FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

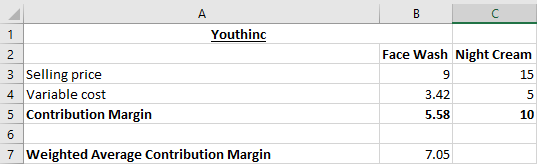

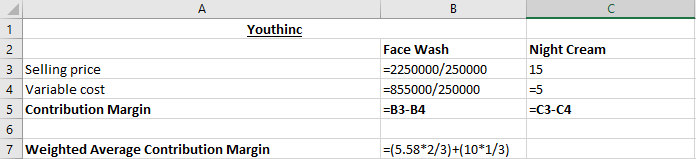

In the next month, the company want to launch new product, a night cream. The selling price for Night Cream is $15 and variable cost per unit to produce is $5. The total fixed cost to produce night cream is $525,000. The sales mix between face wash and night cream is 2:1. Compute break-even unit for each product

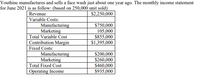

Transcribed Image Text:Youthinc manufactures and sells a face wash just about one year ago. The monthly income statement

for June 2021 is as follow: (based on 250,000 unit sold)

Revenue

Variable Costs:

Manufacturing

Marketing

Total Variable Cost

Contribution Margin

Fixed Costs:

Manufacturing

Marketing

Total Fixed Cost

$2,250,000

$750,000

105,000

$855,000

$1,395,000

$200,000

$260,000

$460,000

$935,000

Operating Income

Expert Solution

arrow_forward

Step 1

First we need to calculate the contribution margin of the individual product then we will calculate the weighted contribution margin for the sales mix to calculate the BEP.

Formula:

Contribution margin per unit = Sales price per unit - Variable cost per unit

Weighted average contribution margin = Contribution margin per unit * Sales mix percentage

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- The “ABM” Company sells pencil cases for $15 each. Manufacturing cost is $4.60 per pencil case; marketing costs are $1.40 per pencil case; and royalty payments are 20% of the selling price. The fixed cost of preparing the pencil cases is $18 000. Capacity is 15 000 pencil cases. Compute the unit contribution margin and contribution rate. Compute the break-even point in units Determine the break-even point in units if fixed costs are increased by 20%. 4. Determine the break-even point in units if the selling price is increased by 30%, while fixed costs are increased by 20%.arrow_forwardPlease fill out this chartarrow_forwardThe Terrence Co. manufactures two products, Baubles and Trinkets. The following are projections for the coming year: Baubles Trinkets 11,000 units 5,500 units Sales $ 11,000 $ 11,000 Costs: Fixed $ 2,400 $ 7,680 Variable 4,400 6,800 2,200 9,880 Income before taxes $ 4,200 $ 1,120 How many Baubles will be sold at the break-even point, assuming that the facilities are jointly used with the sales mix remaining constant? Multiple Choice 7,200 6,720 2,940 4,000arrow_forward

- Lush Lawn, Incorporated produces and sells electric lawn trimmers for $150 each. The variable costs of each mower total $110 while total monthly fixed costs are $6,240. Current monthly sales are $51,000. The company is considering a proposal that will decrease the selling price by 10%, increase monthly fixed costs by 50%, and increase unit sales to 500 units per month. Required: a. Compute the company's current break-even point in units and dollars. b. What is the company's current margin of safety in units, dollars, and percentage? a. Break-even point a. Break-even sales b. Margin of safety b. Margin of safety in dollars b. Margin of safety in ratio units unit %arrow_forwardA furniture company manufactures desks and chairs. Each desk requires 29 hours to manufacture and contributes $400 to profit, and each chair requires 19 hours to manufacture and contributes $250 to profit. Due to marketing restrictions, a total of 2000 hours are available. Use Solver to maximize the company’s profit. What is the maximum profit? How many desks and chairs should the company manufacture? Of the 2000 available hours, how many hours will be used?arrow_forwardMaple Enterprises sells a single product with a selling price of $70 and variable costs per unit of $21. The company's monthly fixed expenses are $29,400. A. What is the company's break-even point in units? Break-even units 600 units B. What is the company's break-even point in dollars? Break-even dollars $49.00 C. Construct a contribution margin income statement for the month of September when they will sell 800 units. Use a minus sign for a net loss if present. Income Statement Sales $56,000 Variable Costs -16,800 Contribution Margin $39,200 Fixed Costs -29,400 Net Income $9,800 D. How many units will Maple need to sell in order to reach a target profit of $44,100? New break-even units _____ units E. What dollar sales will Maple need in order to reach a target profit of $44,100? New break-even dollars $_____ F. Construct a contribution margin income statement for Maple that reflects $140,000 in sales volume. Income Statementarrow_forward

- To make a product it costs $24 per liter. The importation cost is a fixed cost of $ 150 additional of the unit costs. The time that takes from placing the order to receiving it is 5 weeks. During this time the average consumed is 80 liters with a std dev. of 4 liters. If the products ends the costs is $45 per liter. They work 52 weeks a year. The anual interest is 20% What is the order size and reorder point if we want to accomplish 90% of demand in the cycles? What is the order size and reorder point if we want to minimize average costs? what would be service level type 2?arrow_forwardA company sells one of the items in its product line for $8.50 each. The variable costs per unit is $4.80, and the associated fixed costs per week are $2,100. If the total revenue is $8,075 per week, then determine each of the following quantities: (1) The weekly level of output, that is the number of items produced and sold, is units. (2) The total variable costs per week are $ (3) The net income per week is $arrow_forwardA company sells one of its products for $13.80 per unit. Its fixed costs are $1,080.00 per month, and the variable cost per unit is $4.80. The production capacity is 625 units per month. (a) The break-even volume, i.e., the level of output at break-even, is per month. (If necessary, round up to the next whole number of units.) (b) The break-even volume as a percent of capacity is your answer to two decimal places.) units (d) The net income at the break-even level of output is $ %. (If necessary, round (c) The break-even revenue, i.e., the total revenue at the break-even level of output, is $ per month.arrow_forward

- A local toolmaker makes the best hammers on the market. The head of the hammer costs $15.56 and the handle costs $4.24. It takes 1.4 minutes to assemble the hammer and the hourly cost is $91 for assembly time. The company has fixed operating costs of $26348 per month. They sell the hammers for three times their total variable cost. The company wants to make a monthly profit of $8619. How many hammers must they sell? Round to the nearest whole number Answer:arrow_forwardBlossom Company makes radios that sell for $40 each. For the coming year, management expects fixed costs to total $126,380 and variable costs to be $32 per unit. Compute the sales dollars required to earn net income of $153,620.arrow_forwardMaple Enterprises sells a single product with a selling price of $71 and variable costs per unit of $21. The company's monthly fixed expenses are $14,101. How many units will Maple need to sell in order to reach a target profit of $28,721? Round up to the nearest whole unit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education