FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

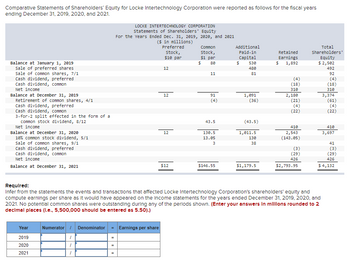

Transcribed Image Text:Comparative Statements of Shareholders' Equity for Locke Intertechnology Corporation were reported as follows for the fiscal years

ending December 31, 2019, 2020, and 2021.

Balance at January 1, 2019

sale of preferred shares

sale of common shares, 7/1

Cash dividend, preferred

Cash dividend, common

Net income

Balance at December 31, 2019

Retirement of common shares, 4/11

Cash dividend, preferred

Cash dividend, common

3-for-2 split effected in the form of a

common stock dividend, 8/12

Net income

Balance at December 31, 2020

18% common stock dividend, 5/1

sale of common shares, 9/1

Cash dividend, preferred

Cash dividend, common

Net income

Balance at December 31, 2021

Year

2019

2020

2021

LOCKE INTERTECHNOLOGY CORPORATION

statements of shareholders' Equity

For the Years Ended Dec. 31, 2019, 2020, and 2021

($ in millions)

Numerator / Denominator = Earnings per share

1

1

1

=

Preferred

stock,

$10 par

12

12

12

$12

Common

stock,

$1 par

80

$

11

91

(4)

43.5

130.5

13.05

3

$146.55

Additional

Paid-in

Capital

530

$

480

81

1,091

(36)

(43.5)

1,011.5

130

38

$1,179.5

Retained

Earnings

$ 1,892

(4)

(18)

310

2,180

(21)

(22)

410

2,543

(143.05)

(3)

(29)

426

$2,793.95

Required:

Infer from the statements the events and transactions that affected Locke Intertechnology Corporation's shareholders' equity and

compute earnings per share as it would have appeared on the income statements for the years ended December 31, 2019, 2020, and

2021. No potential common shares were outstanding during any of the periods shown. (Enter your answers in millions rounded to 2

decimal places (l.e., 5,500,000 should be entered as 5.50).)

Total

Shareholders'

Equity

$ 2,502

492

92

(4)

(18)

310

3,374

(61)

(4)

(22)

410

3,697

41

(3)

(29)

426

$ 4,132

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please show the solution in good accounting form. 8. How much is the total shareholders' equity at year-end?arrow_forwardTamarisk Corporation's adjusted trial balance contained the following accounts at December 31, 2020: Retained Earnings $126,000, Common Stock $765,600, Bonds Payable $109,700, Paid-in Capital in Excess of Par-Common Stock $208,700, Goodwill $59,300, Accumulated Other Comprehensive Loss $154,700, and Noncontrolling Interest $34,200. Prepare the stockholders' equity section of the balance sheet.arrow_forwardThe following information is available for Splish Brothers Inc. and Novak Corp.: Splish Brothers Inc. Novak Corp. (in millions) 2022 2021 2022 2021 Preferred dividends 22 9 27 Net income 545 475 515 565 Shares outstanding at the end of the 215 175 160 195 year Shares outstanding at the beginning of 175 160 195 215 the year Based on this information, what is the amount of Splish Brothers Inc. earnings per share (rounded to two decimals) for 2022? O $ 1.50 O $ 1.34 O $ 2.94 O $ 2.68arrow_forward

- Spicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2023. Assume that the preferred shares are non-cumulative. Accounts Payable Accounts Receivable Accumulated depreciation, Equipment Accumulated depreciation, Warehouse Cash Cash Dividends Common Shares Equipment Income Tax Expense Land Notes Payable, due in 2026 Operating Expenses Preferred Shares Retained Earnings Revenue Warehouse Current assets $ 26,760 40,200 11,140 22,280 9,400 20,600 Required: Prepare a classified balance sheet at December 31, 2023. (Enter all amounts as positive values.) Assets 122,000 79,400 41,600 127,600 34,600 110,200 40,200 28,720 282,100 138,800 SPICER INC. Balance Sheet December 31, 2023 Karrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease show the solution in good accounting form. 5. How much is the TOTAL treasury share capital? 6. How much is the Retained earnings, END? 7. How much is the Retained earnings, end - UNAPPROPRIATED?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education