FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

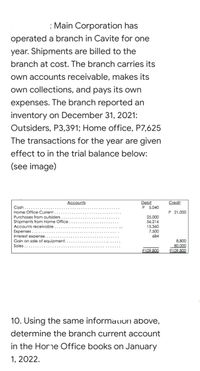

Transcribed Image Text:: Main Corporation has

operated a branch in Cavite for one

year. Shipments are billed to the

branch at cost. The branch carries its

own accounts receivable, makes its

own collections, and pays its own

expenses. The branch reported an

inventory on December 31, 2021:

Outsiders, P3,391; Home office, P7,625

The transactions for the year are given

effect to in the trial balance below:

(see image)

Debit

P 5,040

Accounts

Credit

Cash

Home Office Current

P 21,000

25.000

Purchases from outsiders

Shipments from Home Office

Accounts receivable

Expenses......

Interest expense.

56,216

15,360

7,500

684

Gain on sale of equipment.

Sales

8,800

80.000

P109.800

P109.800

10. Using the same informalion above,

determine the branch current account

in the Horne Office books on January

1, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Infinity Emporium Company received the monthly statement for its bank account, showing a balance of $67,300 on August 31. The balance in the Cash account in the company's accounting system at that date was $72,628. The company's accountant reviewed the statement and the company's accounting records and noted the following. 1. 2. 3. After comparing the cheques written by the company with those deducted from the bank account in August, the accountant determined that all six cheques (totalling $6,180) that had been outstanding at the end of July were processed by the bank in August. However, five cheques written in August, totalling $4,500, were outstanding on August 31. A review of the deposits showed that a deposit made by the company on July 31 for $11,532 was recorded by the bank on August 1, and an August 31 deposit of $13,300 was recorded in the company's accounting system but had not yet been recorded by the bank. The August bank statement also showed: a service fee of $24 a…arrow_forwardHow much is ATHENS' accrual basis total operating expenses during the year? (EXCLUDE INTEREST EXPENSE)arrow_forwardThe trial balance of Pacilio Security Services, Incorporated as of January 1, Year 8, had the following normal balances: $93,708 100 22,540 1,334 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Cash Petty cash Accounts receivable Allowance for doubtful accounts Supplies Prepaid rent Merchandise inventory (18@ $285) 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. Land Salaries payable Common stock Retained earnings During Year 8, Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from Year 7. 2. Purchased equipment and a van for a lump sum of $36,000 cash on January 2, Year 8. The equipment was appraised for $10,000 and the van was appraised for $30,000. Requirement 3. Paid $9,000 on May 1, Year 8, for one year's office rent in advance. 4. Purchased $300 of supplies on account 5. Purchased 120 alarm systems at a cost of $280 each. Pald cash for the purchase. 6. After numerous attempts to collect from customers, wrote off $2,350 of uncollectible accounts…arrow_forward

- For the month of December, the records of Taboo Corporation show the following information: Cash received on accounts receivable - $140,000 Cash Sales - $120,000 Accounts Receivable, December 1 - $320,000 Accounts Receivable, December 31 - $286,000 Accounts Receivable written off as uncollectible - $4,000 The corporation uses the direct write-off method in accounting for uncollectible accounts receivable. What are the gross sales for the month of December?arrow_forwardsarrow_forwardSubject: acountingarrow_forward

- b) Sofea Enterprise runs a retail business. All cash and cheque receipt and payment are recorded in the Cash Book. The following transactions occurred during the month of September 2021 and are yet to be recorded in the Cash Book: The debit balance in the Cash and Bank accounts are $2,000 and $17,000 respectively. 3/9 Transfer cash $1,000 into the bank account. 4/9 Purchased goods worth $3,600 by cheque. 5/9 Paid Jamilah & Co. $5,000 by cheque for purchase of goods. 6/9 The owner took $500 cash for his own use. 8/9 Paid the shop rental $3,000 by cheque. 10/9 Received a cheque from Ms. Angie amounting to $3,600 after deducting cash discount $400. 15/9 Cash sales of $3,200. 18/9 Issued $2,850 cheque to Seri Enterprise after deducting cash discount of 5%. 20/9 Received $5,000 cheque from Faiz Enterprise. 23/9 Cash sales banked the same day, $2,600. 28/9 Paid wages to shop assistant by cheque, $1,200. REQUIRED: Prepare a Three-column Cash Book, balancing it at 30 September 2021. Bring down…arrow_forwardOn December 31, 2020, TEJ Company had a cash balance per books of $8,664. The statement from DUABI Islamic Bank on that date showed a balance of $15,900. A comparison of the bank statement with the Cash account revealed the following facts. NSF check of customer returned by bank $4,200. Check No. 210 was correctly written and paid by the bank for $593. The cash payment journal reflects an entry for Check No. 210 as a debit to Accounts Payable and a credit to Cash in Bank for $539. Bank service charge for December was $100. A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared by the bank in December. The bank collected a note receivable for the company for $3,000 plus $100 interest revenue. Checks written in December but still outstanding $8,000. Checks written in November but still outstanding $5,150. Deposits of December 29 and 30…arrow_forwardDavos Company performed services on account for $160,000 in Year 1. Davos collected $120,000 cash from accounts receivable during Year 1, and the remaining $40,000 was collected in cash during Year 2. Required a. e. & f. Record the Year 1 transactions in T-accounts and close the Year 1 Service Revenue account to the Retained Earnings account. Record the Year 2 cash collection in the appropriate T-accounts.arrow_forward

- The cash register tape for Sheridan Industries reported sales of $27,292.00. Record the journal entry that would be necessary for each of the following situations. (a) Sales per cash register tape exceeds cash on hand by $53.50. (b) Cash on hand exceeds cash reported by cash register tape by $22.00. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.75.) No. Account Titles and Explanation Debit Credit (a) (b)arrow_forwardanswer in text form please (without image)arrow_forwardanswer in text form please (without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education