FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

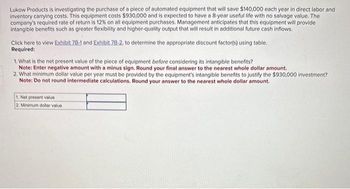

Transcribed Image Text:Lukow Products is investigating the purchase of a piece of automated equipment that will save $140,000 each year in direct labor and

Inventory carrying costs. This equipment costs $930,000 and is expected to have a 8-year useful life with no salvage value. The

company's required rate of return is 12% on all equipment purchases. Management anticipates that this equipment will provide

intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows.

Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using table.

Required:

1. What is the net present value of the piece of equipment before considering its intangible benefits?

Note: Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.

2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $930,000 investment?

Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.

1. Net present value

2. Minimum dollar value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $401,000 is estimated to result in $147,000 in annual pretax cost savings. The press qualifies for 100 percent bonus depreciation and it will have a salvage value at the end of the project of $48,000. The press also requires an initial investment in spare parts inventory of $15,300, along with an additional $2,300 in inventory for each succeeding year of the project. The shop's tax rate is 23 percent and its discount rate is 10 percent. Calculate the project's NPV. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPV S 69,414.39arrow_forwardLukow Products is investigating the purchase of a piece of automated equipment that will save $150,000 each year in direct labor and inventory carrying costs. This equipment costs $800,000 and is expected to have a 5-year useful life with no salvage value. The company’s required rate of return is 12% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. What minimum dollar value per year must be provided by the equipment’s intangible benefits to justify the $800,000 investment? (Do not round intermediate…arrow_forwardDomesticarrow_forward

- Bridgeport Industries is considering the purchase of new equipment costing $1,280,000 to replace existing equipment that will be sold for $194,000. The new equipment is expected to have a $220,000 salvage value at the end of its 5-year life. During the period of its use, the equipment will allow the company to produce and sell an additional 32,800 units annually at a sales price of $29 per unit. Those units will have a variable cost of $15 per unit. The company will also incur an additional $86,000 in annual fixed costs. Identify the amount and timing of all cash flows related to the acquisition of the new equipment. (Enter negative amounts using a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Cash Flow Timing Amount Purchase of new equipment $4 Salvage of old equipment Sales revenue Variable costs Additional fixed costs Salvage of new equipment >arrow_forwardAssume that United Technologies is evaluating a proposal to change the company's manual design system to a computer-aided design (CAD) system. The proposed system is expected to save 10,000 design hours per year; an operating cost savings of $50 per hour. The annual cash expenditures of operating the CAD system are estimated to be $250,000. The CAD system requires an initial investment of $500,000. The estimated life of this system is five years with no salvage value. The tax rate is 40 percent. United Technologies has a cost of capital of 20 percent.Assume that management intends to use double-declining balance depreciation with a switch to straight-line depreciation (applied to any undepreciated balance) starting in Year 4.Determine the project's net present valuearrow_forwardTanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $445,000 is estimated to result in $160,000 in annual pretax cost savings. The press qualifies for 100 percent bonus depreciation, and it will have a salvage value at the end of the project of $40,000. The press also requires an initial investment in spare parts inventory of $20,000, along with an additional $2,800 in inventory for each succeeding year of the project. The shop's tax rate is 22 percent and its discount rate is 9 percent. Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Should the company buy and install the machine press? Yes ........... Noarrow_forward

- Sunland Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $200,000 and has an estimated useful life of eight years with zero salvage value. Management estimates that the new bottling machine will provide net annual cash flows of $36,000. Management also believes that the new machine will save the company money because it is expected to be more reliable than other machines, and thus will reduce downtime. Assume a discount rate of 10%.Click here to view the factor table.Calculate the net present value. (If the net present value is negative, use either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25124.Round present value answer to 0 decimal places, e.g. 1,250.)Net present value$How much would the reduction in downtime have to be worth in order for the project to be acceptable?Present value of reduction in downtime$arrow_forwardLukow Products is investigating the purchase of a piece of automated equipment that will save $130,000 each year in direct labor and inventory carrying costs. This equipment costs $780,000 and is expected to have a 6-year useful life with no salvage value. The company's required rate of return is 10% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? Note: Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount. 2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $780,000 investment? Note: Do not round…arrow_forwardRahularrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education