FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

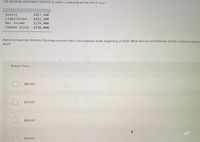

Transcribed Image Text:ine following intormation pertains tO Alpha Computing at the ena of 2021:

Assets

$957,500

$452,500

$270,000

$330,000

Liabilities

Net Income

Common Stock

Alpha Computing's Retained Earnings account had a zero balance at the beginning of 2021. What amount of dividends did the company declare

2021?

Multiple Choice

$96,000

$97,000

$98,000

$95.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (Figures in $ millions) Assets 2021 2022 Liabilities and Shareholders' Equity 2021 2022 Current assets $ 310 $ 420 Current liabilities $ 210 $ 240 Net fixed assets 1,200 1,420 Long-term debt 830 920 Required: a&b. What was shareholders’ equity at the end of 2021 and 2022? c. If Newble paid dividends of $100 million in 2022 and made no stock issues, what must have been net income during the year? d. If Newble purchased $300 million in fixed assets during 2022, what must have been the depreciation charge on the income statement? e. What was the change in net working capital between 2021 and 2022? f. If Newble issued $200 million of new long-term debt, how much debt must have been paid off during the yeararrow_forwardPresented below is X Corporation's selected data for 2020: Retained earnings January 1.2020 Pretax Income Stock dividends declared During the year, the company changed its inventory method from FIFO to LIFO which had resulted in a $6,000,000 2,000,000 330,000 40.000 pretax increase in income by: Cash dividends de clared During 2020. the company discovered that the 2019 depreciation expense were overstated by a net of tax am ount of: Tax rate 225.000 70.000 30% CIEO toarrow_forwardPresented below are data for XYZ Corp. Assets, January 1 Liabilities, January 1 Stockholders' Equity, Jan. 1 Dividends Common Stock, Dec. 31 2023 2024 4,560 ? ? 2,736 2 2,750 570 646 608 650 Stockholders' Equity, Dec. 31 ? 2,266 Net Income 684 Net income for 2024 is O $484 loss. O $162 loss O $162 income. O $120 income. $484 income. $120 loss.arrow_forward

- On January 1, 2022, Pharoah Corporation had retained earnings of $546,000. During the year, Pharoah had the following selected transactions. 1. 2. 3. 4. Declared and paid cash dividends $126,000. Corrected overstatement of 2021 net income because of inventory error $43,000. Earned net income $348,000. Declared and paid stock dividends $63,000. Determine the retained earnings balance at the end of the year. Retained earnings $arrow_forwardComparative balance sheets for Softech Canvas Goods for 2021 and 2020 are shown below. Softech pays no dividends and instead reinvests all earnings for future growth. Comparative Balance Sheets ( $ in thousands) December 31 2021 2020 Assets: Cash $ 89 $ 66 Accounts receivable 165 185 Short-term investments 76 66 330 218 Inventory Property, plant, and equipment (net) 860 745 $1,520 $1,280 Liabilities and Shareholders' Equity: Current liabilities $ 370 $ 275 Bonds payable Paid-in capital Retained earnings 225 225 595 595 330 185 $1,520 $1,280 Required: 1. Determine the return on shareholders' equity for 2021. (Round your answer to 2 decimal places.) Return on shareholders' equityarrow_forwardBalance Sheet Nicole Corporation's year-end 2019 balance sheet lists current assets of $753,000, fixed assets of $603,000, current liabilities of $542,000, and long-term debt of $697,000. What is Nicole's total stockholders' equity? Multiple Choice О о $117,000 $1,356,000 There is not enough information to calculate total stockholder's equity. $1,239,000arrow_forward

- answer quicklyarrow_forwardLowell reports retained earnings at the end of fiscal 2019 of $41115 and retained earnings at the end of fiscal 2018 of $35180. The company reported dividends of $5026. How much net income did the firm report in fiscal 2019? (Round your answer to zero decimal places and omit the "$" sign. Add a minus sign if needed. For example, if your answer is $1,000.2, type in "1000") 1arrow_forwardThe changes in account balances for Elder Company for 2021 are as follows: Assets $ 480,000 debit Common stock 250,000 credit Liabilities 160,000 credit Paid-in capital-excess of par 30,000 credit Assuming the only changes in retained earnings in 2021 were for net income and a $50,000 dividend, what was net income of 2021? 1. A) $40,000. 2. B) $60,000. 3. C) $70,000. 4. D) $90,000. O A O B O Darrow_forward

- Quality Instruments had retained earnings of $320,000 at December 31, 2020. Net income for 2021 totaled $215,000, and dividends declared for 2021 were $95,000. How much retained earnings should Quality report at December 31, 2021? OA. $415,000 OB. $440,000 OC. $320,000 OD. $535,000arrow_forwardHere is financial information for Carla Vista Inc. Current assets Plant assets (net) Current liabilities Long-term liabilities Common stock, $1 par Retained earnings $ $ $ $ December 31, 2025 2025 $ Prepare a schedule showing a horizontal analysis for 2025, using 2024 as the base year. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) $ CARLA VISTA INC. Condensed Balance Sheets $ $109,200 403,500 102,500 125,200 133,200 $ 151,800 $ December 31, 2024 $93,500 2024 353,200 68,200 93,500 118,200 166,800 $ $ $ $ $ Increase or (Decrease) Amount Percent % % % % % % % % % %arrow_forwardWhat is your company’s common and preferred stock par or stated value? 2019arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education