FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

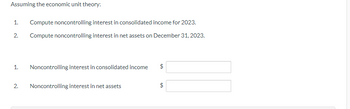

Transcribed Image Text:Assuming the economic unit theory:

1. Compute noncontrolling interest in consolidated income for 2023.

2.

Compute noncontrolling interest in net assets on December 31, 2023.

1. Noncontrolling interest in consolidated income

2.

Noncontrolling interest in net assets

A

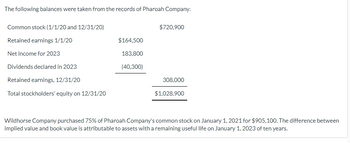

Transcribed Image Text:The following balances were taken from the records of Pharoah Company:

Common stock (1/1/20 and 12/31/20)

$720,900

Retained earnings 1/1/20

$164,500

Net income for 2023

183,800

Dividends declared in 2023

(40,300)

Retained earnings, 12/31/20

308,000

Total stockholders' equity on 12/31/20

$1,028,900

Wildhorse Company purchased 75% of Pharoah Company's common stock on January 1, 2021 for $905,100. The difference between

implied value and book value is attributable to assets with a remaining useful life on January 1, 2023 of ten years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For the year ended December 31, 2020, Blossom Company reported the following: Net income Preferred dividends declared Common dividend declared Unrealized holding loss, net of tax Retained earnings, beginning balance Common stock Accumulated Other Comprehensive Income, Beginning Balance $300400 $643100 $843100 O $601900 49300 9900 5200 401900 200000 25000 What would Blossom report as total stockholders' equity?arrow_forwardThe following data were taken from the financial statements of Gates Inc. for the current fiscal year. Property, plant, and equipment (net) $1,212,000 Liabilities: Current liabilities $120,000 Note payable, 6%, due in 15 years 606,000 Total liabilities $726,000 Stockholders' equity: Preferred $4 stock, $100 par (no change during year) $544,500 Common stock, $10 par (no change during year) 544,500 Retained earnings: Balance, beginning of year $580,000 Net income 226,000 $806,000 Preferred dividends $21,780 Common dividends 58,220 80,000 Balance, end of year 726,000 Total stockholders' equity $1,815,000 Sales $16,351,500 Interest expense $36,360 Assuming that total assets were $2,414,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal…arrow_forwardThe following financial information is available for Sunland Corporation. 2022 2021 Average common stockholders' equity $1,100,000 $877,000 Dividends paid to common stockholders 45,000 25,500 Dividends paid to preferred stockholders 18,500 18,500 Net income 285,000 190,000 Market price of common stock 18 13 The weighted-average number of shares of common stock outstanding was 76,000 for 2021 and 103,000 for 2022. Calculate earnings per share and return on common stockholders' equity for 2022 and 2021 (Round answers to 2 decimal places, e.g. 10.50% or 10.50.) Earnings per share Return on common stockholders' equity $ 2022 % $ 2021 %arrow_forward

- Please do not give solution in image formatarrow_forwardThe comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 62 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,808,800 $1,544,500 Net income 414,400 316,300 Total $2,223,200 $1,860,800 Dividends: On preferred stock $13,300 $13,300 On common stock 38,700 38,700 Total dividends $52,000 $52,000 Retained earnings, December 31 $2,171,200 $1,808,800 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $2,413,380 $2,223,550 Cost of goods sold 825,630 759,580 Gross profit $1,587,750 $1,463,970 Selling expenses $541,940 $662,800 Administrative expenses 461,660 389,260 Total operating expenses $1,003,600 $1,052,060 Income from…arrow_forwardBelow is a company’s stock quote on March 1, 2021: Name Close Net Chg Div P/E DSD 20.25 -.15 1.05 16 What is the company’s earnings per share (EPS)?arrow_forward

- Gadubhaiarrow_forwardPhotoarrow_forwardPresented below are data for Caracas Corp. 2017 2018 Assets, January 1 $6,840 ? Liabilities, January 1 ? $4,104 Stockholders' Equity, Jan. 1 ? $4,125 Dividends 855 969 Common Stock 912 975 Stockholders' Equity, Dec. 31 ? 3,399 Net Income 1,026 ? Net income for 2018 is... $243 loss. $726 income. $180 income. $726 loss. Please show work.arrow_forward

- Barry Co. has a net monetary assets of P75,000 with an quick acid test ration of 1.25. Inventories are P165,000. What is the current Ratio? O 15 O 2 O 175 O 18arrow_forwardThe following financial information is available for Flintlock Corporation. (in millions) Average common stockholders' equity Dividends declared for common stockholders Dividends declared for preferred stockholders Net income BIU T₂ T² Ix !!! 111 2022 lil $2,532 298 40 504 Calculate the payout ratio and return on common stockholders' equity for 2022 and 2021. Comment on your findings. W 2021 $2,591 144 611 40 555 트 M II á TT ¶ O Word(s)arrow_forwardHolland Corporation's annual report is as follows. March 31, 2023 March 31, 2024 Net Income $359,000 $438,500 Preferred Dividends 0 0 Total Stockholders' Equity $4,230,000 $5,252,000 Stockholders' Equity attributable to Preferred Stock 0 0 Number of Common Shares Outstanding 288,000 202,000 Based on the information provided, find the rate of return on common stockholders' equity on March 31, 2024. (Round your final answer two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education