Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

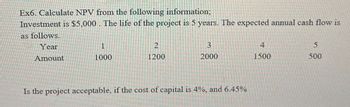

Transcribed Image Text:Ex6. Calculate NPV from the following information;

Investment is $5,000. The life of the project is 5 years. The expected annual cash flow is

as follows.

Year

2

3

4

5

Amount

1000

1200

2000

1500

500

Is the project acceptable, if the cost of capital is 4%, and 6.45%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- BECL Ltd is considering a project, which will involve the following cash inflows and (out)flows: $000 Initial Outlay (400) After 1 year 40 After 2 years 300 After 3 years 300 What will be the NPV (net present value) of this project if a discount rate of 15% is used? a. -$60.8k b. $460.8k c. $240k d. $60.8karrow_forwardCash flows from a new project are expected to be $5,000, $8,000, $14,000, $22,000, $24,000, and $32,000 over the next 6 years, respectively. Assuming qn initial cost of $60,000, and a discount rate of 16%, what is the project's IRR?arrow_forwardklp.2arrow_forward

- 3) see picturearrow_forwardShannon Industries is considering a project which has the following cash flows: Year Cash Flow 0 ? 1 $2,000 2 3,000 3 3,000 4 1,500 The project has a payback of 2.5 years. The firm's cost of capital is 12 percent. What is the project's net present value NPV? Round it to a whole dollar, e.g., 1234.arrow_forward0.5.10 A company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using (a) tabulated factors, and (b) a spreadsheet. Table Summary: A table divided into two columns shows the items to consider for obtaining the annual cost of the project in the first column, and the numeric value of the items in the second column. First cost, $ -800,000 Equipment replacement cost in year 2, $-300,000 Annual operating cost, $/year Salvage value, $ Life, years -950,000 250,000 4arrow_forward

- Judson's cost of capital is 12%, what is the project's NPV? Year Cash Flow in $ 0 ($1000) 1 400 2 400 3 600arrow_forwardXYZ is evaluating a project that would last for 3 years. The project's cost of capital is 15.60 percent, its NPV is $43,200.00 and the expected cash flows are presented in the table. What is X? Years from today 0 1 2 3 Expected Cash Flow (in $) -55,800 71,000 -15,900 X O An amount less than $43,200.00 or an amount greater than $82,666.00 O An amount equal to or greater than $70,205.00 but less than $82,666.00 O An amount equal to or greater than $60,505.00 but less than $70,205.00 O An amount equal to or greater than $53,257.00 but less than $60,505.00 O An amount equal to or greater than $43,200,00 but less than $53,257.00 Marrow_forwardQuestion 3: A project requires an immediate investment of $150,000 and another maintenance expenditure of $30,000every two years starting two years from now. What is the minimum annual income the project should generate starting one year from now for 4 years to satisfy a minimum attractive rate of return (MARR) of 12%? (Provide a cash flow diagram).arrow_forward

- te.7arrow_forwardA project has the following cash flows. It costs $15,000. It briongs in $22,000 after one year, and costs an adittional $6,500 after two years. The Required rate of return is 11%. Calculate the MIRR using the combination approach.arrow_forwardNPV ..... Excel please Project L requires an initial outlay at t = 0 of $50,000, its expected cash inflows are $15,000 per year for 9 years, and its WACC is 10%. What is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education