FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

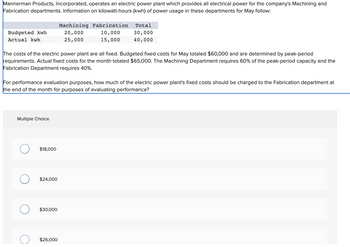

Transcribed Image Text:Mannerman Products, Incorporated, operates an electric power plant which provides all electrical power for the company's Machining and

Fabrication departments. Information on kilowatt-hours (kwh) of power usage in these departments for May follow:

Budgeted kwh

Actual kwh

The costs of the electric power plant are all fixed. Budgeted fixed costs for May totaled $60,000 and are determined by peak-period

requirements. Actual fixed costs for the month totaled $65,000. The Machining Department requires 60% of the peak-period capacity and the

Fabrication Department requires 40%.

Multiple Choice

For performance evaluation purposes, how much of the electric power plant's fixed costs should be charged to the Fabrication department at

the end of the month for purposes of evaluating performance?

$18,000

$24,000

Machining Fabrication

20,000

10,000

25,000

15,000

$30,000

Total

30,000

40,000

$26,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The manufacturing overhead budget at Foshay Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 5,800 direct labor-hours will be required in May. The variable overhead rate is $9.10 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $104,400 per month, which includes depreciation of $8,120. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. What should be the predetermined overhead rate for May?arrow_forwardTiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. The company expected to operate the department at 100% of normal capacity of 8,400 hours. TIGER EQUIPMENT INC. Factory Overhead Cost Budget-Welding Department For the Month Ended May 31 1 Variable costs: 2 Indirect factory wages $30,240.00 3 Power and light 20,160.00 4 Indirect materials 16,800.00 5 Total variable cost $67,200.00 6 Fixed costs: 7 Supervisory salaries $20,000.00 8 Depreciation of plant and equipment 36,200.00 9 Insurance and property taxes 15,200.00 10 Total fixed cost 71,400.00 11 Total factory overhead cost $138,600.00 During May, the department operated at 8,860 standard hours. The factory overhead costs incurred were indirect…arrow_forwardFlounder Company estimates that it will produce 6,000 units of product IOA during the current month. Budgeted variable manufacturing costs per unit are direct materials $8, direct labor $13, and overhead $19. Monthly budgeted fixed manufacturing overhead costs are $7,700 for depreciation and $3,700 for supervision. In the current month, Flounder actually produced 6,500 units and incurred the following costs: direct materials $44,976, direct labor $76,400, variable overhead $122,094, depreciation $7,700, and supervision $3,959. Prepare a static budget report. Hint: The Budget column is based on estimated production while the Actual column is the actual cost incurred during the period. (List variable costs before fixed costs.) FLOUNDER COMPANY Static Budget Report ÷ Budget Actual $ +A Difference Favorable Unfavorablarrow_forward

- Pita Bread Ltd has two production departments, Assembly and Finishing, and two service departments, Stores and Maintenance. The company has budgeted the following costs for the forthcoming period. Assembly Finishing Stores Maintain Allocation Indirect Material 15,250 13,500 12,650 14,000 Allocation Indirect Labour 10,250 5,600 5,520 7,500 Overheads Depreciation of equipment 58,000 Plant insurance 88,000 Heat and light 75,000 Canteen costs 24,000 Rent 50,000 Supervision 80,000 The following information is also available: Assembly Finishing Stores Maintain Total Floor Area sm 10,000 10,000 2,500 2,500 Employees 40 20 10 10 Plant book value $100,000 $100,000 $40,000 $50,000 Depreciation per annum 30% 30% 20% 20% Machine Hours 60,000 40,000 - - Stores Requisition $200,000 $300,000…arrow_forwardHannibal Steel Company's Transport Services Department provides trucks to haul ore from the company's mine to its two steel mills- the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $237,500 per year, consisting of $0.22 per ton variable cost and $187,500 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 64% of the Transport Services Department's capacity and the Southern Plant requires 36% During the year, the Transport Services Department actually hauled 126,000 tons of ore to the Northern Plant and 67,900 tons to the Southern Plant. The Transport Services Department Incurred $363,000 In cost during the year, of which $54,000 was variable and $309,000 was fixed. Required: 1. How much of the Transport Services Department's variable costs should be charged to each plant? 2. How much of the Transport Services Department's fixed costs should be charged to…arrow_forwardHarrison, Inc. is preparing their budget for the upcoming year and requires a breakdown of the costs of power used in its factory into the fixed and variable components. They have determined the number of direct labor hours worked affects the cost of power. The following data on the cost of power used and direct labor hours worked are available for the last six months of this year: Month July August September October High-Low Method November December Total Cost of Power $ 14,850 15,400 16,370 19,800 17,600 18,500 $102.520 Direct Labor Hours 3,000 2,050 2,900 3,650 2,670 2,650 16.920 1. Assuming that Harrison uses the high-low method of analysis, calculate the cost function to be used to estimate the power costs. 2. They have determined that production needs will require 8,467 direct labor hours. Using the cost function calculated above, what is the estimated cost of power?arrow_forward

- The cost formula for the maintenance department of Rambo Limited is $19,200 per month plus $7.50 per machine hour used by the production department. Required: a. Calculate the maintenance cost that would be budgeted for a month in which 6,600 machine hours are planned to be used. b. Prepare an appropriate performance report for the maintenance department assuming that 7,100 machine hours would be used in the month of May and that the total actual maintenance cost incurred in May was $68,950. Complete this question by entering your answers in the tabs below. Required A Required B Calculate the maintenance cost that would be budgeted for a month in which 6,600 machine hours are planned to be used. Maintenance costarrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $2,201,190. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 18,000 units. Each night light requires 2 hours of direct labor. Desk lamps are budgeted for 18,700 units. Each desk lamp requires 3 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year.fill in the blank direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places.fill in the blank per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places.Night lights fill in the blank per unitDesk lamps fill in the blank per unitarrow_forwardThe total factory overhead for Landen Company is budgeted for the year at $675,000. Landen manufactures two drapery products: sheer curtains and insulated curtains. These products each require 6 direct labor hours (dlh) to manufacture. Each product is budgeted for 7,500 units of production for the year. What would the factory overhead allocated per unit for insulated curtains using the single plantwide factory overhead rate be? a.$15.00 b.$270.00 c.$45.00 d.$90.00arrow_forward

- Shalom Company prepared its 2023 manufacturing overhead budget to produce Product Peace. Variable overhead costs per direct labor hour are Indirect materials, P3; Indirect labor, P15; Maintenance, P2. Fixed costs totaled P68,000 composed of Supervisor's salaries, P36,000; Depreciation, P20,000; Maintenance, P12,000. Producing each unit requires 2 direct labor hours. Shalom Company estimates that units to be produced for each quarter are 3,000, 3,600, 4,000, and 6,000, respectively. Amounts must be in whole numbers. Example: 88,000 or (88,000) How much is the total manufacturing overhead budget? Cash payments in quarter 3arrow_forwardKatherin, Ltd. is developing their manufacturing overhead budget for May, which is based on budgeted direct labor hours. The variable overhead rate is $16.05 per direct labor hour and 11,552 direct labor hours are budgeted for May. Fixed manufacturing overhead is budgeted at $102,000. All overhead costs are current cash flows except for $15,300 of depreciation. The predetermined overhead rate every month is recomputed every month. What should the predetermined overhead rate for May be? Select one: A. $24.88 B. $26.20 C. $8.83 D. $17.66 E. $17.37arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education