Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s

| Product A | Product B | |

|---|---|---|

| Initial investment: | ||

| Cost of equipment (zero salvage value) | $ 390,000 | $ 585,000 |

| Annual revenues and costs: | ||

| Sales revenues | $ 420,000 | $ 500,000 |

| Variable expenses | $ 185,000 | $ 222,000 |

| $ 78,000 | $ 117,000 | |

| Fixed out-of-pocket operating costs | $ 90,000 | $ 70,000 |

The company’s discount rate is 21%.

Required:

1. Calculate the payback period for each product.

2. Calculate the

3. Calculate the

4. Calculate the profitability index for each product.

5. Calculate the simple rate of return for each product.

6a. For each measure, identify whether Product A or Product B is preferred.

6b. Based on the simple rate of return, which of the two products should Lou’s division accept?

Just need help with 4-6.

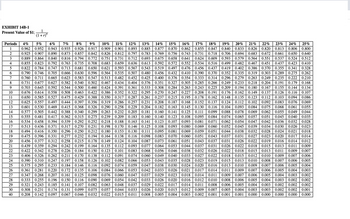

![EXHIBIT 14B-2

Present Value of an Annuity of $1 in Arrears; [1

;

3

4

5

6

7

8

9

10

11

23% 24% 25%

1

2

12

13

14

Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22%

0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800

1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440

2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210

2.210 2.174 2.140 2.106 2.074 2.042 2.011 1.981 1.952

3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.362

4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689

5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.951

6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161

6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.726 3.619 3.518 3.421 3.329

7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463

8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019

5.019 4.833 4.659 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3.571

8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656

9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725

9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780

10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824

15 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.859

16 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887

12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.910

12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702

7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.608 4.419 4.243 4.080 3.928

13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 4.635 4.442 4.263 4.097 3.942

13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469

7.469 7.025

7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954

14.029 12.821 11.764 10.836 10.017 9.292 8.649 8.075 7.562 7.102 6.687 6.312 5.973 5.665 5.384 5.127 4.891 4.675 4.476 4.292 4.121 3.963

14.451 13.163 12.042 11.061 10.201 9.442 8.772 8.176 7.645 7.170 6.743 6.359 6.011 5.696 5.410 5.149 4.909 4.690 4.488 4.302 4.130 3.970

14.857 13.489 | 12.303 | 11.272 10.371 9.580

|

8.883 8.266 7.718 7.230 6.792 6.399 6.044 5.723 5.432 5.167 4.925 4.703 4.499 4.311 4.137 3.976

15.247 13.799 12.550 11.469 10.529 9.707 8.985 8.348 7.784 7.283 6.835 6.434 6.073 5.746 5.451

5.451 5.182 4.937 4.713 4.507 4.318 4.143 3.981

15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4.514 4.323 4.147 3.985

15.983 14.375 13.003 11.826 10.810 9.929 9.161 8.488 7.896 7.372 6.906 6.491 6.118 5.783 5.480 5.206 4.956 4.728 4.520 4.328 4.151 3.988

16.330 14.643 13.211 | 11.987 10.935 10.027 9.237 8.548 7.943 7.409 6.935 6.514 6.136 5.798 5.492 5.215 4.964 4.734 4.524 4.332 4.154 3.990

16.663 14.898 13.406 12.137 11.051 10.116 9.307 8.602 7.984 7.441 6.961 6.534 6.152 5.810 5.502 5.223 4.970 4.739 4.528 4.335 4.157 3.992

16.984 15.141 13.591 | 12.278 11.158 10.198 9.370 8.650 8.022 7.470 6.983 6.551 6.166 5.820 5.510 5.229 4.975 4.743 4.531 4.337 4.159 3.994

17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.339 4.160 3.995

19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.999

17

18

19

20

21

22

23

24

25

26

(1+r)"

27

28

29

30

40

-]](https://content.bartleby.com/qna-images/question/689592b2-a407-4b23-b74c-d8e6fff37733/957fc52d-bdf7-4242-aeef-ac1e0b1aded8/osf27kj_thumbnail.png)

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 17% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 176,600 $ 390,000 Annual revenues and costs: Sales revenues $ 260,000 $ 360,000 Variable expenses $ 124,000 $ 174,000 Depreciation expense $ 36,000 $ 78,000 Fixed out-of-pocket operating costs $ 71,000 $ 50,000 The company’s discount rate is 15%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each…arrow_forwardWinthrop Company has an opportunity to manufacture and sell a new product for a five-year period. To pursue this opportunity, the company would need to purchase a plece of equipment for $130,000. The equipment would have a useful life of five years and a $10,000 salvage value. The CCA rate for the equipment is 30%. After careful study. Winthrop estimated the following annual costs and revenues for the new product: Sales revenues: Variable expenses Fixed expenses $250,000 $130,000 $ 70,000 The company's tax rate is 30% and its after-tax cost of capital is 10%. Required: 1. Compute the net present value of the project. (Hint Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and PV factor. Round the final answers to the nearest whole dollar. Negative value should be indicated with minus sign.) 2. Would you recommend that the project be undertaken? 1. Net present value 2 Would you recommend that the project be undertaken?arrow_forwardDerrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 25% each of the last three years. Derrick is considering a capital budgeting project that would require a $5,170,000 investment in equipment with a useful life of five years and no salvage value. Holston Company's discount rate is 19%. The project would provide net operating income each year for five years as follows: Sales $ 4,500,000 Variable expenses 2,000,000 Contribution margin 2, 500,000 Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $780,000 Depreciation 1,034,000 Total fixed expenses 1,814,000 Net operating income $ 686,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the project's net present value. 2. Compute the project's simple rate of return. 3 a. Would the company want Derrick to pursue…arrow_forward

- Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The company's discount rate is 17%. After careful study, Oakmont estimated the following costs and revenues for the new product: Cost of equipment needed Working capital needed Overhaul of the equipment in two years Salvage value of the equipment in four years Annual revenues and costs: Sales revenues $ 155,000 $ 65,000 $ 9,000 $ 14,500 $ 300,000 Variable expenses $ 145,000 Fixed out-of-pocket operating costs $ 75,000 When the project concludes in four years the working capital will be released for investment elsewhere within the company. Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using tables. Net present value Required: Calculate the net present value of this investment opportunity. Note: Round your final answer to the nearest whole dollar amount.arrow_forwardLou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 23% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 290,000 $ 500,000 Annual revenues and costs: Sales revenues $ 350,000 $ 450,000 Variable expenses $ 160,000 $ 210,000 Depreciation expense $ 58,000 $ 100,000 Fixed out-of-pocket operating costs $ 80,000 $ 60,000 The company’s discount rate is 16%. 4. Calculate the project profitability index for each product. (Round discount factor(s) to 3 decimal places. Round your answers to 2 decimal places.) 5. Calculate the simple rate of return for each product. (Round percentage answers to 1…arrow_forwardAshley Foods, Inc. has determined that only one of five machines can be used in one phase of its dairy products operation. The first and annual costs are estimated; all machines are expected to have a 4-year useful life. If the MARR is 20% per year, determine which machine should be selected on the basis of rate of return.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education