Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

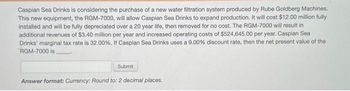

Transcribed Image Text:Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines.

This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $12.00 million fully

installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in

additional revenues of $3.40 million per year and increased operating costs of $524,645.00 per year. Caspian Sea

Drinks' marginal tax rate is 32.00%. If Caspian Sea Drinks uses a 9.00% discount rate, then the net present value of the

RGM-7000 is.

Submit

Answer format: Currency: Round to: 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.30 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.20 million per year and cost $1.77 million per year over the 10-year life of the project. Marketing estimates 12.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 24.00%. The WACC is 12.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.arrow_forwardCaspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $13.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.89 million per year and increased operating costs of $548,726.00 per year. Caspian Sea Drinks' marginal tax rate is 32.00%. If Caspian Sea Drinks uses a 8.00% discount rate, then the net present value of the RGM-7000 is _____. (ROUND TO 4 DECIMAL PLACES)arrow_forwardCaspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.29 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.46 million per year and cost $1.84 million per year over the 10-year life of the project. Marketing estimates 13.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 22.00%. The WACC is 15.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward

- Sarasota Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $450,000 and has an estimated useful life of 8 years with zero salvage value. Management estimates that the new bottling machine will provide net annual cash flows of $78,750. Management also believes that the new bottling machine will save the company money because it is expected to be more reliable than other machines, and thus will reduce downtime. Click here to view PV tables. How much would the reduction in downtime have to be worth in order for the project to be acceptable? Sarasota's discount rate is 10%. (Use the above table.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 5,275.) Reduction in downtime would have to have a present value $arrow_forwardCaspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $13.00 million fully installed and will be fully depreciated over a 16.00 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.09 million per year and increased operating costs of $680,871.00 per year. Caspian Sea Drinks' marginal tax rate is 33.00%. The incremental cash flows for produced by the RGM-7000 are Submit Answer format: Currency: Round to: 2 decimal places.arrow_forwardThe Short-Line Railroad is considering a $175,000 investment in either of two companies. The cash flows are as follows: Year Electric Company Water Works 1 $ 80,000 $ 35,000 5 25,000 60,000 3 70,000 80,000 4 to 10 30,000 40,000 Compute the payback period for both companies. Note: Round your answers to 1 decimal place. Electric Company : Years Water Works: Yearsarrow_forward

- Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $2.00 million, and sold for that amount in year 10. Net working capital will increase by $1.36 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.70 million per year and cost $1.78 million per year over the 10-year life of the project. Marketing estimates 19.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 29.00%. The WACC is 11.00%. Find the NPV (net present value).arrow_forwardAn oil company will build an aqueduct to bring water for water injection project. It can be built at a reduced size now for $300 million and be enlarged 25 years later for an additional $350 million. An alternative to construct the full-sized aqueduct now for $400 million. Both alternatives would provide the needed capacity for the 50-year analysis period. Maintenance costs are expected to be $10000 yearly for the first 25 years and will increase by 20% until the end of the project. At 6% interest, which alternative should be selected? Answer:arrow_forwardFirm Z has invested $4 million in marketing campaign to assess the demand for the product Minish. This product will be in the market next year and will last five years. Revenues are projected to be $50 million per year along with expenses of $20 million. The firm spends $15 million immediately on equipment that will be depreciated using MACRS depreciation to zero. Additionally, it will use some fully depreciated existing equipment that has a market value of $4 million. Finally, Minish will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). But, receivables are expected to account for 15% of annual sales. Payables are expected to be 15% of the annual cost of goods sold (COGS) between year 1 and year 4. All accounts payables and receivables will be settled at the end of year 5. Based on this information and WACC in the first part of the question, find the NPV of the project. Identify the IRR of the…arrow_forward

- RealTurf is considering purchasing an automatic sprinkler system for its sod farm by borrowing the entire $30,000 purchase price. The loan would be repaid with four equal annual payments at an interest rate of 12%/year. It is anticipated that the sprinkler system would be used for 9 years and then sold for a salvage value of $2,000. Annual operating and maintenance expenses for the system over the 9-year life are estimated to be $9,000 per year. If the new system is purchased, cost savings of $15,000 per year will be realized over the present manual watering system. RealTurf uses a MARR of 15%/year for economic decision making. Based on a present worth analysis, is the purchase of the new sprinkler system economically attractive?arrow_forwardTanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $415,000 is estimated to result in $154,000 in annual pretax cost savings. The press falls in the MACRS five-year class (MACRS schedule) and it will have a salvage value at the end of the project of $55,000. The press also requires an initial investment in spare parts inventory of $16,000, along with an additional $3,000 in inventory for each succeeding year of the project. The shop's tax rate is 25 percent and its discount rate is 12 percent. Calculate the project's NPV. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Net present valuearrow_forwardAbbott Mining Systems wants to determine whether it should upgrade a piece of equipment used in deep mining operations in one of its international operations now or later. If the com- pany selects plan A, the upgrade will be purchased now for $200,000. However, if the com- pany selects plan 1, the purchase will be deferred for 3 years when the cost is expected to rise to $300,000. Abbott is ambitious; it expects a real MARR of 12% per year. The inflation rate in the country has averaged 3% per year. From only an economic perspective, determine whether the company should purchase now or later (a) when inflation is not considered and (b) when inflation is considered.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education