Concept explainers

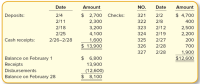

Oscar’s Red Carpet Store maintains a checking account with Academy Bank. Oscar’s sells carpet each day but makes bank deposits only once per week. The following provides information from the company’s cash ledger for the month ending February 28, 2021.

Information from February’s bank statement and company records reveals the following additional information:

a. The ending cash balance recorded in the bank statement is $13,145.

b. Cash receipts of $1,600 from 2/26–2/28 are outstanding.

c. Checks 325 and 327 are outstanding.

d. The deposit on 2/11 includes a customer’s check for $200 that did not clear the bank (NSF check).

e. Check 323 was written for $2,800 for advertising in February. The bank properly recorded the check for this amount.

f. An automatic withdrawal for Oscar’s February rent was made on February 4 for $1,100.

g. Oscar’s checking account earns interest based on the average daily balance. The amount of interest earned for February is $20.

h. In January, one of Oscar’s suppliers, Titanic Fabrics, borrowed $6,000 from Oscar. On February 24, Titanic paid $6,250 ($6,000 borrowed amount plus $250 interest) directly to Academy Bank in payment for January’s borrowing.

i. Academy Bank charged service fees of $125 to Oscar’s for the month.

Required:

1. Prepare a bank reconciliation for Oscar’s checking account on February 28, 2021.

2. Record the necessary cash adjustments.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- Peterson Company's general ledger shows a cash balance of $7,520 on May 31. May cash receipts of $1,290, included in the general ledger balance, are placed in the night depository at the bank on May 31 and processed by the bank on June 1. The bank statement dated May 31 shows an NSF check from a customer for $160 and a service fee of $70. The bank processes all checks written by the company by May 31 and lists them on the bank statement, except for one check totaling $1,850. The bank statement shows a balance of $7,850 on May 31. Required: Prepare a bank reconciliation to calculate the correct balance of cash on May 31. (Amounts to be deducted should be indicated with a minus sign.) Bank's Cash Balance Per bank statement Bank balance per reconciliation PETERSON COMPANY Bank Reconciliation May 31 Company's Cash Balance Per general ledger Company balance per reconciliationarrow_forwardSee image pleasearrow_forwardOscar’s Red Carpet Store maintains a checking account with Academy Bank. Oscar’s sells carpet each day but makes bank deposits only once per week. The following provides information from the company’s cash ledger for the month ending February 28, 2021. Date Amount No. Date Amount Deposits: 2/4 $ 2,250 Checks: 321 2/2 $ 4,250 2/11 1,850 322 2/8 550 2/18 2,750 323 2/12 2,050 2/25 3,650 324 2/19 1,750 Cash receipts: 2/26-2/28 1,150 325 2/27 350 $ 11,650 326 2/28 850 327 2/28 1,450 Balance on February 1 $ 6,350 $ 11,250 Receipts 11,650 Disbursements (11,250 ) Balance on February 28 $ 6,750 Information from February's bank statement and company records reveals the following additional information: The ending cash balance recorded in the bank statement is $10,580. Cash receipts of $1,150 from…arrow_forward

- A company's Cash account shows a balance of $3,420 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as bank service fees ($60), an NSF check from a customer ($400), a customer's note receivable collected by the bank $(1,400), and interest earned $(170). Prepare the necessary entries to adjust the balance of cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardPlease solve thisarrow_forwardHansabenarrow_forward

- In the process of reconciling its bank statement for January, Maxi's Clothing's accountant compiles the following information: Cash balance per company books on January 30 $ 6,825 Deposits in transit at month-end $ 2,220 Outstanding checks at month-end $ 730 Bank service charges $ 46 An NSF check returned on a customer account $ 800 The adjusted cash balance per the books on January 31 is: Multiple Choice $7,724 $6,994 $5,979 $6,663 $7,196arrow_forwardDinesh bhaiarrow_forwardOscar Myer receives the March bank statement for Jam Enterprises on April 11, 2018. The March 31 bank statement shows an ending cash balance of $67,566. A comparison of the bank statement with the general ledger Cash account, No. 101, reveals the following. O. Myer notices that the bank erroneously cleared a $500 check against his account in March that he did not issue. The check documentation included with the bank statement shows that this check was actually issued by a company named Jam Systems. On March 25, the bank lists a $50 charge for the safety deposit box expense that Jam Enterprises agreed to rent from the bank beginning March 25. On March 26, the bank lists a $102 charge for printed checks that Jam Enterprises ordered from the bank. On March 31, the bank lists $33 interest earned on Jam Enterprises' checking account for the month of March. O. Myer notices that the check he issued for $128 on March 31, 2018, has not yet cleared the bank. O. Myer verifies that all deposits…arrow_forward

- Brangelina Adoption Agency's general ledger shows a cash balance of $4,586. The balance of cash in the March-end bank statement is $7,331. A review of the bank statement reveals the following information: checks outstanding of $2,796, bank service fees of $78, and interest earned of $27. Calculate the correct balance of cash at the end of March. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardAccounting please answer asap? John Corporation's bank statement for April 30 showed an ending cash balance of $1,350. The company's Cash account in its general ledger showed a $995 debit balance. The following information was also available as of April 30: • The bank deducted $125 for an NSF check from a customer deposited on April 15. • The April 30 cash receipts, $1,250, were placed in the bank's night depository after banking hours on that date and this amount did not appear on the April 30 bank statement. • A$15 debit memorandum (service charges) for checks printed by the bank was included with the canceled checks. • Outstanding checks amounted to $1,145. • Included with the bank statement was a credit memo in the amount of $875 for an EFT in payment of a customer's account. • Included with the canceled checks was a check for $275, drawn on the account of another company by error. Required: 1. Prepare a bank reconciliation as of April 30. 2. Prepare the journal entries for the…arrow_forwardOscar's Red Carpet Store maintains a checking account with Academy Bank. Oscar's sells carpet each day but makes bank deposits only once per week. The following provides information from the company's cash ledger for the month ending February 28, 2021. Date Amount No. Date Amount $ 2,000 Checks: 1,600 2,500 Deposits: 2/4 321 2/2 $4,000 2/11 322 2/8 450 2/18 323 2/12 1,800 2/25 3,400 324 2/19 1,500 Cash receipts: 2/26-2/28 900 325 2/27 250 $10,400 326 2/28 750 327 2/28 1,200 Balance on February 1 $ 6,100 $9,950 Receipts 10,400 Disbursements (9,950) Balance on February 28 $ 6,550 Information from February's bank statement and company records reveals the following additional information: a. The ending cash balance recorded in the bank statement is $9,610. b. Cash receipts of $900 from 2/26-2/28 are outstanding. c. Checks 325 and 327 are outstanding. d. The deposit on 2/11 includes a customer's check for $250 that did not clear the bank (NSF check). e. Check 323 was written for $2,500 for…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education