FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

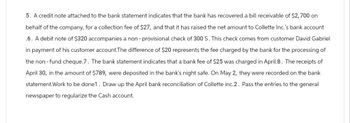

Transcribed Image Text:5. A credit note attached to the bank statement indicates that the bank has recovered a bill receivable of $2,700 on

behalf of the company, for a collection fee of $27, and that it has raised the net amount to Collette Inc.'s bank account

.6. A debit note of $320 accompanies a non-provisional check of 300 S. This check comes from customer David Gabriel

in payment of his customer account.The difference of $20 represents the fee charged by the bank for the processing of

the non-fund cheque.7. The bank statement indicates that a bank fee of $25 was charged in April.8. The receipts of

April 30, in the amount of $789, were deposited in the bank's night safe. On May 2, they were recorded on the bank

statement.Work to be done1. Draw up the April bank reconciliation of Collette inc.2. Pass the entries to the general

newspaper to regularize the Cash account.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- I need help with questionarrow_forwardQ. 15.. The check register for Promotions, Inc. showed a balance of $5,684.37. The bookkeeper then made a deposit of $6,753.91. The bookkeeper then wrote checks for $1,704. 12, $1,600.32, and $2,110.14. Compute the new cash balance shown in the check register.arrow_forwardThe Cash account of ReeseCorporation had a balance of $3,540 at October 31, 2018. Included were outstanding checkstotaling $1,800 and an October 31 deposit of $300 that did not appear on the bank statement.The bank statement, which came from Turnstone State Bank, listed an October 31 balance of$5,570. Included in the bank balance was an October 30 collection of $600 on account froma customer who pays the bank directly. The bank statement also showed a $30 service charge,$10 of interest revenue that Reese earned on its bank balance, and an NSF check for $50.Prepare a bank reconciliation to determine how much cash Reese actually had at October 31.arrow_forward

- Using the following information: The bank statement balance is $3,718. The cash account balance is $4,086. Outstanding checks amounted to $866. Deposits in transit are $1,177. The bank service charge is $48. A check for $78 for supplies was recorded as $69 in the ledger. Prepare a bank reconciliation for Candace Co. for May 31.arrow_forwardOn December 31st, the cheque book balance of Bob's Burgers Ltd. was $1,301.31. The bank statement balance was $1,670.26. Cheques outstanding were $3,152.88. The statement revealed a deposit in transit of $2,815.35 as well as a bank service charge of $112.88. The company earned interest income of $44.30. Complete a bank reconciliation for Bob's Burgers Ltd. $1,332.73 $1,968.23 $1.514.04 $1,345.61 $1,414.19 $1,896.66 $1.269.89 $2.454.19arrow_forwardPlease Solve this Onearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education