FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

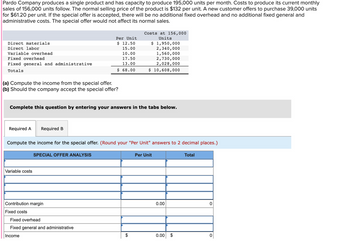

Transcribed Image Text:Pardo Company produces a single product and has capacity to produce 195,000 units per month. Costs to produce its current monthly

sales of 156,000 units follow. The normal selling price of the product is $132 per unit. A new customer offers to purchase 39,000 units

for $61.20 per unit. If the special offer is accepted, there will be no additional fixed overhead and no additional fixed general and

administrative costs. The special offer would not affect its normal sales.

Direct materials

Direct labor

Variable overhead

Fixed overhead

Fixed general and administrative

Totals

(a) Compute the income from the special offer.

(b) Should the company accept the special offer?

Required A Required B

Complete this question by entering your answers in the tabs below.

Variable costs

Per Unit

$ 12.50

15.00

10.00

17.50

13.00

$ 68.00

SPECIAL OFFER ANALYSIS

Compute the income for the special offer. (Round your "Per Unit" answers to 2 decimal places.)

Contribution margin

Fixed costs

Costs at 156,000

Units

Fixed overhead

Fixed general and administrative

Income

$ 1,950,000

2,340,000

1,560,000

2,730,000

2,028,000

$ 10,608,000

Per Unit

0.00

0.00 $

Total

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Dimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitri's normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitri's other operations. PLEASE NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). 1. If Dimitri accepts the offer, what will be the impact on profits of accepting the order? • Incremental dollar amount = o Increase or Decrease? no quotes. Please note: Your answer is either "Increase" or "Decrease" - capital first letters andarrow_forwardCalculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $78.30 per unit. Determine whether management should accept or reject the new business.arrow_forwardLusk Corporation produces and sells 14,300 units of Product X each month. The selling price of Product X is $25 per unit, and variable expenses are $19 per unit. A study has been made concerning whether Product X should be discontinued. The study shows that $72,000 of the $102,000 in monthly fixed expenses charged to Product X would not be avoidable even if the product was discontinued. If Product X is discontinued, the monthly financial advantage (disadvantage) for the companyarrow_forward

- Yorkville sells a haircutter at $65 and each unit has variable cost of $25. Yorkville's fixed manufacturing costs are $80,000 when produces at its full capacity of 10,000 units and its its fixed cost per unit is $8 per unit. The company has an offer of 2,000 units at $30 each in an international market, which would not affect its current production but would increase the fixed cost by $5,000. How much is the incremental net income if it accepts the special order? Select one: a. $10,000 profit b. $6,000 loss c. $5,000 profit O d. $70,000 lossarrow_forwardBurns Industries currently manufactures and sells 30,000 power saws per month, although it has the capacity to produce 45,000 units per month. At the 30,000- unit-per-month level of production, the per-unit cost is $85, consisting of $50 in variable costs and $35 in fixed costs. Burns sells its saws to retail stores for $90 each. Allen Distributors has offered to purchase 6,000 saws per month at a reduced price. Burns can manufacture these additional units with no change in its present level of fixed manufacturing costs. Burns decides to accept the special order for 6,000 units from Allen at a unit sales price that will add $120,000 per month to its operating income. The unit price Burns is charging Allen is: Multiple Choice $85. $50 $90. $70.arrow_forwardAccording to its original plan, Thornton Consulting Services Company plans to charge its customers for service at $127 per hour in Year 2. The company president expects consulting services provided to customers to reach 49,000 hours at that rate. The marketing manager, however, argues that actual results may range from 44,000 hours to 54,000 hours because of market uncertainty. Thornton's standard variable cost is $44 per hour, and its standard fixed cost is $1,320,000. Required Develop flexible budgets based on the assumptions of service levels at 44,000 hours, 49,000 hours, and 54,000 hours. Flexible Budget 44,000 Hours Flexible Budget Flexible Budget 49,000 Hours 54,000 Hoursarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education