FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

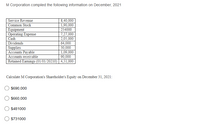

Transcribed Image Text:M Corporation compiled the following information on December, 2021

8,40,000

1,90,000

Service Revenue

Common Stock

Equipment

Operating Expense

Cash

Dividends

254000

7,27,000

2,05,000

64,000

30,000

1,09,000

90,000

Retained Earmings (01/01/20210) 4,51,000

Supplies

Accounts Payable

Accounts receivable

Calculate M Corporation's Shareholder's Equity on December 31, 2021:

$690,000

$660,000

$481000

$731000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comparative Statements of Shareholders' Equity for Locke Intertechnology Corporation were reported as follows for the fiscal years ending December 31, 2019, 2020, and 2021. Balance at January 1, 2019 sale of preferred shares sale of common shares, 7/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2019 Retirement of common shares, 4/11 Cash dividend, preferred Cash dividend, common 3-for-2 split effected in the form of a common stock dividend, 8/12 Net income Balance at December 31, 2020 18% common stock dividend, 5/1 sale of common shares, 9/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2021 Year 2019 2020 2021 LOCKE INTERTECHNOLOGY CORPORATION statements of shareholders' Equity For the Years Ended Dec. 31, 2019, 2020, and 2021 ($ in millions) Numerator / Denominator = Earnings per share 1 1 1 = Preferred stock, $10 par 12 12 12 $12 Common stock, $1 par 80 $ 11 91 (4) 43.5 130.5 13.05 3 $146.55 Additional Paid-in…arrow_forwardSW Company provides the Equity & Liability information below for analysis. SW Company had net income of $365, 700 in 2023 and $335,800 in 2022. Equity and Liabilities 2023 2022 Share capital-common (137,700 shares issued) $ 1,417,500 $ 1,417,500 Retained earnings (Note 1) 417,700 311, 300 Accrued liabilities 10,300 6,500 Notes payable (current) 82,700 65,500 Accounts payable 59,500 179,000 Total equity and liabilities $1,987,700 $ 1,979,800 Note 1: Cash dividends were paid at the rate of $1 per share in 2022 and $2 per share in 2023. Required: 1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,454,000 at December 31, 2021.) (Round your answers to 1 decimal place.) 2. Calculate the book value per shares for 2022 and 2023. (Round your answers to 2 decimal places.)arrow_forwardDrake Co. summarized select account balances on December 31, 2020, and activity for 2020 in the following table. Retained earnings, beginning balance $60,000 Common stock, $1 par, 100,000 shares authorized, 50,000 shares issued 40,000 Treasury stock, 1,000 shares 10,500 Paid-in capital in excess of par 440,000 Accumulated other comprehensive income 25,000 Investment in stock 100,000 Bonds payable 50,000 Net income for 2020 (not included in retained earnings above) 12,000 Dividends declared and paid during 2020 (not included in retained earnings above) 5,000 Noncontrolling interests 2,500 Based on the information provided, what is total stockholders’ equity on December 31, 2020? Select one: a. $559,000 b. $585,000 c. $564,000 d. $574,000arrow_forward

- Blabla Grocery Inc., reported the following financial information on December 31, 2019: Common shares issued and outstanding throughout 2019 700,000 shares 6% nonconvertible cumulative preferred shares capital $450,000 Retained Earnings on January 1. 2019 $3,500,000 Basic EPS for 2019 $0.99 per share In addition, the company did not declare any dividends for either 2018 or 2019. The amount which the company would report as Retained Earnings on December 31, 2019 would be: Select one: a. $673,000. b. $693,000. c. $4,220,000. d. $4,173,000. e. $4,166,000.arrow_forwardCYCLONE, INC. Statement of Stockholders' Equity Year ended Dec. 31, 2021 Common Stock Total Stockholders' Retained Earnings Equity Beginning balance Issuances of stock Add: Net income Less: Dividends 2$ 13,000 $ 6,000 $ 19,000 4,000 4,000 Ending balance 2$ 15,000 $ 7,000 $ 22,000arrow_forwardShown as follows are the amounts from the stockholders' equity section of the balance sheets of Wasson Corporation for the years ended December 31, 2020 and 2021. Stockholders' equity: Capital Stock Retained Earnings Total stockholders' equity a. b. 2021 2020 $50,000 $30,000 200,000 180,000 $250,000 $210,000 Calculate the amount of additional investment that the stockholders made during 2021. Assuming that the corporation declared and paid $15,000 in dividends during 2021, calculate the amount of net income earned by the corporation during 2021. c. Explain the significance of the $200,000 balance of retained earnings at December 31, 2021.arrow_forward

- Wheaton Tire Inc., [WTI] reported the following excerpts from shareholders’ equity on January 1, 2021: Preferred shares, 0.90, 300,000 issued and outstanding $6,000,000 Common shares, 400,000 issued and outstanding $4,400,000 The company declared and paid a cash dividend on February 1, 2021 of $1,400,000. Dividends had not been declared for the past two years, 2019 and 2020. now assume that for this question only that the preferred shares were non cumulative and fully participating. How much will each shareholder group receive? Select one: a. All $1,400,000 to Common since the Preferred are non-participating. b. Each group receives an equal amount of $700,000 per group. c. $270,000 to Preferred and $1,130,000 to Common. d. $807,692 to Preferred and $592,308 to Common. e. None of the above.arrow_forwardssarrow_forwardThe financial statements of Company Permanent and its subsidiary Company Senior are shown below. Statement of Financial Position As at 31 December 2019: Permanent Senior $ $ Investment in Senior 450,000 - Other net assets 4,653,400 605,550 5,103,400 605,550 Share capital 2,350,000 300,000 Retained earnings 2,753,400 305,550 5,103,400 605,550 Income Statement and Partial Statement of Changes in Equity For the Year Ended 31 December 2019 Permanent Senior $ $ Sales 10,000,000 3,300,000 Cost of sales (9,000,000) (3,139,450) Dividend income from Senior 24,000 - Profit before tax 1,024,000 160,550 Tax (220,000) (35,000) Profit after tax 804,000 125,550 Retained earnings, 1 January 2019 2,050,000 210,000 Dividends declared (100,600)…arrow_forward

- ine following intormation pertains tO Alpha Computing at the ena of 2021: Assets $957,500 $452,500 $270,000 $330,000 Liabilities Net Income Common Stock Alpha Computing's Retained Earnings account had a zero balance at the beginning of 2021. What amount of dividends did the company declare 2021? Multiple Choice $96,000 $97,000 $98,000 $95.000arrow_forwardRahularrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education