Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

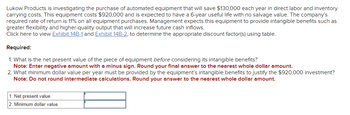

Transcribed Image Text:Lukow Products is investigating the purchase of automated equipment that will save $130,000 each year in direct labor and inventory

carrying costs. This equipment costs $920,000 and is expected to have a 6-year useful life with no salvage value. The company's

required rate of return is 11% on all equipment purchases. Management expects this equipment to provide intangible benefits such as

greater flexibility and higher-quality output that will increase future cash inflows.

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table.

Required:

1. What is the net present value of the piece of equipment before considering its intangible benefits?

Note: Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.

2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $920,000 investment?

Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.

1. Net present value

2. Minimum dollar value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Munabhaiarrow_forwardA logistic company is considering using automated guided vehicles (AGVS) system to speed up the process and cut some costs. To implement the system, the company need to anticipates the purchasing price of the AGVS system. The system will save $1,500,000 per year in labor and operational cost. However, it will incur a maintenance cost of $400,000 per year. The system is expected to have a 15-year service life and a salvage value of about $100,000. If the company's MARR is 10%, determine the maximum price that the company should pay to purchase the AGVS system so that project is profitable.arrow_forwardCarson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $10,000,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $2,500,000 per year for each of the next 8 years. In year 8 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1 million. Thus, in year 8 the investment cash inflow totals $3, 500, 000. Calculate the project's NPV using a discount rate of 9 percent.arrow_forward

- Raytronics wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and burn-in. It is installed for $1.4 million and will have a salvage value of $200,000 after 8 years. Its use will create an opportunity to increase sales by $650,000 per year and will have operating expenses of $250,000 per year. Corporate income-tax rate is 25%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR if the chamber is kept for 8 years. After-tax MARR is 10%. Use MACRS-GDS(5) with the Section 179 expense deduction.arrow_forwardLukow Products is investigating the purchase of a piece of automated equipment that will save $150,000 each year in direct labor and Inventory carrying costs. This equipment costs $940,000 and is expected to have a 7-year useful life with no salvage value. The company's required rate of return is 14% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 148:1 and Exhibit 148-2. to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $940,000 investment? (Do not round intermediate…arrow_forwardFirm Z has invested $4 million in marketing campaign to assess the demand for the product Minish. This product will be in the market next year and will last five years. Revenues are projected to be $50 million per year along with expenses of $20 million. The firm spends $15 million immediately on equipment that will be depreciated using MACRS depreciation to zero. Additionally, it will use some fully depreciated existing equipment that has a market value of $4 million. Finally, Minish will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). But, receivables are expected to account for 15% of annual sales. Payables are expected to be 15% of the annual cost of goods sold (COGS) between year 1 and year 4. All accounts payables and receivables will be settled at the end of year 5. Based on this information and WACC of 5.418, find the NPV of the project. Identify the IRR of the project. Draw NPV vs r graph of…arrow_forward

- Whispering Winds Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $160,000 and has an estimated useful life of eight years with zero salvage value. Management estimates that the new bottling machine will provide net annual cash flows of $30,000. Management also believes that the new machine will save the company money because it is expected to be more reliable than other machines, and thus will reduce downtime. Assume a discount rate of 11%. Click here to view the factor table. Calculate the net present value. (If the net present value is negative, use either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25124. Round present value answer to O decimal places, e.g. 1,250.) Net present value How much would the reduction in downtime have to be worth in order for the project to be acceptable? Present value of reduction…arrow_forwardCaroline’s Chill Chronometers (3C) is considering buying a machine for $600 million. The machine has a useful life of 20 years. Sales are projected to be $120 million per year, with operating expenses of $35 million per year. An initial NWC investment of $10 million would be needed. NWC, however, would decrease by $300,000 per year over the 15 year life of the project due to improved inventory efficiency. The machine can be sold for $175 million at the end of the project. The tax rate is 20% and the required rate of return is 7%. Find the NPV using straight-line depreciation.arrow_forwardAlliance Manufacturing Company is considering the purchase of a new automated drill press to replace an older one. The machine now in operation has a book value of zero and a salvage value of zero. However, it is in good working condition with an expected life of 10 additional years. The new drill press is more efficient than the existing one and, if installed, will provide an estimated cost savings (in labor, materials, and maintenance) of $6,000 per year. The new machine costs $25,000 delivered and installed. It has an estimated useful life of 10 years and a salvage value of $1,000 at the end of this period. The firm’s cost of capital is 14 percent, and its marginal income tax rate is 40 percent. The firm uses the straight-line depreciation method. Complete the following table to compute the net present value (NPV) of the investment. (Hint: Remember that, in Year 10, Alliances also receives the salvage value of the machine.) Year Cash Flow PV Interest Factor at 14%…arrow_forward

- Carson Trucking is considering wether to expand its regional service center. The exapnsion will require expensiture of $10,000,000 for new service equipment and will generate annual net cash inflows by reducing operating costs $ 2,500,000 per year for each of the next 8 years. In year 8, the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1,000,000. Thus in year 8, the total cash inflow is $3,500,000. Assuming an 11% discount rate, calculate the project's NPV: a. $3,500,000 b. $3,299,233 c. $2,500,000 d. $2,399,233arrow_forwardCaspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $13.00 million fully installed and will be fully depreciated over a 15 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.37 million per year and increased operating costs of $612,883.00 per year. Caspian Sea Drinks' marginal tax rate is 28.00%. The internal rate of return for the RGM-7000 is Submit Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434))arrow_forwardAgate Marketing Inc. intends to distribute a new product. It is expected to produce net returns of $13,000 per year for the first four years and $11,000 per year for the following three years. The facilities required to distribute the product will cost $36,000, with a disposal value of $9,600 after seven years. The facilities will require a major facelift costing $10,000 each after three years and after five years. If Agate requires a return on investment of 15%, should the company distribute the new product? If NPV is negative your answer must include the negative sign. Net Present Value (NPV) = Should the decision be Accept or Reject? Firarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education