit be under variable costing for each alternative? 46000 units 54000 units $13.80 $13.80 $17.80 $17.80 $19.55 $20.80 $20.80 $19.55arrow_forwardCompute the break-even point in dollar sales for next year assuming the machine is installed. Astro Company sold 28,500 units of its only product and reported income of $57,900 for the current year. During a planning session for next year’s activities, the production manager notes that variable costs can be reduced 50% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $142,000. Total units sold and the selling price per unit will not change. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales ($50 per unit) $ 1,425,000 Variable costs ($47 per unit) 1,339,500 Contribution margin 85,500 Fixed costs 27,600 Income $ 57,900arrow_forward

- Assume that you are one of the owners of Pinoy Corporation. Upon reviewing the project income statements as shown in Tables 7.3 and 7.4 you realized that salaries are understated because it only accounts for the 12 months of salary of each employee and does not include the 13th month pay, which is required by law. You also feel that cost of goods sold ought to be computed at 45% instead of 40% of salles revenues. Using a spreadsheet program, revise the projected income statements for the first year and the first three years of the business.arrow_forwardGoshford Company produces a single product and has capacity to produce 100,000 units per month. Costs to produce its current sales of 80,000 units follow. The regular selling price of the product is $100 per unit. Management is approached by a new customer who wants to purchase 20,000 units of the product for $75.00 per unit. If the order is accepted, there will be no additional fixed manufacturing overhead and no additional fixed selling and administrative expenses. The customer is not in the company’s regular selling territory, so there will be a $5.00 per unit shipping expense in addition to the regular variable selling and administrative expenses. Per Unit Costs at 80,000 Units Direct materials $ 12.50 $ 1,000,000 Direct labor 15.00 1,200,000 Variable manufacturing overhead 10.00 800,000 Fixed manufacturing overhead 17.50 1,400,000 Variable selling and administrative expenses 14.00 1,120,000 Fixed selling and…arrow_forward[The following information applies to the questions displayed below.] Astro Company sold 20,000 units of its only product and reported income of $25,000 for the current year. During a planning session for next year's activities, the production manager notes that variable costs can be reduced 40% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $241,000. The selling price per unit will not change. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales ($50 per unit) Variable costs ($40 per unit) Contribution margin Fixed costs Income 2. Prepare a contribution margin income statement for next year that shows the expected results with the machine installed. Assume sales are $1,000,000. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 $ 1,000,000 800,000 200,000 175,000 $ 25,000 Contribution marginarrow_forward

- [The following information applies to the questions displayed below.] Astro Company sold 22,500 units of its only product and reported income of $60,000 for the current year. During a planning session for next year's activities, the production manager notes that variable costs can be reduced 45% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $155,000. Total units sold and the selling price per unit will not change. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales ($55 per unit) Variable costs ($50 per unit) Contribution margin Fixed costs Income 1. Compute the break-even point in dollar sales for next year assuming the machine is installed. (Round your answers to 2 decimal places.) Contribution margin Contribution Margin Ratio Numerator: Contribution margin per unit $ 1 Fixed costs per unit $ 1,237,500 1,125,000 112,500 52,500 $ 60,000 $ Denominator: Selling price…arrow_forwardSHOW YOUR SOLUTION IN GOOD ACCOUNTING FORM. THANK YOU A company sells its product at P30 per unit.Unit variable cost is P22 and total fixed coststotal to P100,000 per month. The companycurrently pays salaries of P40,000 per monthbut with no commission. It is considering acompensation plan whereby the salespeoplewould receive 5% commission based onsales, but their salaries would be decreasedto P25,000 per month. At what sales level isthe company indifferent between the twocompensation plans?arrow_forwardThe total fixed costs per year for the company are $674,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix is the same at the break-even point, compute the break-even point. c. If the product sales mix were to change to nine Programmer-style bags for each Executive-style bag, what would be the new break-even volume for On-the-Go? a What is the anticipated level of profits for the expected sales volumes? Anticipated profit b Assuming that the product mix is the same at the break-even point, compute the break-even point. (Round your final answer up to the nearest whole unit.) Break-even point units c If the product sales mix were to change to nine Programmer-style bags for each Executive-style bag, what would be the new break-even volume for On-the-Go? (Round your final answer up to the nearest whole…arrow_forward

- Pardo Company produces a single product and has capacity to produce 195,000 units per month. Costs to produce its current monthly sales of 156,000 units follow. The normal selling price of the product is $132 per unit. A new customer offers to purchase 39,000 units for $61.20 per unit. If the special offer is accepted, there will be no additional fixed overhead and no additional fixed general and administrative costs. The special offer would not affect its normal sales. Direct materials Direct labor Variable overhead Fixed overhead Fixed general and administrative Totals (a) Compute the income from the special offer. (b) Should the company accept the special offer? Required A Required B Complete this question by entering your answers in the tabs below. Variable costs Per Unit $ 12.50 15.00 10.00 17.50 13.00 $ 68.00 SPECIAL OFFER ANALYSIS Compute the income for the special offer. (Round your "Per Unit" answers to 2 decimal places.) Contribution margin Fixed costs Costs at 156,000 Units…arrow_forwardAmerican Investor Group is opening an office in Portland, Oregon. Fixed monthly costs are office rent ($8,800), depreciation on office furniture ($1,800), utilities ($2,500), special telephone lines ($1,500), a connection with an online brokerage service ($2,400), and the salary of a financial planner ($4,000). Variable costs include payments to the financial planner (9% of revenue), advertising (11% of revenue), supplies and postage (4% of revenue), and usage fees for the telephone lines and computerized brokerage service (6% of revenue). Read the requirements. Requirement 1. Use the contribution margin ratio approach to compute American's breakeven revenue in dollars. If the average trade leads to $750 in revenue for American, how many trades must be made to break even? Begin by showing the formula and then entering the amounts to calculate the required sales dollars for American to break even. (Abbreviation used: CM = contribution margin.) Fixed costs Target profit ) + CM ratio =…arrow_forwardCompute the sales level required in both dollars and units to earn $120,000 of target income for next year with the machine installed. Astro Company sold 28,500 units of its only product and reported income of $57,900 for the current year. During a planning session for next year’s activities, the production manager notes that variable costs can be reduced 50% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $142,000. Total units sold and the selling price per unit will not change. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales ($50 per unit) $ 1,425,000 Variable costs ($47 per unit) 1,339,500 Contribution margin 85,500 Fixed costs 27,600 Income $ 57,900arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education