FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Dream Makers is a small manufacturer of gold and platinum jewelry. It uses a

- April insurance cost for the manufacturing property and equipment was $1,850. The premium had been paid in January.

- Recorded $1,060

depreciation on an administrative asset. - Purchased 21 pounds of high-grade polishing materials at $16 per pound (indirect materials).

- Paid factory utility bill, $6,550, in cash.

- Incurred 4,000 hours and paid payroll costs of $160,000. Of this amount, 1,000 hours and $20,000 were indirect labor costs.

- Incurred and paid other

factory overhead costs , $6,300. - Purchased $25,000 of materials. Direct materials included unpolished semiprecious stones and gold. Indirect materials included supplies and polishing materials.

- Requisitioned $19,000 of direct materials and $1,700 of indirect materials from Materials Inventory.

- Incurred miscellaneous selling and administrative expenses, $5,800.

- Incurred $3,610 depreciation on manufacturing equipment for April.

- Paid advertising expenses in cash, $2,725.

- Applied factory overhead to production on the basis of direct labor hours.

- Completed goods costing $64,500 during the month.

- Made sales on account in April, $58,620. The Cost of Goods Sold was $48,700.

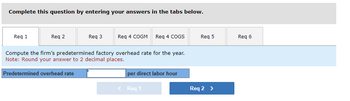

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req 1

Req 2

Req 3

Req 4 COGM Req 4 COGS

Compute the firm's predetermined factory overhead rate for the year.

Note: Round your answer to 2 decimal places.

Predetermined overhead rate

per direct labor hour

< Req 1

Req 5

Req 2 >

Req 6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sweeten Company had no jobs in progress at the beginning of the year and no beginning inventories. It started, completed, and sold only two jobs during the year-Job P and Job Q. The company uses a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, it estimated that 4,000 machine-hours would be required for the period's estimated level of production. Sweeten also estimated $26,200 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $2.00 per machine-hour. Because Sweeten has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following additional information to enable calculating departmental overhead rates: Estimated total machine-hours used Molding Fabrication 2,500 Estimated total fixed manufacturing overhead 1,500 $ 15,450 $ 2.50 $ 10,750 $ 1.70…arrow_forwardHansabenarrow_forwardEdwin Parts, a job shop, recorded the following transactions in May: Purchased $87,200 in materials on account. Issued $3,650 in supplies from the materials inventory to the production department. Issued $43,600 in direct materials to the production department. Paid for the materials purchased in transaction (1). Incurred wage costs of $67,200, which were debited to Payroll, a temporary account. Of this amount, $22,300 was withheld for payroll taxes and credited to Payroll Taxes Payable. The remaining $44,900 was paid in cash to the employees. See transactions (6) and (7) for additional information about Payroll. Recognized $34,700 in fringe benefit costs, incurred as a result of the wages paid in (5). This $34,700 was debited to Payroll and credited to Fringe Benefits Payable. Analyzed the Payroll account and determined that 65 percent represented direct labor; 15 percent, indirect manufacturing labor; and 20 percent, administrative and marketing costs. Applied overhead on the basis…arrow_forward

- Mai Ling Inc., incurred the following actual overhead costs for the month of March: Account Cost Indirect materials 8,000 Indirect labor 25,000 Factory equipment depreciation 6,000 Factory building rent 7,000 Environmental compliance costs 5,000 Overhead is applied based on a predetermined rate of $10 per direct labor hour, and 6,000 direct labor hours were used during March. The balance of the T account for Manufacturing Overhead (MOH) would show which of the following? Group of answer choices $9,000 of debit balance of overallocated MOH $14,000 of debit balance of under allocated MOH $14,000 of credit balance of overallocated MOH $9,000 of credit balance of overallocated MOHarrow_forwardAshvinbhaiarrow_forwardSweeten Company had no jobs in progress at the beginning of the year and no beginning inventories. It started, completed, and sold only two jobs during the year-Job P and Job Q. The company uses a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, it estimated that 4,000 machine-hours would be required for the period's estimated level of production. Sweeten also estimated $29,800 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $2.90 per machine-hour. Because Sweeten has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following additional information to enable calculating departmental overhead rates: Estimated total machine-hours used Estimated total fixed manufacturing overhead Molding Fabrication 2,500 1,500 $ 16,800 $ 3.40 Estimated variable…arrow_forward

- ces Sweeten Company had no jobs in progress at the beginning of the year and no beginning inventories. It started, completed, and sold only two jobs during the year-Job P and Job Q. The company uses a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, it estimated that 4,000 machine-hours would be required for the period's estimated level of production. Sweeten also estimated $25,400 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $1.80 per machine-hour. Because Sweeten has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following additional information to enable calculating departmental overhead rates: Direct materials Direct labor cost Actual machine-hours used: Molding Fabrication Molding 2,500 Estimated total machine-hours used Estimated…arrow_forwardSweeten Company had no jobs in progress at the beginning of the year and no beginning inventories. It started, completed, and sold only two jobs during the year—Job P and Job Q. The company uses a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, it estimated that 4,000 machine-hours would be required for the period’s estimated level of production. Sweeten also estimated $25,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $1.70 per machine-hour. Because Sweeten has two manufacturing departments—Molding and Fabrication—it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following additional information to enable calculating departmental overhead rates: Molding Fabrication Total Estimated total machine-hours used 2,500 1,500 4,000 Estimated total fixed manufacturing overhead $ 10,000…arrow_forwardLuebke Incorporated has provided the following data for the month of November. The balance in the Finished Goods inventory account at the beginning of the month was $52,000 and at the end of the month was $30,000. The cost of goods manufactured for the month was $212,000. The actual manufacturing overhead cost incurred was $55,000 and the manufacturing overhead cost applied to Work in Process was $58,000. The company closes out any underapplied or overapplied manufacturing overhead to cost of goods sold. The adjusted cost of goods sold that would appear on the income statement for November is: Multiple Choice $190,000 $234,000 $231,000 $212,000arrow_forward

- Sweeten Company had no jobs in progress at the beginning of the year and no beginning inventories. It started, completed, and sold only two jobs during the year-Job P and Job Q. The company uses a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, it estimated that 4,000 machine-hours would be required for the period's estimated level of production. Sweeten also estimated $29,800 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $2.90 per machine-hour. Because Sweeten has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following additional information to enable calculating departmental overhead rates: Estimated total machine-hours used Estimated total fixed manufacturing overhead Molding Fabrication 2,500 1,500 $ 16,800 $ 3.40 Estimated variable…arrow_forwardBright Star Incorporated is a job-order manufacturer. The company uses predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours were 134,000 and estimated factory overhead was $1,085,400. The following information was for September. Job X was completed during September, while Job Y was started but not finished.arrow_forwardDuring January, its first month of operations, Bridgeport Company accumulated the following manufacturing costs: raw materials purchased $ 5,400 on account, factory labor $ 7,300, and utilities payable $ 2,600. In January, requisitions of raw materials for production are as follows: Job 1 $ 910, Job 2 $ 1,400, Job 3 $ 810, and general factory use $ 610.Record raw materials used. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Manufacturing Costs Work in Process Inventory Raw Materials Inventory Factory Labor Manufacturing Overhead Balance $ enter a dollar amount $ enter a dollar amount $ enter a dollar amount enter a dollar amount Direct materials enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount Indirect materials enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount Balance $ enter a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education