FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

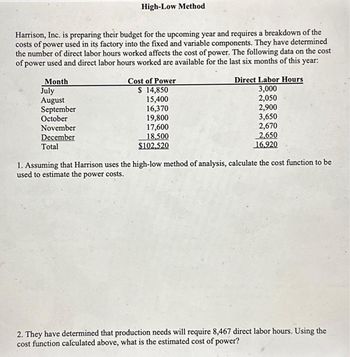

Transcribed Image Text:Harrison, Inc. is preparing their budget for the upcoming year and requires a breakdown of the

costs of power used in its factory into the fixed and variable components. They have determined

the number of direct labor hours worked affects the cost of power. The following data on the cost

of power used and direct labor hours worked are available for the last six months of this year:

Month

July

August

September

October

High-Low Method

November

December

Total

Cost of Power

$ 14,850

15,400

16,370

19,800

17,600

18,500

$102.520

Direct Labor Hours

3,000

2,050

2,900

3,650

2,670

2,650

16.920

1. Assuming that Harrison uses the high-low method of analysis, calculate the cost function to be

used to estimate the power costs.

2. They have determined that production needs will require 8,467 direct labor hours. Using the

cost function calculated above, what is the estimated cost of power?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Production workers for Benson Manufacturing Company provided 380 hours of labor in January and 660 hours in February. Benson expects to use 4,000 hours of labor during the year. The rental fee for the manufacturing facility is $16,000 per month. Required Based on this information, how much of the rental cost should be allocated to the products made in January and to those made in February? (Do not round intermediate calculations.) Month Allocated Cost January Februaryarrow_forwardEllington, SRL is developing their manufacturing overhead budget for February, which is based on budgeted direct labor hours. The variable overhead rate is $16.40 per direct labor hour and 7,900 direct labor hours are budgeted for February. Fixed manufacturing overhead is budgeted at $67,000. All overhead costs are current cash flows except for $10,720 of depreciation. What should the manufacturing overhead budget indicate for cash disbursements for manufacturing overhead for the month of February?arrow_forwardJ&J Co. provides house cleaning services. The company uses the number of jobs to measure activity. At the beginning of March, the company budgeted for 60 jobs, but the actual number of jobs turned out to be 70. Wages and salaries expense is a mixed cost. Supplies expense is a variable cost. Transportation expense is a fixed cost. Here is a report comparing the actual vs. budgeted revenues and costs for the month of March: What is the amount of Supplies Expense in the Flexible Budget?arrow_forward

- Botosan Factory has budgeted factory overhead for the year at $615,285, and budgeted direct labor hours for the year are 372,900. If the actual direct labor hours for the month of May are 339,300, the overhead allocated for May is a. $559,845 b. $576,640 c. $475,868 d. $677,412arrow_forwardThe Janesky Company has collected data on the manufacture of 6,473 robot grippers last month. The breakdown of total costs is shown below. They now need to plan for future months. Units sold last month 6,473 Direct materials $142,853 Direct labor $379,071 Manufacturing variable overhead $267,425 Selling and administrative costs $211,977 What is the break even quantity for a price of $382?arrow_forwardGayner Corporation is an oil well service company that measures its output by the number of wells serviced. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for November. Variable Actual Fixed Element Element per Total for per Month November Well Serviced 4,300 $ 148,400 Revenue Employee salaries and 1,000 $ 006 wages 009 2$ 20,200 Servicing materials $29,600 30,300 Other expenses When the company prepared its planning budget at the beginning of November, it assumed that 30 wells would have been serviced. However, 34 wells were actually serviced during November. The spending variance for "Servicing materials" for November would have been closest to: MacBook Air い DD 888 delete 8. 6 9 %24 %24 %24 %24 %24arrow_forward

- Prestridge Corporation is a service company that measures its output by the number of customers served. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for August. Fixed Element per Month Revenue Variable Element per Customer Served $ 4,100 Actual Total for August $ 120,500 Employee salaries and wages $ 41,500 $ 1,000 $ 71,200 Travel expenses $ 500 $ 14,800 Other expenses $ 38,900 $ 38,400 When the company prepared its planning budget at the beginning of August, it assumed that 31 customers would have been served. However, 29 customers were actually served during August. The spending variance for total expenses for August would have been closest to:arrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $1,163,800. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 17,900 units. Each night light requires 2 hours of direct labor. Desk lamps are budgeted for 21,800 units. Each desk lamp requires 3 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year. direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places. $ per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places. Night lights $ Desk lamps $ per unit per unitarrow_forwardKatherin, Ltd. is developing their manufacturing overhead budget for May, which is based on budgeted direct labor hours. The variable overhead rate is $16.05 per direct labor hour and 11,552 direct labor hours are budgeted for May. Fixed manufacturing overhead is budgeted at $102,000. All overhead costs are current cash flows except for $15,300 of depreciation. The predetermined overhead rate every month is recomputed every month. What should the predetermined overhead rate for May be? Select one: A. $24.88 B. $26.20 C. $8.83 D. $17.66 E. $17.37arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education