Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

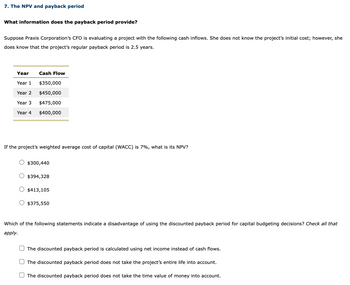

Transcribed Image Text:7. The NPV and payback period

What information does the payback period provide?

Suppose Praxis Corporation's CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she

does know that the project's regular payback period is 2.5 years.

Year

Year 1

Year 2

Year 3

Year 4

Cash Flow

$350,000

$450,000

$475,000

$400,000

If the project's weighted average cost of capital (WACC) is 7%, what is its NPV?

$300,440

$394,328

$413,105

$375,550

Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that

apply.

The discounted payback period is calculated using net income instead of cash flows.

The discounted payback period does not take the project's entire life into account.

The discounted payback period does not take the time value of money into account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering a project that has the following cash flow data. What is the project's payback? (Ch. 11) Year 0 1 2 3 Cash Flow -900 350 450 600 Group of answer choices 1.95 1.52 2.60 2.17 2.38arrow_forwardConsider a project that will produce sales of $55,150 and have costs of $31,100. Taxes will be $5,400 and the depreciation expense will be $3,325. An initial cash outlay of $2,250 is required for net working capital. What is the project's operating cash flow?arrow_forwardCompany XYZ is considering an investment project that is expected to generate the following cash flows: Year 1: $500,000 Year 2: $700,000 Year 3: $800,000 Year 4: $900,000 Year 5: $1,200,000 The cost of capital for the company is 10%. Calculate the Firm's Present Value (FPV) of the cash flows. To calculate the Firm's Present Value (FPV) of the cash flows, you need to discount each cash flow to its present value using the cost of capital, and then sum up the present values of all cash flows.arrow_forward

- A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: Years 0 1 2 3 4 S -1,100 900 350 100 10 L -1,100 0 300 550 850 The company's cost of capital is 12 percent, and it can get an unlimited amount of capital at that cost. The cutoff payback period is two years. Which project should the company choose based on payback period and discounted payback period? Question 5 options: Based on payback, choose project L; based on discounted payback, also choose L. Based on payback, choose project L; based on discounted payback, choose neither. Based on payback, choose project S; based on discounted payback, also choose S. Based on payback, choose project S; based on discounted payback, choose neither.arrow_forwardHansarrow_forwardCompute the payback period statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown in the chart if the maximum allowable payback is four years. year 0-(-$1,450) Year 1-$250 Year 2-$380 Year 3-$620 Year 4-$1,000 Year 5-$100arrow_forward

- Suppose an opportunity arises to invest $10 million that will pay $5.5 million at the end of year 1 and $6.5 million at the end of year two. The cost of capital is 10%. Find NPV. Is the project a go? Show and explain Suppose the project’s cash flows are delayed a year, but not the outlay. How does that change your answer? Show and explain Suppose there is a cost overrun of 20%. The cash flows and their timing are the same as in part a. How does this change your answer? Show and explain. Suppose the second-year cash flow decreases to $5 million. The outlay and timing of the cash flows are the same as in part a. How does this change your answer? Show and explain. Evaluate the proposal. Would you undertake it?arrow_forwardThe NPV and payback period What information does the payback period provide? Suppose ABC Telecom Inc.’s CFO is evaluating a project with the following cash inflows. She does not know the project’s initial cost; however, she does know that the project’s regular payback period is 2.5 years. Year Cash Flow Year 1 $350,000 Year 2 $500,000 Year 3 $500,000 Year 4 $400,000 If the project’s weighted average cost of capital (WACC) is 10%, what is its NPV? $280,268 $224,214 $252,241 $322,308 Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply. The discounted payback period does not take the project’s entire life into account. The discounted payback period is calculated using net income instead of cash flows. The discounted payback period does not take the time value of money into account.arrow_forwardYou are considering a project that has the following cash flow data. What is the project's payback? Year 0 1 2 3 Cash Flow -900 350 450 550 Group of answer choices 2.40 1.53 1.96 2.18 2.62arrow_forward

- Kiley Electronics is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the cost of capital (and even negative), in which case it will be rejected. r: 10.00% Year 0 1 2 3 Cash flows −$1,000 $550 $560 $570arrow_forward7. The NPV and payback period What information does the payback period provide? Suppose Praxis Corporation's CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she does know that the project's regular payback period is 2.5 years. Year Cash Flow Year 1 $350,000 Year 2 $475,000 Year 3 $475,000 Year 4 $400,000 If the project's weighted average cost of capital (WACC) is 10%, what is its NPV? $278,324 $333,989 $292,240 $236,575 Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply. ☐ The discounted payback period does not take the project's entire life into account. The discounted payback period does not take the time value of money into account. The discounted payback period is calculated using net income instead of cash flows. ☐arrow_forwardI think the payback periods are correct, I just need the different cash flows of each year + the final question at the bottom. Thank you.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education