Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

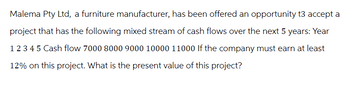

Transcribed Image Text:Malema Pty Ltd, a furniture manufacturer, has been offered an opportunity t3 accept a

project that has the following mixed stream of cash flows over the next 5 years: Year

1 2 3 4 5 Cash flow 7000 8000 9000 10000 11000 If the company must earn at least

12% on this project. What is the present value of this project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Royal Arts Company has invested 18000 as the initial investment into a new project. the following are the expected cash flows from the project. the appropriate discount rate is 5% what is the NPV of the project?Year 1 11000Year 2 8000Year 3 2000arrow_forwardThe business is considering a project and is not sure which of these two projects to embark on. The initial investment is £15,000, and the interest rate is 2%, estimating that the investment will provide the following cashflows for 5 years: Project A (£) Project B (£) CF1 2,000 5000 CF2 8000 6000 CF3 9000 1000 CF4 3000 4000 CF5 5000 2400 You must explain to the Board the viability of this investment using the net present value (NPV) criterion. Based on the above information, answer the following question • What is the NPV of each investment? • Is the investment viable? If yes, why? Simple Interest and Compound Interest 1. One of the directors suggested that the company invests £4200 in a Platinum Saver Account which pays 6.3% interest per annum. How much simple interest will the company receive after 4 years? 2. He also suggested investing £1200 for four years, and wondered how much that investment will be worth if they paid 12%…arrow_forward7. The NPV and payback period What information does the payback period provide? Suppose Praxis Corporation's CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she does know that the project's regular payback period is 2.5 years. Year Cash Flow Year 1 $350,000 Year 2 $475,000 Year 3 $475,000 Year 4 $400,000 If the project's weighted average cost of capital (WACC) is 10%, what is its NPV? $278,324 $333,989 $292,240 $236,575 Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply. ☐ The discounted payback period does not take the project's entire life into account. The discounted payback period does not take the time value of money into account. The discounted payback period is calculated using net income instead of cash flows. ☐arrow_forward

- Bunnings Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 8%. The cash flows of the projects are provided below. Equipment 1 Equipment 2 Cost $186000 $195000 Future Cash Flow Year 1 86000 97000 Year 2 93000 84000 Year 3 83000 86000 Year 4 75000 75000 Year 5 55000 63000 Required:a) Identify which option of equipment should the company accept based on Profitability Index? b) Identify which option of equipment should the company accept based on discounted pay back method if the payback criterion is maximum 2 years?arrow_forwardNEED HELP ASAP! Imagine you are going to have a project to sell a Massive Machinary you owned. You have invested THB 15,500,000 for the Machine. This machine is expected ot have a life of 7 years. The expected cash flow for the next seven years are as follow; Year 1 - THB 900,000 Year 2 - THB 950,000 Year 3 - THB 1,200,000 Year 4 - THB 2,500,000 Year 5 - THB 2,500,000 Year 6 - THB 3,640,000 Year 7 - THB 5,560,000 Discount Rate is at 7% per year. Please find the Present Value for each year and also the Net Present Value. Then, see if you should accept this project or not? Give me a solid support for your answerarrow_forwardPet World is considering a project that has the following cash flow data. Year Cash flows 0 -$9,500 1 2 3 4 $2,000 $2,025 $2,050 $2,075 $2,100 If the required rate of the return on similar projects is 3%, the firm should IRR is 5 this project because its accept; 2.31% reject; 2.57% reject; 2.82% reject; 2.08% accept; 3.10%arrow_forward

- Find the present worth at time 0 of the chrome plating costs shown in the cash flow diagram. Assume i = 10% per year.arrow_forwardIt is estimated that a certain piece of equipment can save as $25,000 per year in labour and materials. The equipment has an expected life of six years and no market value. If the company must earn a 20% annual return on such investments, select the appropriate cash flow diagram that represents this transaction. O A. O B. P= ? A = $25,000 P= ? A= $25,000 1 2 3 4 End of Year 5 6 2 3 4 End of Year Oc. O D. A= $25,000 A = $25,000 ! 3 End of Year 5 6 1 2. 3 6 End of Year P=? P=? Lütfen birini seçin: O A. C О В. В O C. A O D. Darrow_forwardA company is considering a 4-year project with the following cash flows: C0 =-$20,000 C1 =C2 =C3 =C4 =$7,000 If the company’s opportunity cost of capital is 12%, then compute the following for the project: a) the project’s NPV b) the project’s IRR c) determine if the project will have more than 1 IRR d) The project’s PI e) Should the project be rejected because its payback period is longer than two years? f) Should the project be rejected because its IRR is greater than its required rate of return?arrow_forward

- Barry Inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? WACC = 9.75% Year 1 3 5 CFs -$53,600 8,010 16,020 24,030 32,040 40,050 2.arrow_forwards Find the present worth at time 0 of the chrome plating costs shown in the cash flow diagram. Assume /= 12% per year. P-7 2000 1800 1400 1600 1200 1000 year The present worth of the chrome plating is determined to be $arrow_forwardResnick Inc. is considering a project that has the following cash flow data. What is the project's payback? Year Cash flows a. 2.58 years O b. 1.58 years O c. 1.38 years O d. 2.17 years e. 2.83 years 0 -$325 1 $150 2 $150 3 $150arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education