Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

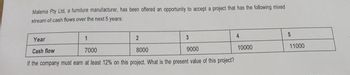

Transcribed Image Text:Malema Pty Ltd, a furniture manufacturer, has been offered an opportunity to accept a project that has the following mixed

stream of cash flows over the next 5 years:

2

Year

1

3

Cash flow

7000

8000

9000

If the company must earn at least 12% on this project. What is the present value of this project?

4

10000

5

11000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The 5-year project your team is starting right now requires the following levels of net working capital for the next 5 years: Timeline T0 T1 T2 T3 T4 T5 net working capital $59000 $62000 $77000 $86000 $86000 $0 What's the cash flow from changes in net working capital at the end of the project (T5)?arrow_forwardI need some help starting thisarrow_forwardBECL Ltd is considering a project, which will involve the following cash inflows and (out)flows: $000 Initial Outlay (400) After 1 year 40 After 2 years 300 After 3 years 300 What will be the NPV (net present value) of this project if a discount rate of 15% is used? a. -$60.8k b. $460.8k c. $240k d. $60.8karrow_forward

- A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: Years 0 1 2 3 4 S -1,100 900 350 100 10 L -1,100 0 300 550 850 The company's cost of capital is 12 percent, and it can get an unlimited amount of capital at that cost. The cutoff payback period is two years. Which project should the company choose based on payback period and discounted payback period? Question 5 options: Based on payback, choose project L; based on discounted payback, also choose L. Based on payback, choose project L; based on discounted payback, choose neither. Based on payback, choose project S; based on discounted payback, also choose S. Based on payback, choose project S; based on discounted payback, choose neither.arrow_forwardRoyal Arts Company has invested 18000 as the initial investment into a new project. the following are the expected cash flows from the project. the appropriate discount rate is 5% what is the NPV of the project?Year 1 11000Year 2 8000Year 3 2000arrow_forwardThe business is considering a project and is not sure which of these two projects to embark on. The initial investment is £15,000, and the interest rate is 2%, estimating that the investment will provide the following cashflows for 5 years: Project A (£) Project B (£) CF1 2,000 5000 CF2 8000 6000 CF3 9000 1000 CF4 3000 4000 CF5 5000 2400 You must explain to the Board the viability of this investment using the net present value (NPV) criterion. Based on the above information, answer the following question • What is the NPV of each investment? • Is the investment viable? If yes, why? Simple Interest and Compound Interest 1. One of the directors suggested that the company invests £4200 in a Platinum Saver Account which pays 6.3% interest per annum. How much simple interest will the company receive after 4 years? 2. He also suggested investing £1200 for four years, and wondered how much that investment will be worth if they paid 12%…arrow_forward

- Charlie Charlie Ltd is considering investing in equipment to make a new product. The machine would cost £500,000 and would be sold after 6 years for an estimated £200,000. The production would generate net positive cashflows as follows: Year Net operating cashflow (£) 1 80,000 2 80,000 3 90,000 4 100,000 5 110,000 6 120,000 The company has a cost of finance of approximately 10% pa. Calculate: The Payback Period (assume the operating cashflows are spread evenly over each year) The Accounting Rate of Return based on average investment The NPV (assume here that operating cashflows occur at the end of each year) The IRR (try 15% for the other rate)arrow_forwardBunnings Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 8%. The cash flows of the projects are provided below. Equipment 1 Equipment 2 Cost $186000 $195000 Future Cash Flow Year 1 86000 97000 Year 2 93000 84000 Year 3 83000 86000 Year 4 75000 75000 Year 5 55000 63000 Required:a) Identify which option of equipment should the company accept based on Profitability Index? b) Identify which option of equipment should the company accept based on discounted pay back method if the payback criterion is maximum 2 years?arrow_forwardThe ABC Resort is redoing its golf course at a cost of $843,000. It expects to generate cash flows of $593,000, $743,000 and $129,000 over the next three years. If the appropriate discount rate for the company is 17.5 percent, what is the NPV of this project (to the nearest dollar)? O a. $279363 O b. $373541 O c. $1965363 O d. $112202arrow_forward

- Bunnings Ltd is considering to invest in one of the two following projects to buy a newequipment. Each equipment will last 5 years and have no salvage value at the end. Thecompany’s required rate of return for all investment projects is 8%. The cash flows of theprojects are provided below.Equipment 1 Equipment 2Cost $186,000 $195,000Future Cash FlowsYear 1Year 2Year 3Year 4Year 586 00093 00083 00075 00055 00097 00084 00086 00075 00063 000Required:a) Identify which option of equipment should the company accept based onProfitability Index? b) Identify which option of equipment should the company accept based ondiscounted pay back method if the payback criterion is maximum 2 years? Do not use excel calculationsarrow_forward1. Google, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusively projects. Project Alpha requires an initial outlay of BD 24000; project Beta requires an initial outlay of BD44000. Using the expected cash inflows given for each project in the following table. Expected cash flow Year Project Alpha Project Beta 1 BD6000 BD19000 2 BD9000 BD6000 3 BD4000 BD4000 4 BD6000 BD13000 5 BD3500 BD5000 6 BD2000 BD4000 Required: 1. Determine the payback period of each project 2. Because they are mutually exclusive, Google must choose one. Which should the company invest in? 3. Explain why one of the projects is the better choice than the otherarrow_forwards Find the present worth at time 0 of the chrome plating costs shown in the cash flow diagram. Assume /= 12% per year. P-7 2000 1800 1400 1600 1200 1000 year The present worth of the chrome plating is determined to be $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education